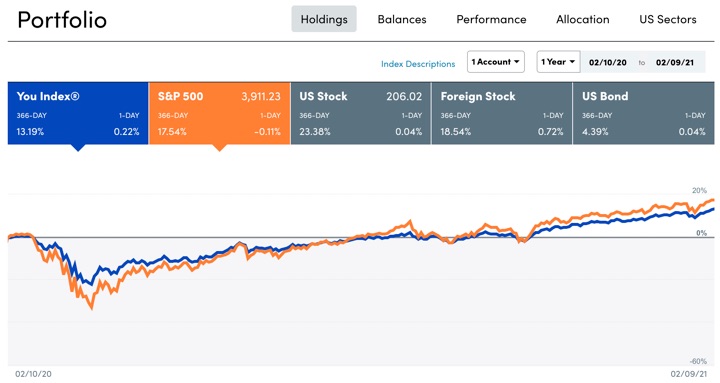

Are stocks too overpriced? Is inflation coming to crush bonds? The media is not incentivized to tell you what is often the best advice: do absolutely nothing. If you still want to take action, consider rebalancing your portfolio. If you’ve stayed invested throughout the last several years, your portfolio may have shifted as in the scenario above:

For example, imagine you selected an asset allocation of 50% stocks and 50% bonds. If 4 years go by during which stocks return an average of 8% a year and bonds 2%, you’ll find that your new asset mix is more like 56% stocks and 44% bonds.

Here are some quick tips about rebalancing your portfolio back towards your target risk level, taken from Vanguard article #1 and Vanguard article #2.

Here are three possible rebalancing strategies:

- Time: Rebalance your portfolio on a predetermined schedule such as quarterly, semiannually, or annually (not daily or weekly).

- Threshold: Rebalance your portfolio only when its asset allocation has drifted from its target by a predetermined percentage.

- Time and threshold: Blend both strategies to further balance your risk.

Here are three practical tips from Vanguard to rebalance with minimal tax drag:

- Focus on tax-advantaged accounts. Selling investments from a taxable account that’s gained value will most likely mean you’ll owe taxes on the realized gains. To avoid this, you could rebalance within your tax-advantaged accounts only.

- Rebalance with portfolio cash flows. Direct cash inflows such as dividends and interest into your portfolio’s underweighted asset classes. And when withdrawing from your portfolio, start with your overweighted asset classes. (If you’re age 72 or over, take your required minimum distribution (RMD) from your retirement account(s) while you’re rebalancing your portfolio. You can then reinvest your RMDs in one of your taxable accounts that has an underweighted asset class.)

- Be mindful of costs. To minimize transaction costs and taxes, you could opt to partially rebalance your portfolio to its target asset allocation. Focusing primarily on shares with a higher cost basis (in taxable accounts) or on asset classes that are extremely overweighted or underweighted will limit both taxes and transaction costs associated with rebalancing.

These tips are very closely related to my own simple rebalancing system. Here’s what my process looks like these days:

- Only peek once a quarter. I update my Google portfolio spreadsheet and log into Personal Capital once a quarter. Otherwise, try not to track daily movements in my portfolio or the stock market in general. Consuming more information is not always better, as you start to confuse noise vs. signal.

- Rebalance first with available cash. In my Solo 401k and taxable brokerage accounts, this includes bond interest, dividends, and capital gains distributions. During the accumulation stage, this included regular savings from job income.

- If the stock/bond ratio is still off by more than 5%, then rebalance more using tax-advantaged accounts. I have multiple asset classes, but for triggering rebalancing, I focus on the overall stocks/bonds ratio during my quarterly check-up. My equities are all “risk on” (including Small Cap Value, Emerging Markets, and REITs) and my bonds are all “risk off” (US Treasuries, TIPS, and FDIC/NCUA-insured CDs only). I can use my 401k balance (including brokerage window), IRAs, and Solo 401k brokerage plan to make adjustments with no capital gains.

- If absolutely required in a rare case, make taxable sale using specific ID of tax lots. I select the “Specific ID” method at Vanguard to identify the tax lots when selling. I can thus choose to realize a bigger gain when my tax rates are low, and a lesser gain when my tax rates are high.

Rebalancing should be a relatively minor adjustment, but selling 5% can be enough to feel like you took some positive action. (I try to avoid large, sudden changes for any reason, even though I do feel the fear at times.) If stocks go down, you can be happy you sold some stocks while they were “up”. If stocks keep going up, you’ll still be mostly invested and participating in those gains.

Vanguard is making a

Vanguard is making a

Interest rates on liquid savings accounts keep dropping, making bank bonuses more attractive on a relative basis. Opening new accounts are more hassle, so I usually want at least double the interest rates I could get by doing nothing. This

Interest rates on liquid savings accounts keep dropping, making bank bonuses more attractive on a relative basis. Opening new accounts are more hassle, so I usually want at least double the interest rates I could get by doing nothing. This  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)