I’ve written a little about about Multi-year guaranteed annuity (MYGA) fixed deferred annuities in the past, and I actually bought one as one of my “$10,000 Experiments” way back in 2015. I bought the MYGA with the highest available interest rate at the time from a company called Sentinel Security Life. Owning a MYGA is very quiet, I only get a mailed statement once a year and the only action required is to roll it over every 5 years. In 2020, Sentinel still offered the highest rate, so I rolled it over to them again. More quiet…

Fast forward to early 2025, and after my recent post about private equity entering the world of MYGAs, I decided to check in on ole’ Sentinel Security Life. Turns out they have been going through some major drama recently!

- In December 2024, the Utah Insurance Department issued an emergency order prohibiting Sentinel Security Life, along with its affiliates Haymarket Insurance and Jazz Reinsurance, from issuing new policies after December 31, 2024.

- In mid-March 2025, a Utah judge paused this emergency order, and allowed them to start issuing policies again, pending the result of a trial to start in May 2025.

- In March 2025, Utah Insurance Commissioner Jonathan Pike petitioned for Sentinel to be placed into “rehabilitation”, stated that it had a “years-long history of self-dealing, conflicts of interest, and obfuscation.” For example, allegedly, Sentinel Insurance would make substantial risky loans to entities also owned by the same controlling party (Kenneth King and Advantage Capital Partners, known as A-Cap). They also have additional insurance companies in South Carolina that are having similar issues with regulators.

“Drama” and your insurance/annuity provider are not a good combo. I knew that going for the highest interest would involve buying from a riskier insurance company, but went for it anyway because that was the entire point of the experiment. The reason to go for a MYGA instead of an FDIC-insured bank CD is to earn a significantly higher net rate due to the combination of the rate gap and the tax deferral benefits during accumulation. Along with that is the assumption that insurance department will require the insurance companies have proper reserves, and that your state guaranty association will cover you in the unlikely case that your insurance company does fail.

While in the accumulation stage, I feel that I can be more aggressive in using a higher-interest-paying, lower-credit-rating company since my exposure will be limited to the next 5 years. But eventually if I choose to convert the final amount to an annuitized income stream, I would be more conservative since my exposure would be potentially for decades. If I was relying on Sentinel to provide my monthly paycheck in retirement, that would be very stressful.

As it stands, my current 5-year MYGA contract ends in less than 5 months (September 2025), and I will be looking to transfer to another 5-year MYGA from a different insurance provider. Honestly, I’ll still probably be comparison shopping amongst the highest rates. I worry that if I tried to buy only from some old, stodgy traditional insurance company, these days it could be bought out by some private equity firm and transformed within a year anyway.

In the end, like many insurance and annuity products, MYGAs are very complex with a lot of variables and grey areas. As a finance geek, this actually intrigues me, but on the flip side this means they are not very consumer-friendly. I personally don’t view their benefits to justify the added complexity to my overall portfolio, so I have not bought any additional MYGAs since my first and only purchase.

If you do decide to pursue MYGAs, I encourage you to research State Guaranty Associations and be careful to stay under your applicable state limits. Since their beginnings in the 1970s, no state guaranty association has failed to pay a covered claim. However, nobody knows what would happen if there was a large crisis. They are not backed by any Federal guarantee like FDIC or NCUA insurance.

As a follow-up to my post about

As a follow-up to my post about

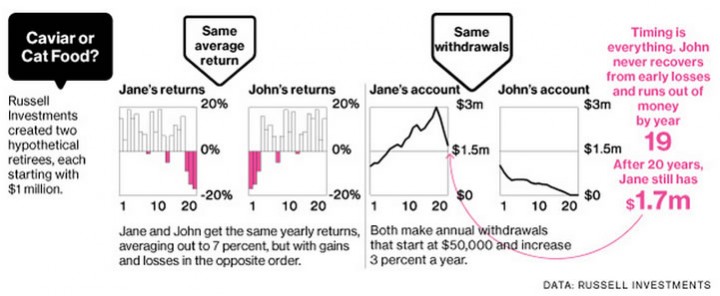

One of the first things that pops up when doing research on retirement annuities is the “annuity puzzle”. Essentially, economists have done their calculations and shown that simple, immediate income annuities are theoretically the best fit for many people. You give up some things like liquidity and upside potential, but in exchange you get the most monthly income for the rest of your life. But in the real world, only a small fraction of such people actually go out and buy such annuities.

One of the first things that pops up when doing research on retirement annuities is the “annuity puzzle”. Essentially, economists have done their calculations and shown that simple, immediate income annuities are theoretically the best fit for many people. You give up some things like liquidity and upside potential, but in exchange you get the most monthly income for the rest of your life. But in the real world, only a small fraction of such people actually go out and buy such annuities.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)