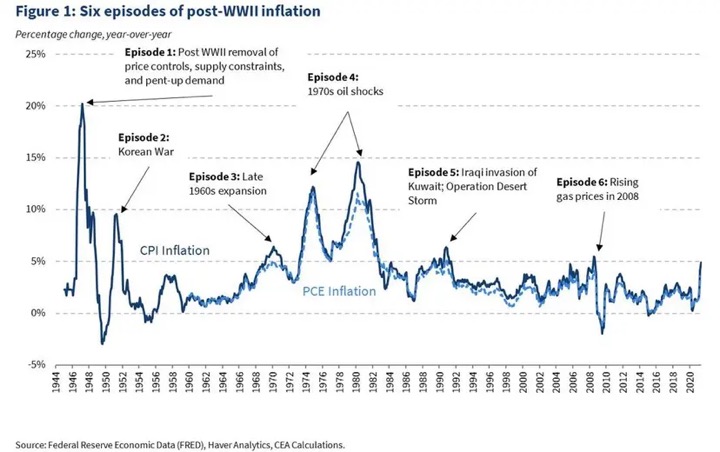

Sometimes it seems like everyone just wants risk these days. Crypto. Sports gambling. Options trading, ETFs that magically yield 10% or more. However, if you’re in the opposite camp and you want the absolute least amount of risk, you’d want to retire off an investment that has a return that is fully-guaranteed, pays out a monthly income like clockwork, is even guaranteed to grow with inflation. Inflation was relatively mild for a long time until recently, but historically it has been a significant risk factor.

If that interests you, check out 3 Ways to Build an Inflation-Adjusted Pension by Allan Roth – which first reminds you that Social Security is exactly this! – but also introduces a new series of LifeX Inflation-Protected Longevity Income ETFs.

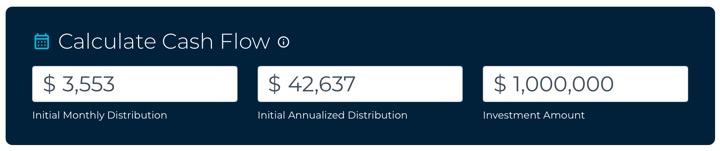

At current rates as of 12/11/25, the LifeX 2055 Inflation-Protected Longevity Income ETF (LIAM) contains a managed portfolio of United States Treasury Inflation Indexed Bonds (TIPS) that can provide you with a 4.26% guaranteed real withdrawal rate for 30 years. That means a $1,000,000 portfolio would distribute roughly $42,600 in annual income this year, but that number would increase with CPI inflation each year for 30 years (through the year 2055). At 3% average inflation, your 30th year’s income would have grown to over $100,000 a year. Of course, inflation could be a lot higher, which is why no private insurance company will sell you inflation protection over such a long period of time.

After those 30 years, you will be left with nothing. Your initial principal will be gone. Therefore, your income taken each year is partially a return of principal.

The expense ratio is 0.25%, which isn’t Vanguard-level but not horrible. I like that it does all of the work for you in a tidy ETF package, as building a TIPS ladder yourself can be a bit tricky (and do you want to keep doing it at age 80, 90?). Of course, I also worry about what happens if you bought a 30-year ladder at 65 and happen to live past 95. It could happen, and remember, this product is meant for the risk-averse folks that like to cover all the bases.

In general, I feel a TIPS ladder or equivalent that adjusts with inflation would work well in combination with a traditional annuity like an SPIA or a deferred longevity annuity that starts at a later age, which doesn’t adjust with inflation but does provide an higher initial fixed income that can last as long as you live. This is what I have set up for my parents – Social Security that rises with inflation, plus a joint income annuity that pays out as long as one is living.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)