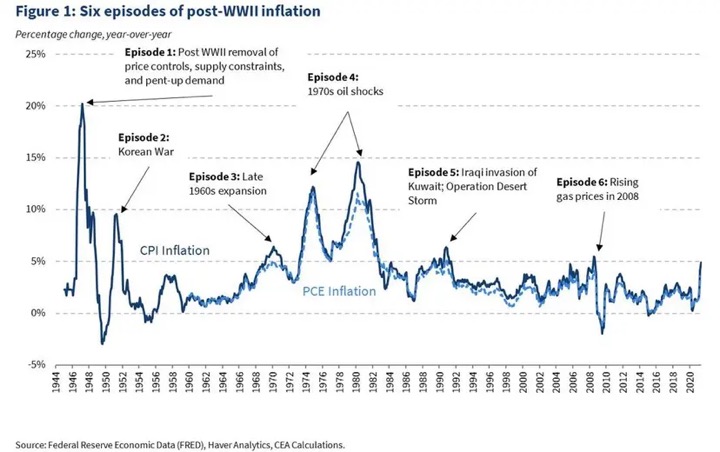

Sometimes it seems like everyone just wants risk these days. Crypto. Sports gambling. Options trading, ETFs that magically yield 10% or more. However, if you’re in the opposite camp and you want the absolute least amount of risk, you’d want to retire off an investment that has a return that is fully-guaranteed, pays out a monthly income like clockwork, is even guaranteed to grow with inflation. Inflation was relatively mild for a long time until recently, but historically it has been a significant risk factor.

If that interests you, check out 3 Ways to Build an Inflation-Adjusted Pension by Allan Roth – which first reminds you that Social Security is exactly this! – but also introduces a new series of LifeX Inflation-Protected Longevity Income ETFs.

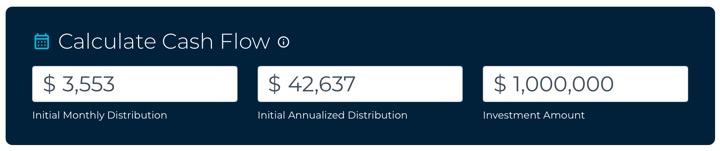

At current rates as of 12/11/25, the LifeX 2055 Inflation-Protected Longevity Income ETF (LIAM) contains a managed portfolio of United States Treasury Inflation Indexed Bonds (TIPS) that can provide you with a 4.26% guaranteed real withdrawal rate for 30 years. That means a $1,000,000 portfolio would distribute roughly $42,600 in annual income this year, but that number would increase with CPI inflation each year for 30 years (through the year 2055). At 3% average inflation, your 30th year’s income would have grown to over $100,000 a year. Of course, inflation could be a lot higher, which is why no private insurance company will sell you inflation protection over such a long period of time.

After those 30 years, you will be left with nothing. Your initial principal will be gone. Therefore, your income taken each year is partially a return of principal.

The expense ratio is 0.25%, which isn’t Vanguard-level but not horrible. I like that it does all of the work for you in a tidy ETF package, as building a TIPS ladder yourself can be a bit tricky (and do you want to keep doing it at age 80, 90?). Of course, I also worry about what happens if you bought a 30-year ladder at 65 and happen to live past 95. It could happen, and remember, this product is meant for the risk-averse folks that like to cover all the bases.

In general, I feel a TIPS ladder or equivalent that adjusts with inflation would work well in combination with a traditional annuity like an SPIA or a deferred longevity annuity that starts at a later age, which doesn’t adjust with inflation but does provide an higher initial fixed income that can last as long as you live. This is what I have set up for my parents – Social Security that rises with inflation, plus a joint income annuity that pays out as long as one is living.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)

Could you give us a side-by-side comparison of a $1,000,000 portfolio, that is either A.) 100% LIAM to B.) 75% LIAM and 25% deferred longevity annuity. Let’s say the person in scenario A. invests 100% at age 60 and B. invests in the annuity ($250k) at age 50, to start payout at 60 and invests the rest in LIAM at 60. I would be curious as to how much of a bump in income they could realize with scenario B at age 60 (not knowing how annuities should perform these days), perhaps it could be a stop gap measure to help create a bridge to full retirement (age 70+) and potentially allowing them maximize SS payments.

That’s an interesting question, there are a lot of variables with annuity quotes (male/female/joint survivor to start) but I like BlueprintIncome.com for their clean interface.

You might get the equivalent of 7.8% ($78,000 a year of income on $1M) but of course if you die early, you’d be out the entire principal unless you bought an optional rider. But if you live to 100, you’d have income the entire time. It’s a tricky balance.

If the income is the solo purpose, why don’t you just buy an annuity with a lifetime income rider? a half million annuity will generate about $8ok income each year depending on at what age you buy and when you retire.

Inflation protection is the differentiating feature here. The risk is of very high inflation for an extended period of time during your retirement period. A fixed, nominal annuity income for 30+ years would be greatly impacted.