Updated for 2017. You’ve worked hard and you have some money to put away for your future self. What should you do with your money? There is no definitive list, but each person can create their own with common components. You may also want to revisit it again every year.

You can find some examples in this Vanguard blog and see what I had down in this 2006 blog post. Here’s my current list:

- Invest in your 401(k) or similar plan up until any match. Company matches typically offer you 50 cents to a dollar for each dollar that you contribute yourself, up to a certain amount. Add in the tax deferral benefits, and it adds up to a great deal. Estimated annual return: 25% to 100%. Even if you are unable to anything else in this list, try to do this one as it can also serve as an “emergency” emergency fund.

- Pay down your high-interest debt (credit cards, personal loans, car loans). If you pay down a loan at 12% interest, that’s the same as earning a 12% return on your money and higher than the average historical stock market return. Estimated annual return: 10-20%.

- Create an emergency fund with at least 3 months of expenses. It can be difficult, but I’ve tried to describe the high potential value of an emergency fund. For example, a bank overdraft or late payment penalty can be much higher than 10% of the original bill. Estimated return: Varies.

- Fund your Traditional or Roth IRA up to the maximum allowed. You can invest in stocks or bonds at any brokerage firm, and the tax advantages let you keep more of your money. Estimated annual return: 8%. Even if you think you are ineligible due to income limits, you can contribute to a non-deductible Traditional IRA and then roll it over to a Roth (aka Backdoor Roth IRA).

- Continue funding your 401(k) or similar to the maximum allowed. There are both Traditional and Roth 401(k) options now, although your investment options may be limited as long as you are with that employer. Estimated annual return: 8%.

- Save towards a house down payment. This is another harder one to quantify. Buying a house is partially a lifestyle choice, but if you don’t move too often and pay off that mortgage, you’ll have lower expenses afterward. Estimated return: Qualify of life + imputed rent.

- Fully fund a Health Savings Account. If you have an eligible health insurance plan, you can use an HSA effectively as a “Healthcare Roth IRA

where your contributions can be invested in mutual funds and grow tax-deferred for decades with tax-free withdrawals when used towards eligible health expenses. - Invest money in taxable accounts. Sure you’ll have to pay taxes, but if you invest efficiently then long-term capital gains rates aren’t too bad. Estimated annual return: 6%.

- Pay down any other lower-interest debt (2% car loans, educational loans, mortgage debt). There are some forms of lower-interest and/or tax-deductible debt that can be lower priority, but must still be addressed. Estimated annual return: 2-6%.

- Save for your children’s education. You should take care of your own retirement before paying off your children’s tuition. There are many ways to fund an education, but it’s harder to get your kids to fund your retirement. 529 plans are one option if you are lucky enough to have reached this step. Estimated return: Depends.

I wasn’t sure where to put this, but you should also make sure you have adequate insurance (health, disability, and term life insurance if you have dependents). The goal of most optional insurance is to cover catastrophic events, so ideally you’ll pay a small amount and hope to never make a claim.

Citibank has a

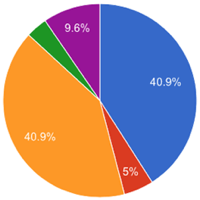

Citibank has a  Here is a roughly mid-year 2016 update on my investment portfolio holdings. This includes tax-deferred accounts like 401ks, IRAs, and taxable brokerage holdings, but excludes things like our primary home and cash reserves (emergency fund). The purpose of this portfolio is to create enough income to cover household expenses.

Here is a roughly mid-year 2016 update on my investment portfolio holdings. This includes tax-deferred accounts like 401ks, IRAs, and taxable brokerage holdings, but excludes things like our primary home and cash reserves (emergency fund). The purpose of this portfolio is to create enough income to cover household expenses.

If you have an Ally Bank savings or checking account, you’ve likely been pitched their new

If you have an Ally Bank savings or checking account, you’ve likely been pitched their new

This is becoming a recurring theme around here, but I came across an interesting tidbit in this

This is becoming a recurring theme around here, but I came across an interesting tidbit in this

I like the idea of living off dividend and interest income. Who doesn’t? The problem is that you can’t just buy stocks with the absolute highest dividend yields and junk bonds with the highest interest rates without giving up something in return. There are many bad investments lurking out there for desperate retirees looking only at income. My goal is to generate reliable portfolio income by not reaching too far for yield.

I like the idea of living off dividend and interest income. Who doesn’t? The problem is that you can’t just buy stocks with the absolute highest dividend yields and junk bonds with the highest interest rates without giving up something in return. There are many bad investments lurking out there for desperate retirees looking only at income. My goal is to generate reliable portfolio income by not reaching too far for yield. It has been a while, so here is a 2016 First Quarter update on my investment portfolio holdings. This includes tax-deferred accounts like 401ks, IRAs, and taxable brokerage holdings, but excludes things like our primary home and cash reserves (emergency fund). The purpose of this portfolio is to create enough income to cover household expenses.

It has been a while, so here is a 2016 First Quarter update on my investment portfolio holdings. This includes tax-deferred accounts like 401ks, IRAs, and taxable brokerage holdings, but excludes things like our primary home and cash reserves (emergency fund). The purpose of this portfolio is to create enough income to cover household expenses. The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)