Back in 2020, I wrote a post Do Not Buy List: Healthcare Sharing Ministry As Health Insurance Alternative. Although they may present a lower-cost option that even aligns with your faith, they can also contain hidden and unpredictable risks. Since then, membership has grown but many have also found themselves stuck with large and unexpected unpaid bills.

Sharity Ministries, also formerly known as Trinity HealthShare, went into bankruptcy in 2021 and left their 40,000+ members with over $300 million in unpaid healthcare claims. A 2022 lawsuit by the State of California alleged that Sharity Ministries paid out as little as 16 cents of every dollar it took in.

Medical Cost Sharing Inc. of Missouri was shut down by the FBI and Dept. of Justice in early 2023 after allegedly taking in millions in premiums but only paying out an estimated 3.5% of premiums collected.

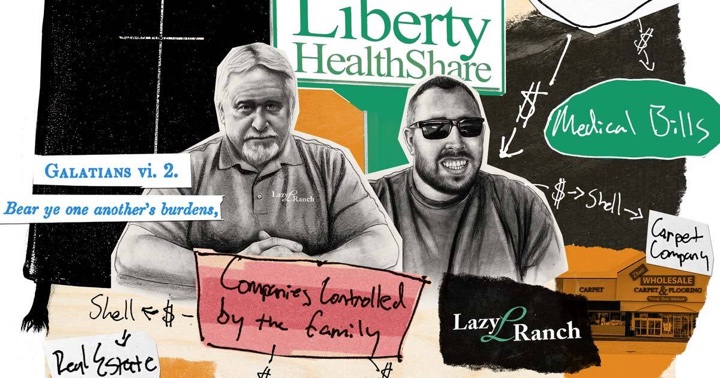

Liberty Health Share, which has over 220,000 members, has been involved in multi-million dollar settlements with its vendors (which records show were owned by relatives or prior business partners of the CEOs) and is the subject of a new investigative article by Propublica: A Christian Health Nonprofit Saddled Thousands With Debt as It Built a Family Empire Including a Pot Farm, a Bank and an Airline.

The failure of federal and state agencies to move decisively against the Beers family has left Liberty HealthShare members struggling with millions of dollars in medical debt. Many have joined a class-action lawsuit accusing the nonprofit of fraud.

One of the main issues is that they purposefully operate in a gray area where they make all the rules. Anyone can claim to pay 100% of “eligible” expenses, as long as they get to define “eligible”. The “non-profit” executives can also pay other businesses affiliated with themselves, which in turn do make plenty of profit.

Despite abundant evidence of fraud, much of it detailed in court records and law enforcement files obtained by ProPublica, members of the Beers family have flourished in the health care industry and have never been prevented from running a nonprofit. Instead, the family’s long and lucrative history illustrates how health care sharing ministries thrive in a regulatory no man’s land where state insurance commissioners are barred from investigating, federal agencies turn a blind eye and law enforcement settles for paltry civil settlements.

With minimal regulatory oversight, things can go bad without anyone noticing:

There is no national data showing how much health care sharing ministries spend on members’ medical bills. However, as scrutiny of sharing ministries increased in recent years, some states have begun to require financial disclosure. Data published by the Massachusetts’ insurance board shows that Liberty spent about 56 cents of every dollar it took in from members in that state on medical expenses in 2019 and 2020, a figure that would be scandalous if it were an insurance company. The federal government requires insurance companies to spend at least 80 cents of every dollar on direct care.

While they may claim to be non-profit charities, these entities are all businesses in the end. They must balance revenue and expenses, deal with the overall economy, deal with internal and external fraud. The numbers have to add up, while low premiums conflict with generous claims payouts. Charities fail. Businesses fail. Can you predict which one?

Given that a single medical diagnosis could add up to $100,000 or $200,000 or more in total bills, the failure of a health care sharing ministry could basically mean the bankruptcy of most families. Even worse, they may place a household in the position to avoid or skip important treatment. The entire reason we have car, home, and life insurance is to prevent financial disaster from a single incident.

Things can go well for a long time. Bernie Madoff’s clients were quite happy with his services… until they weren’t. Warren Buffett summarizes with this quote:

Over the years, a number of very smart people have learned the hard way that a long string of impressive numbers multiplied by a single zero always equals zero.

I share the stories above that have occurred just over the past few years, and while I’m hopeful that there will be no future examples, I’m also realistic that the list will likely continue to grow. Be careful out there. It’s not worth risking a zero for me.

Everyone loves a 100% money-back guarantee. A popular option on insurance policies is the “Return of Premium” rider. Let’s say you buy a $1,000,000 term life insurance for 30 years at $1,000 a year. At the end of 30 years, if you’re still alive, the insurance policy will no longer pay you the $1,000,000 if you die, but it will return all the premium you paid ($30,000). In your mind, you could think of it as “no risk” because you’ll get your $30,000 back no matter what!

Everyone loves a 100% money-back guarantee. A popular option on insurance policies is the “Return of Premium” rider. Let’s say you buy a $1,000,000 term life insurance for 30 years at $1,000 a year. At the end of 30 years, if you’re still alive, the insurance policy will no longer pay you the $1,000,000 if you die, but it will return all the premium you paid ($30,000). In your mind, you could think of it as “no risk” because you’ll get your $30,000 back no matter what!

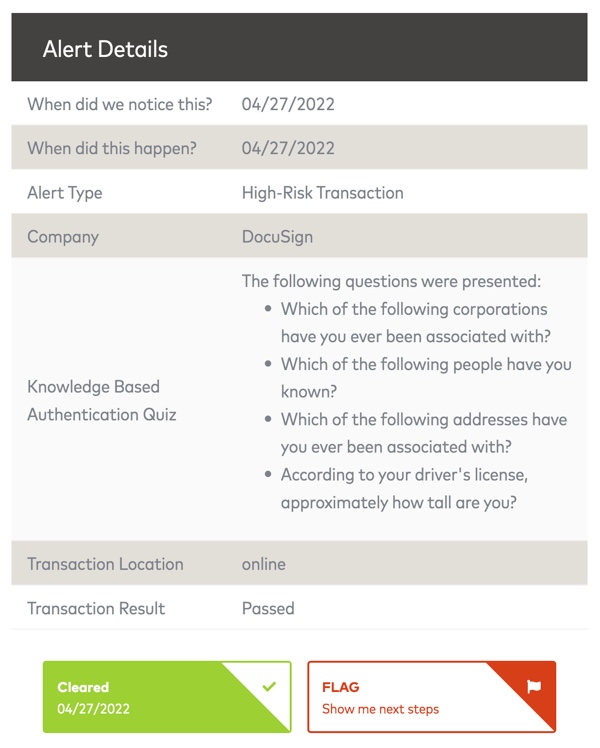

Data breaches are scary fact of life these days. If you have a Mastercard, did you know that they offer a

Data breaches are scary fact of life these days. If you have a Mastercard, did you know that they offer a  My current commute/workout/kid taxi listening is old Berkshire Hathaway shareholder meetings after finding them in

My current commute/workout/kid taxi listening is old Berkshire Hathaway shareholder meetings after finding them in

Updated for 2021. Here is the second part of my big list of free consumer reports from over 50 different reporting agencies. The first part included your

Updated for 2021. Here is the second part of my big list of free consumer reports from over 50 different reporting agencies. The first part included your  Many of us are driving less these days. Nearly all of the major auto insurers are providing some sort of refund – this

Many of us are driving less these days. Nearly all of the major auto insurers are providing some sort of refund – this

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)