In the book Missing Billionaires, Victor Haghani and James White argue that through the power of compound interest, there should be many more billionaires around – simply through time, even with modest investment performance. The reason why there are “missing” billionaires is not because they didn’t find the optimal asset allocation, it’s due to making poor risk decisions and/or excessive spending (and then taking big risks to keep the fun times rolling).

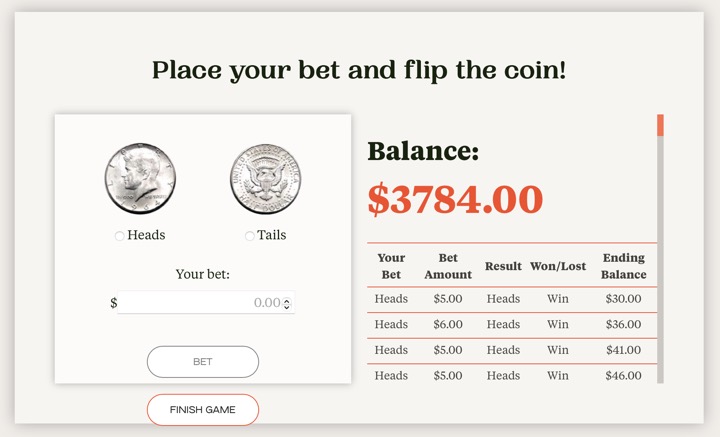

For example, one simple way that you can lose money even with the odds in your favor is poor bet sizing. The authors created the Elm Wealth Coin Flip Challenge in order to teach this interactively. In the game, the coin is altered such that you know it will come up heads 60% of the time, and tails 40% of the time. If you know anything about gambling in the real world, you’ll know this is a huge advantage! Dramatic movies about card counting and the MIT Blackjack team involves edges of only ~1%.

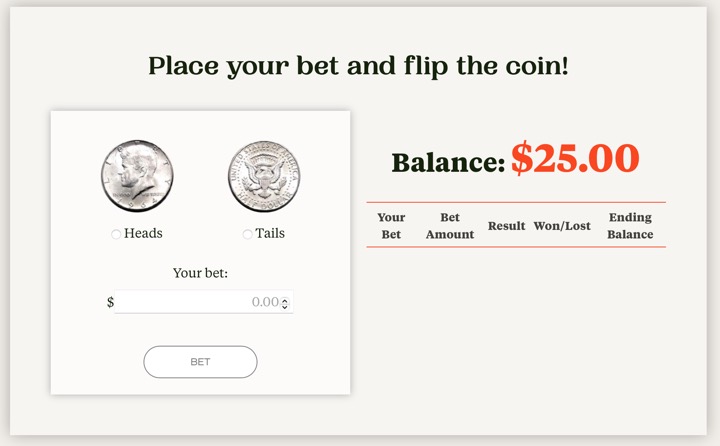

You get $25 to wager, and you can bet any amount you have. Can you build your stack up to thousands of dollars? Try for yourself, first with just your intuition. You’ll soon discover that it’s harder than it looks! Too little a bet, and the needle doesn’t really move much even on the good swings. Too big a bet, and you can’t survive the bad swings. It’s quite easy to dwindle quickly down to zero. After that, as Warren Buffett has stated, “Anything times zero is zero.”

Nowadays, we all have a 24/7 casino lurking in our pockets. With ads constantly telling us we can get rich with crypto, stock options, and sports betting, I think it’s very critical to teach ourselves and our kids about these concepts like odds and betting. Warren Buffett once bought and installed slot machines in his own house, to teach his kids about the one-armed bandits. Investing done right with proper risk management is a positive-sum game with excellent odds for the investor. Crypto speculation, aggressive use of stock options, and sport betting are only excellent for the “house” and I fear will create a generation of missing wealth. The next wave of volatility will come soon enough.

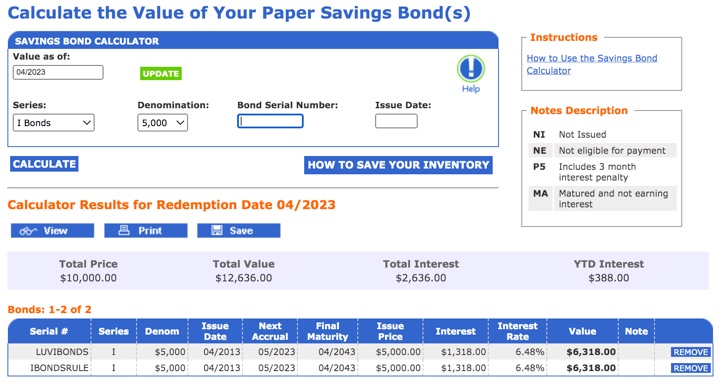

If you have accumulated some savings bonds but don’t really enjoy logging into TreasuryDirect.gov all the time, here are some alternative methods to tracking your balances over time. Each has its own strengths and weaknesses, and the unofficial ones are the results of motivated DIY investors. As an example, I will track a Savings I Bond purchased in April 2013 for $10,000.

If you have accumulated some savings bonds but don’t really enjoy logging into TreasuryDirect.gov all the time, here are some alternative methods to tracking your balances over time. Each has its own strengths and weaknesses, and the unofficial ones are the results of motivated DIY investors. As an example, I will track a Savings I Bond purchased in April 2013 for $10,000.

While updating my posts on

While updating my posts on

If you are an individual investor that usually buys bank certificates of deposit, right now you may want to compare against a US Treasury bond of similar maturity. Treasury bond rates are traded constantly, but this

If you are an individual investor that usually buys bank certificates of deposit, right now you may want to compare against a US Treasury bond of similar maturity. Treasury bond rates are traded constantly, but this

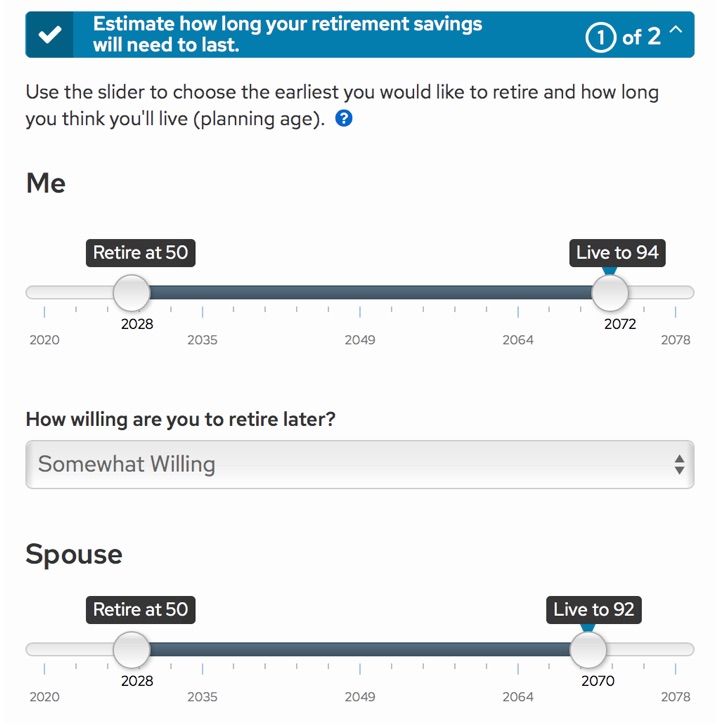

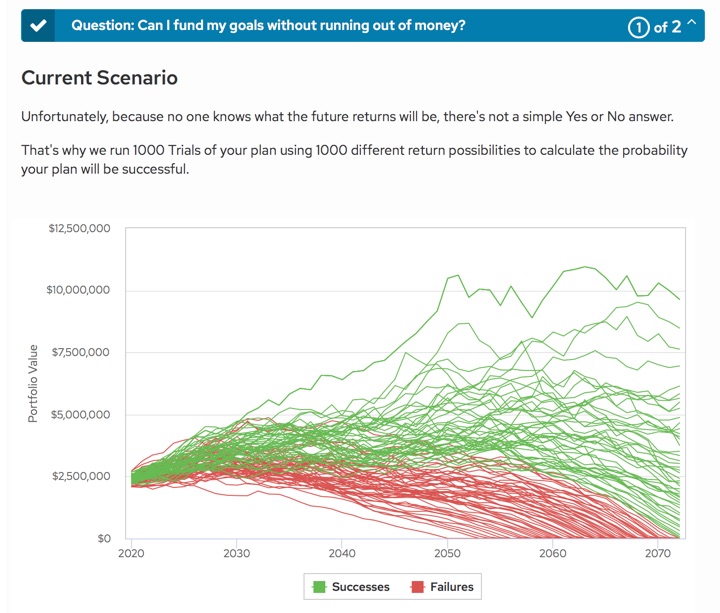

Schwab has rolled out a new digital financial planning tool called

Schwab has rolled out a new digital financial planning tool called

Thanks to generous assistance from a reader, I was able to spend some time poking around the

Thanks to generous assistance from a reader, I was able to spend some time poking around the

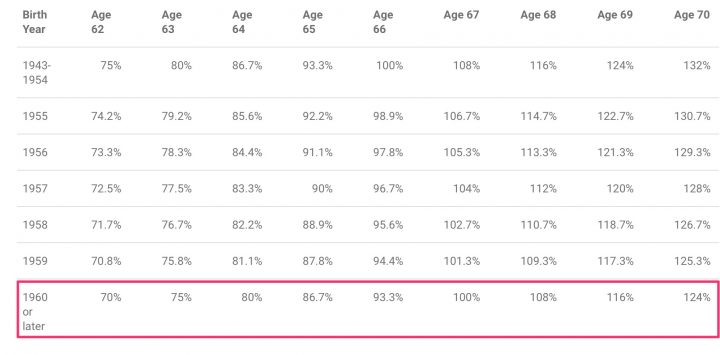

When to start claiming Social Security to maximize your potential benefit can be a complicated question, especially for couples. There are multiple paid services that will run the numbers for you, including

When to start claiming Social Security to maximize your potential benefit can be a complicated question, especially for couples. There are multiple paid services that will run the numbers for you, including  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)