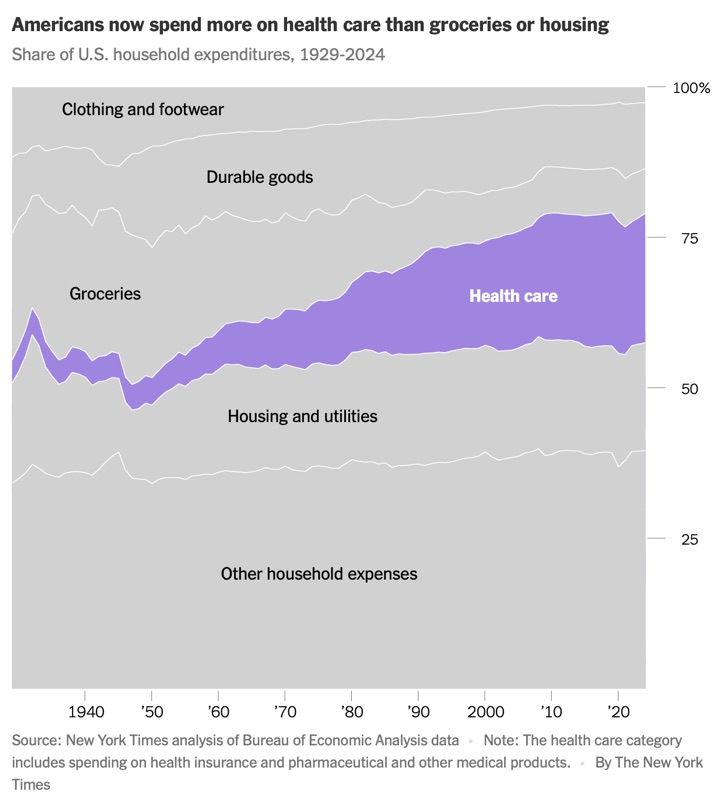

Housing has always been considered the biggest expense in a family’s budget. More recently, everyone’s grocery and restaurant bills have skyrocketed, bringing food costs into focus. But the biggest item in your budget is very likely to be healthcare, even if it is often disguised by your employer’s direct payment of part of the premium.

(Although employers seem to cover less and less every year… Employers love Health Savings Accounts (HSAs) as it allows them to justify pushing lower-cost high-deductible health plans (HDHPs) wherever possible. If you are a family with a kid with ongoing medical needs, HSA+HDHP does not work out to be a good deal.)

The NYTimes article How Health Care Remade the U.S. Economy (gift) shows us how this came to be over time. Healthcare costs include insurance premiums as well as drugs and other medical products.

As someone who has been thinking about early retirement since they were 25 years old, I am well aware that health insurance premiums for our family of 5 is roughly $25,000 a year. I’m not even counting our actual healthcare expenses like co-payments and deductibles. Healthcare has always been a huge expense to offset with investment income.

Some people try to keep their modified adjusted gross income low and use ACA subsidies, check out this KFF ACA calculator to estimate your numbers. Note that the ACA income “cliff” is set to return in 2026, meaning household incomes exceeding 400% of the Federal Poverty Level (FPL) will not be eligible for any ACA premium subsidies.

Checked and updated for 2025. Since these are available every 12 months, it is a good idea to check these near or around the same time each year. A lot of companies make their money by collecting and selling data – your personal data. It can be critical to know what they are telling prospective lenders, landlords, even employers about you. Under the FCRA and/or FACT Act, many consumer reporting agencies (CRAs) are now legally required to send you a free copy of your report every 12 months, as well as provide a way to dispute incorrect information.

Checked and updated for 2025. Since these are available every 12 months, it is a good idea to check these near or around the same time each year. A lot of companies make their money by collecting and selling data – your personal data. It can be critical to know what they are telling prospective lenders, landlords, even employers about you. Under the FCRA and/or FACT Act, many consumer reporting agencies (CRAs) are now legally required to send you a free copy of your report every 12 months, as well as provide a way to dispute incorrect information.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)