I managed to catch the movie The Big Short (trailer) before it left the theaters. Having read the book with great interest back in 2011, I wondered how it would remade for the big screen. Isn’t it hard to believe that the events described started roughly an entire decade ago? There are plenty of reviews at all the big media sites, but here are my notes:

- The original book The Big Short by Michael Lewis was classified as non-fiction.* The movie, however, is only “based on a true story”. As such, many of the individual names were changed. Steve Eisman (real person) became Mark Baum (movie character). Ben Hockett became Ben Rickert. Charles Ledley & James Mai became Charlie Geller & Jamie Shipley. Cornwall Capital became Brownfield Capital. For some reason, the names of Dr. Michael Burry and his firm Scion Capital went unchanged.

- The director, Adam McKay, is probably best known for his comedies with Will Ferrell in Anchorman and Talladega Nights. Oh, and the classic short The Landlord (censored version). I suppose The Big Short could be called a dark comedy.

- In retrospect, it might seem like betting against the housing market was an easy and obvious bet. While the movie might dramatize things, it did take courage and conviction. They had to put up millions of dollars to place the bet, and then more millions to keep the derivative bets running. Most other investors thought they were stupid, and tried to get them to reverse the bets. The banks also tried to make them sell their positions before they could realize profits. They were risking their own money, their family and friends’ money, and their entire careers.

- The movie does a good job showing you how the bubble persisted for so long because everyone was incentivized to keep it going. Wall Street workers made money by packaging and selling the bonds. The pension funds and large institutions got to buy “safe” high-interest bonds. The money managers got to collect their fees. The mortgage brokers and real estate agents collected commissions. Homeowners saw their equity grow. Everyone was happy.

- In contrast, the people who did the contrarian bet were all on the margins, outsiders, even a little weird. Hedge funds run by a guy who avoided human contact and wore cargo shorts and a free t-shirt everyday. (Christian Bale actually asked the real Michael Burry to take off his cloths and give them to him.) Another one based out of their parent’s garage.

- The revolving door between the regulators and the industry that they regulate remains open. People go from big paychecks on Wall Street, to smaller paychecks at the SEC and other government roles, and then go back to big paychecks on Wall Street. People usually don’t like to burn bridges with future employers. See this Michael Lewis interview.

- * As the book was non-fiction, CDO manager Wing Chau actually sued Michael Lewis for libel. Chau’s defamation lawsuit was dismissed and his appeal was denied. The SEC actually investigated him and his firm, found them both liable for fraud, banned him personally from the industry, and fined them $3 million in total. He probably didn’t like how he was portrayed in the movie, either.

- Where are they investing now? In a January 2012 post, I wrote about the current investments of Michael Burry and Steve Eisman. Burry’s water investments seem like a long-term play, but Eisman’s bet against for-profit education is already starting to unfold. In May 2015, Corinthian College and twenty four of its subsidiaries (i.e. Heald College, WyoTech) filed for bankruptcy after challenges by both US and Canadian governments.

If you can’t watch some great acting performances by Christian Bale, Ryan Gosling, and Steve Carell, you could always get a refresher course via cartoon stick figures instead. 🙂

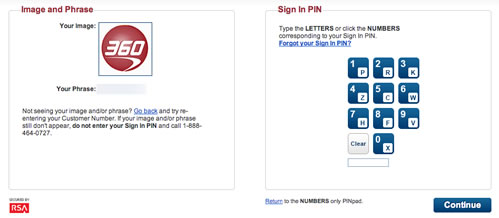

Capital One bought ING Direct USA back in early 2012, and has finally completed their transition and re-branding. Their new savings account product is called Capital One Consumer Bank Savings. Since I’ve had an account with them for over a decade (September 2001, as they remind me every time I log in), here’s an updated review of my 2nd oldest bank account meant for both new and existing customers.

Capital One bought ING Direct USA back in early 2012, and has finally completed their transition and re-branding. Their new savings account product is called Capital One Consumer Bank Savings. Since I’ve had an account with them for over a decade (September 2001, as they remind me every time I log in), here’s an updated review of my 2nd oldest bank account meant for both new and existing customers.

Here’s a reminder regarding an opportunity to buy savings bonds near the end of May and receive an annualized return of 2.51% over the next 11 months. This would be 1% more than the highest current CD rates, with potential for continued higher interest. See

Here’s a reminder regarding an opportunity to buy savings bonds near the end of May and receive an annualized return of 2.51% over the next 11 months. This would be 1% more than the highest current CD rates, with potential for continued higher interest. See

With the Ally Bank certificates of deposit, you can still access your money as long as you pay a early withdrawal penalty of 60 days interest. That’s significantly less than at other banks. I have a 5-year CD paying 3% APY, but the current rate for new deposits is 1.60% APY for a 5-year CD (as of 10/25/13).

With the Ally Bank certificates of deposit, you can still access your money as long as you pay a early withdrawal penalty of 60 days interest. That’s significantly less than at other banks. I have a 5-year CD paying 3% APY, but the current rate for new deposits is 1.60% APY for a 5-year CD (as of 10/25/13).

How did you come up with your budget? Did it end up costing more or less than you thought?

How did you come up with your budget? Did it end up costing more or less than you thought?

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)