Finally… I passed the “Insurance Planning” course for my University of Georgia Self-Paced CFP class. That’s only #2 out of the 7 topics, but here are a few quick observations so far:

- After trying a couple of times… 😅 I was not able to pass the course exams without studying the course materials first. You need 80% correct to pass, and I’d be in the 60% to 80% range without any studying.

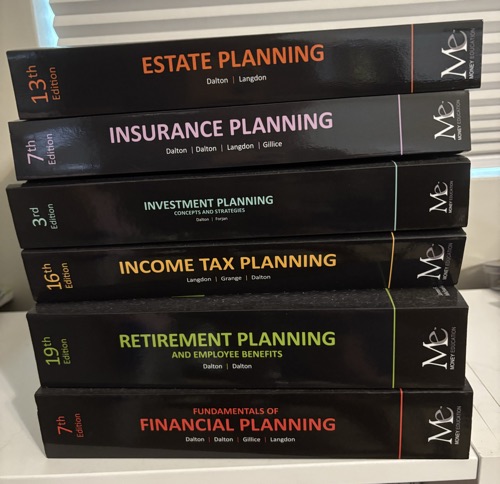

- I’ve been able to pass the exams after only reading the online course slides and review questions. I haven’t opened the textbooks once (as shown in pristine condition above!), even though I spent extra for the physical textbooks (as opposed to electronic-only).

- As a personal finance geek, I did know a lot of the material beforehand, but there are definitely new bits that I’m learning here and there. The material is dry, but it covers a lot of topics.

- Like many other professional certification exams, much of passing means studying specifically for the test. The questions aren’t necessarily weighted by what’s commonly used in financial planning practice, but by what is easiest to test in a multiple-choice format. That means memorizing formulas that require a financial calculator, “none of the above”, “all of the above”-type questions, and minor differences in definitions. I now understand why even after completing this educational course requirement, most CFP applicants sign up for another ~$1,000 “cram course” that just drills you on sample test questions.

Back to Insurance Planning. I got stuck on this course for while as it is a very wide topic with some rather dull topics, so here is a high-level overview of what was covered.

Three main categories of “Pure Risk” for individuals and families:

- Personal

- Property

- Liability

Principles and Purpose of Insurance

- Types of risk (pure vs. speculative)

- Methods of managing risk (avoidance, reduction, retention, transfer)

Property and Casualty Insurance

- Homeowners and renters insurance

- Auto insurance

- Liability and umbrella policies

- Business-related coverage

Life Insurance

- Types (term, whole, universal, variable)

- Suitability and needs analysis

- Policy selection, riders, beneficiary designations

Health Insurance and Disability Insurance

- Health plans (PPO, HMO, HDHP, etc.)

- Medicare and Medicaid

- Social Security

- Disability coverage (short-term, long-term, own vs. any occupation)

- Long-Term Care Insurance

Employee and Group Benefits

- Group life, health, and disability plans

- COBRA and continuation coverage

- Cafeteria and flexible spending accounts

Annuities

- Types (fixed, variable, immediate, deferred)

- Payout options and guarantees

- Tax treatment and suitability

Role of a financial planner.

- Coverage level determination

- Help clients identify coverage gaps or excesses.

- Refer clients to qualified Property & Casualty (P&C) agents.

- Evaluate insurance as part of a broader financial plan.

- Review and update over time

For example, for personal liability insurance you would ask about:

- Personal Auto Policy (PAP): For motor vehicle-related liabilities.

- Homeowners Policy: Covers bodily injury/property damage to others.

- Comprehensive Personal Liability (CPL) Policy: Standalone liability coverage.

- Umbrella Policy: Broad, high-limit policy supplementing existing coverages.

You may not need all of them individually, but some combination of these should work together to make sure there no holes. It’s also possible that you may have duplicate coverage or otherwise too much insurance.

A lot of financial advice focuses on “offense”: maximizing income, minimizing expenses, and optimizing investments. But “defense” is just as important, as it includes protecting from loss of future income and loss of existing assets.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)

Is my house insured for 100% of the cost to replace the building (“replacement cost”, as opposed to “actual cash value” which includes depreciation)? Does that amount increase with inflation? Does that include any recent improvements or additions to the home?

this doesnt make sense to me. rebuilding is expensive, and if multiple people have losses at the same time, could be even more expebsive.

why not just pay off the loan and walk away? in which case you wont get replacement cost, you will get current value. which means replacement cost is over insuring.

Your house might have a “actual cash value” of $400,000 due to depreciation over the years (it is “used”), but if it actually burned down, then it would cost $500,000 to get you a new house. You’d have to move to a cheaper house. You just have to choose if you want to insure it for $400,000 or $500,000. It is fine to opt for less insurance, but the point is to make it a conscious decision as many people would want to live in the same house/neighborhood and won’t have the extra $100,000 available to rebuild their house otherwise.

Hi Jonathan,

Is there any career path linked to these courses. Do you have any insights on that?

Regards,

Atish

This course is specifically designed to satisfy the Education requirement for CFP. If you mean besides for getting the Certified Financial Planner designation, lots of folks with CFPs end up doing different things in the financial field.