Updated. There are many people who are eligible for 100% forgivable federal assistance from the Paycheck Protection Program, but aren’t applying for it, either due to misinformation or being discourage by all the bureacracy. Many PPP loan recipients are self-employed workers, sole proprietors, freelancers and/or independent contractors that file a Schedule C who may be eligible only for a modest amount, but that amount can still make a big difference. I am not an accountant nor a lawyer, but I encourage the (really) small businesses out there to get help if impacted by COVID. It’s not too late, and COVID isn’t over!

New focus on business with LESS than 20 employees. The Treasury Department just announced that businesses with more than 20 employees will be shut out of the PPP for a two-week period starting Wednesday, 2/24. In other words, only businesses with less than 20 employees can apply for PPP loans during the next two weeks. From ABC News:

In an attempt to improve equitable distribution of loans, administration officials said changes would also be aimed at helping sole proprietors, independent contractors and self-employed individuals to receive more financial support by revising the program’s funding formula.

PPP Round 2 loan applications now open. First of all, if you never took a PPP loan, you can still apply for a first-draw PPP loans under the more lenient first-draw eligibility rules. Second-draw PPP loans have a different set of eligibility rules, notably you need to show a reduction in revenue. If you are a self-employed worker with no other employees and have higher than a $100,000 net income (2019 IRS Form 1040 Schedule C line 31 or equivalent), then you must reduce it to $100,000. Here are the full SBA 2nd Draw guidelines. In terms of loan size, you can still get 2.5 times your average monthly net profit from 2019.

The next general hurdle is that you must show a 25% drop in income when comparing the same quarter in 2019 and 2020:

Applicant must demonstrate that gross receipts in any calendar quarter of 2020 were at least 25 percent lower than the same quarter of 2019. Alternatively, Applicants may compare annual gross receipts in 2020 with annual gross receipts in 2019 if they were in business in 2019.

Looking for a PPP lender? One problem is that most banks are restricting PPP applications to those with existing business credit relationships. Many freelancer and independent contractors don’t have that. The small-business fintech Fundera has an open PPP loan application (both for first and second-draw loans) to help freelancers and independent contractors find a lender without any no prior relationship.

Single-page form for PPP Round 1 loan forgiveness now available. If you have an existing loan under $150,000, there is now a single-page form that requires you to submit no additional documentation (it must still exist, of course, and they may ask you for it later if audited). That form, called the PPP Loan Forgiveness Application Form 3508S, has been released and lenders are starting to accept them. You may even be able to use the longer 24-week covered period and get more of your loan forgiven than with the previous 8-week period. (I haven’t heard of widespread final forgiveness being granted by the SBA yet.)

Looking for a self-employed or small business payroll provider? I want to mention Gusto here, as I use them for payroll and saw them create many tools this year to help their users satisfy the PPP documentation requirements and help them take advantage of this relief. If you are a single-person company, they have a basic tier that costs only $25 per month, which is much less than the major payroll providers. (You can also split up your direct deposit however you like, handy for various banking promotions.) Right now, referred user can get a $100 Visa gift card after running your first payroll with Gusto (my referral link).

My family enjoys watching

My family enjoys watching  As a follow-up to my initial post on the

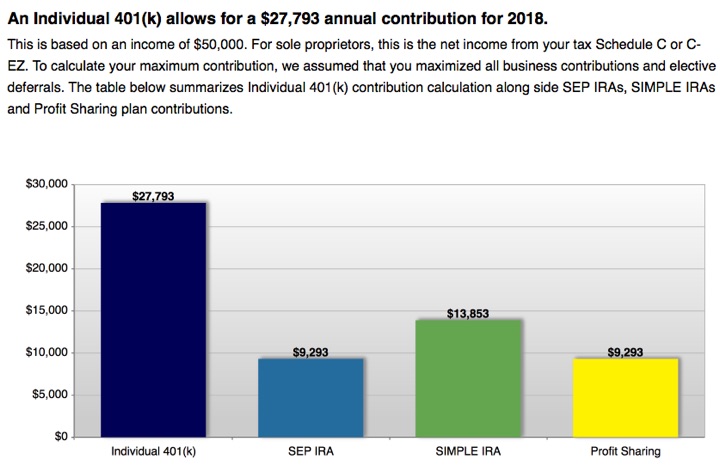

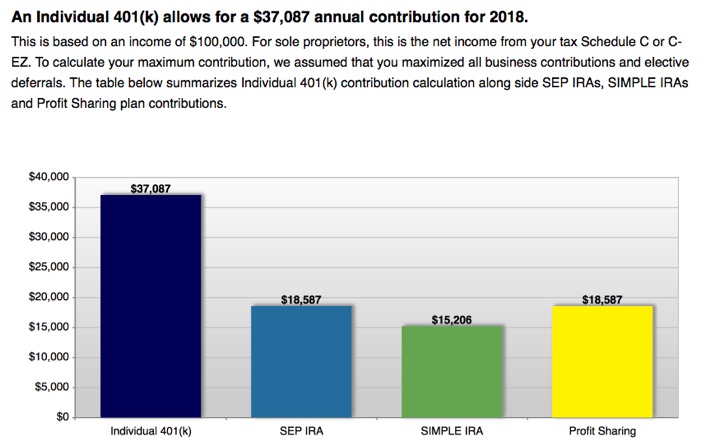

As a follow-up to my initial post on the  I use a Solo 401k plan because it lets you contribute the most tax-deferred money for a modest amount of self-employed income. At the end of each year, I can more clearly estimate my total income for 2019 and thus my maximum contribution limits. There are several online calculators out there (try

I use a Solo 401k plan because it lets you contribute the most tax-deferred money for a modest amount of self-employed income. At the end of each year, I can more clearly estimate my total income for 2019 and thus my maximum contribution limits. There are several online calculators out there (try

Charles Munger is probably best known as the Vice Chairman of Berkshire Hathaway and partner of Warren Buffett. The University of Michigan Ross School of Business recently shared a

Charles Munger is probably best known as the Vice Chairman of Berkshire Hathaway and partner of Warren Buffett. The University of Michigan Ross School of Business recently shared a

If you have significant self-employment or other income outside of your W-2 paycheck that is not subject to witholding (interest, rents, dividends, alimony), you may need to send the IRS some money before the usual tax-filing time. This is my annual reminder to either slide in a last-minute payment for 2016 if needed, or plan ahead for four equal installments in 2017.

If you have significant self-employment or other income outside of your W-2 paycheck that is not subject to witholding (interest, rents, dividends, alimony), you may need to send the IRS some money before the usual tax-filing time. This is my annual reminder to either slide in a last-minute payment for 2016 if needed, or plan ahead for four equal installments in 2017. Many of the podcasts I listen to aren’t financially-related, but I’ve recently been catching up

Many of the podcasts I listen to aren’t financially-related, but I’ve recently been catching up  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)