Groupon has a limited-time deal on new Costco Gold Star or Executive Memberships. There are two options. Offer expires December 21, 2025.

$65 for Gold Star Membership Package

- 1-year Gold Star Membership (normally $65 by itself)

- Membership card for the Primary Cardholder and one additional Household Card for anyone living at the same address, over the age of 18.

- $40 Digital Costco Shop gift card Valid in-store and online. The Digital Costco Shop Card will be emailed within two weeks of sign-up.

$130 for Executive Membership Package

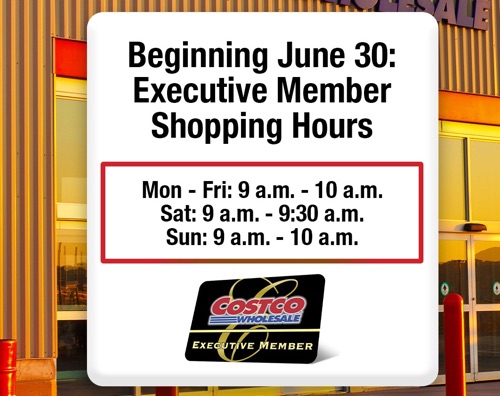

- 1-year Executive Membership (normally $130 by itself). Executive membership includes an annual 2% reward (up to $1,250) on eligible Costco and Costco Travel purchases.

- Membership card for the Primary Cardholder and one additional Household Card for anyone living at the same address, over the age of 18.

- $60 Digital Costco Shop gift card Valid in-store and online. The Digital Costco Shop Card will be emailed within two weeks of sign-up.

They’ve made it a bit more restrictive in that both the Primary and Household/Affiliate member must not have had a membership in the last 18 months. I know that some people like to alternate between a Costco and Sam’s Club membership.

Valid only for new members and those whose previous memberships (Primary and Affiliate) have been expired for at least 18 months or more. Not valid for renewal or upgrade of an existing membership.

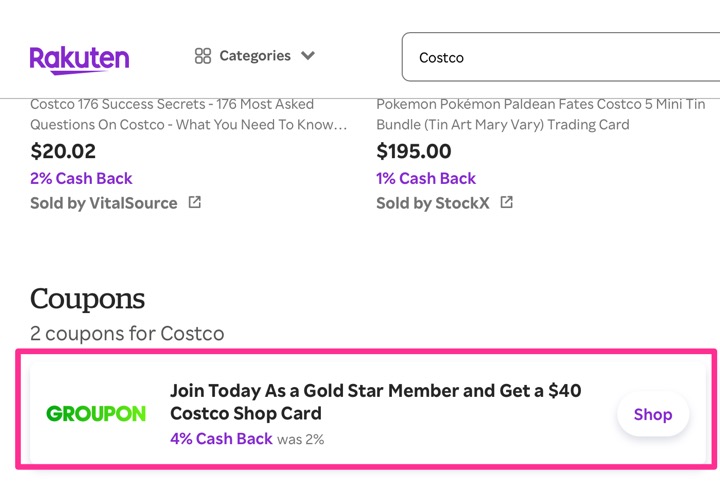

Save even more on your Groupon with a cashback shopping portal. For example, trigger the Rakuten new member bonus ($50 bonus right now after you spend $50) and also get 4% back. If Groupon doesn’t give it to you, send them this screenshot from their own website after searching for “Costco” and scrolling down (taken 10/30/25):

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

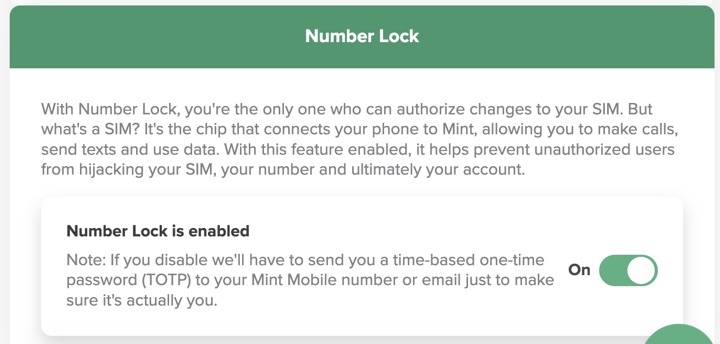

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)