After my post about the Permanent Portfolio which included physical gold, a reader asked me where he could open up a foreign bank account to store gold. Well, in the Appendix of the book Fail-Safe Investing, the author did list specific banks that allow U.S. investors to open account and buy gold within them. Here they are:

Anglo-Irish Bank [Austria]

Phone: 011-431 406-6161

URL: http://www.angloirishbank.ie/

Anker Bank / BDGE Group [Switzerland]

Phone: 011-4121 321-0707

URL: http://www.bcge.ch

Canadian Imperial Bank of Commerce [Switzerland]

Phone: 011-4121 215-6087

URL: http://www.cibc.com/

UeberseeBank / AIG Private Bank

Phone: 011-411 267-5555

URL: http://www.ueberseebank.ch/

Browne makes it sound that opening an account at one of these places is as simple as opening an online account with no physical branch near you. He also states that these are either Swiss or Austrian banks, which are bound by the laws of those countries, not the countries of their parent companies. Now, I can’t attest to the accuracy of this list, as the book was last updated around 2001 and I have no personal experience with any of them. Please perform your own due diligence.

The reasons for buying gold in a foreign bank account are primarily to provide a safe store of assets in case of very unlikely (but still possible) situations like war, government collapse/confiscating of assets, or other crisis. I’m not going to participate myself as I see the risks outweigh the benefits – cost, complexity, chance of fraud or loss, etc. – but if you read some of the stories from Argentina’s economic collapse it can get scary.

As for legality, it would seem to be perfect legit. You are simply storing physical gold there. Gold does not produce dividends or interest, so you’d only be liable for taxes if you sold them at a profit.

Well, the big boys are getting their rescue/bailout plan, but I guess ours got lost in the mail… So what should we do? I think that everyone should take a second look at their cash reserves. Do you have enough?

Well, the big boys are getting their rescue/bailout plan, but I guess ours got lost in the mail… So what should we do? I think that everyone should take a second look at their cash reserves. Do you have enough?

Well, it finally happened. IndyMac Bank has been taken over by the FDIC, becoming the second-largest financial institution failure in U.S. history. I’ve been reading a bunch of new stories about it, and here are what I think are the highlights:

Well, it finally happened. IndyMac Bank has been taken over by the FDIC, becoming the second-largest financial institution failure in U.S. history. I’ve been reading a bunch of new stories about it, and here are what I think are the highlights:

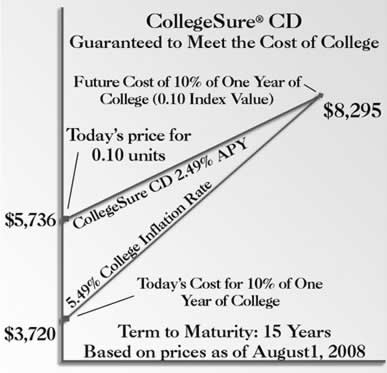

An alternative to

An alternative to

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)