It looks like my post on EE Savings Bonds a few weeks ago is already obsolete, as the U.S Treasury Department announced yesterday that Series EE Savings Bonds issued on and after May 1, 2005, will earn fixed rates of interest for the lifetime of the bond. You’ll basically be buying a 30-year CD with no early withdrawal penalties after 5 years.

It looks like my post on EE Savings Bonds a few weeks ago is already obsolete, as the U.S Treasury Department announced yesterday that Series EE Savings Bonds issued on and after May 1, 2005, will earn fixed rates of interest for the lifetime of the bond. You’ll basically be buying a 30-year CD with no early withdrawal penalties after 5 years.

[Read more…]

Search Results for: High Interest Savings

Series EE Savings Bonds To Earn Fixed Rates

U.S. Savings Bonds: I-Bonds and EE-Bonds – Good investment? (Part 2)

(This post is continued from Part 1)

Okay, so we went over I-Bonds for a little bit, now let?s see what EE Bonds have to offer. Again, EE-Bonds share many characteristics with I-Bonds, which were outlined in my previous post. However, EE-Bonds are sold at half of face value ? a ?$50 EE Bond? costs $25. Whenever a contest offers you a ?$50 Savings Bond?, odds are it?s an EE-Bond.

[Read more…]

U.S. Savings Bonds: I-Bonds and EE-Bonds – Good investment? (Part 1)

Right now, my portfolio is very cash heavy (almost 50k), as I saving for up a house in crazy-prices land. Accordingly, I am always on the looking for liquid investments that are safe and pay competitive interest rates. So I’m taking another look at U.S. Savings Bonds.

Right now, my portfolio is very cash heavy (almost 50k), as I saving for up a house in crazy-prices land. Accordingly, I am always on the looking for liquid investments that are safe and pay competitive interest rates. So I’m taking another look at U.S. Savings Bonds.

Let?s start with the two types of Savings Bonds that are available: EE and I Bonds. I’ll start with characteristics that are the same for both types, and then focus on I-bonds, leaving EE bonds for a later post.

[Read more…]

Portfolio Manager Rick Ferri Shares Personal Portfolio and Asset Allocation

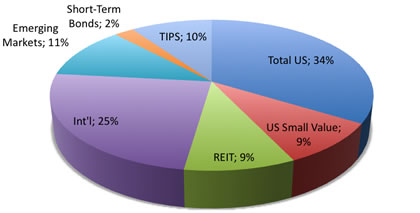

In a recent post on the NY Times Bucks blog, portfolio manager and author Richard Ferri shared his own personal portfolio. As a proponent of low-cost, passive investing, it was not surprising to see mostly index funds in his portfolio, but it was interesting to see that his overall asset allocation is 80% stocks and 20% bonds. He is quick to note that he does have a pension and defined-benefit plans which balance out his overall financial picture. Wouldn’t you like to know what all those financial advisors out there actually own?

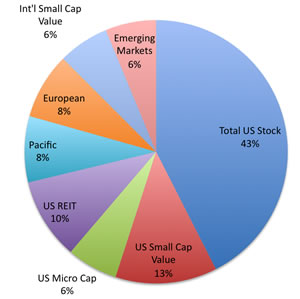

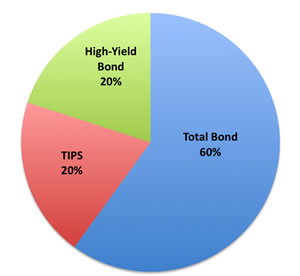

Asset Allocation

Here is his asset allocation broken down into stocks and bonds separately using pretty pie charts:

Stocks

Bonds

Here’s the overall 80/20 breakdown with ticker symbols (based on this Bogleheads post):

34% Vanguard Total Stock Market ETF (VTI)

10% S&P SmallCap 600 Value Index Fund (IJS)

5% Ultra-Small Company Market (BRSIX)

8% Vanguard REIT ETF (VNQ)

6.5% Vanguard Pacific ETF (VPL)

6.5% Vanguard European ETF (VGK)

5% DFA International Small Cap Value

5% DFA Emerging Markets Core

—- [alternative: Vanguard Emerging Markets ETF (VWO)]

12% Vanguard Total Bond Market Index Fund Investor Shares (VBMFX)

4% Vanguard Inflation-Protected Securities Fund Investor Shares (VIPSX)

4% Vanguard High-Yield Corporate Fund Investor Shares (VWEHX)

Reading his book All About Asset Allocation was very helpful in creating my own portfolio. (Also see Model Portfolio #3 taken from that book.) I haven’t been updating my own own portfolio asset allocation as diligently as I should, although I have been keeping track of it. Here’s the last snapshot I took:

I’ve had some asset allocation drift for sure, although I have been countering this by rebalancing with new funds. I really need an update…

Emergency Funds

It’s also interesting to note that he keeps an emergency fund of two years’ living expenses, and that he uses the Vanguard Short-Term Bond (BSV) with a current SEC yield of 1.08%. Very simple and almost no-maintenance.

I prefer using a mix of high interest savings accounts and longer-term CDs/rewards-type checking accounts. I figure that index fund investors get so excited by saving 10 basis points (0.10%) on mutual fund, but with a bit of work you could beat a short-term bond fund by 100 basis points (1%) with what I would call less risk.

Bond funds still have risk to principal, meaning you may have to sell for less than you bought in for, while FDIC-insured bank accounts do not. Money market funds are currently averaging less than 0.10% yield.

SoFi Offers: SoFi Plus Changes, New 5% Grocery Card, $325/4.20% APY Checking Bonus, $300-$1000 Loan Bonuses

Update December 2025: SoFi announced some changes to their available features and what is only available with their SoFi Plus “Premium” membership program. I feel that they are trying to build something like “Robinhood Gold”, but hopefully better promos are coming because I don’t feel the perks are worth the cost right now. First, there are now three different ways to earn their higher APY tier (any single ONE of these is enough):

- Eligible Direct Deposit of any amount (even $1). Many people can split their paycheck multiple ways.

- $5,000+ in combined balances across SoFi Checking and Savings accounts

- SoFi Plus members that pay $10/month fee.

You can see this on their rate sheet (as of 11/12/25):

Second, SoFi Plus is now paid-only at $10/month. You no longer get it for free with a direct deposit, although they are extending complimentary access to all SoFi Plus benefits through March 30, 2026 with eligible deposits. You can see a list of SoFi Plus benefits here.

For the most part, the SoFi Plus benefits are the same as before. A notable new addition is the SoFi Smart Card which is a charge card linked to your SoFI Bank accounts that offers unlimited 5% cash back at grocery stores.

Otherwise, I would say the most valuable SoFi Plus perks that existing Direct Deposit folks lost with this change are:

- 10% rewards boost on the SoFi Unlimited 2% Credit Card, which turns the 2% cash back into 2.2% cash back.

- 2% match on recurring IRA contributions, plus a 1% match on recurring deposits made through SoFi Invest taxable brokerage accounts.

- Possibly the ability to “schedule an unlimited number of appointments with a financial planner”, although I’m not sure of the quality of this advice. There is no indication you’re guaranteed at least a CFP. I’ve never used this feature, but it might be nice if you wanted to get some general advice.

Update April 2024: SoFi made a few notable changes recently, both positive and negative:

- The SoFi Unlimited 2% Credit Card added 10% boost on their rewards with direct deposit into SoFi Checking or Savings. This would work out to 2.2% cash back rewards points on everyday purchases. (As of December 2025, this is now restricted to SoFi Plus members paying $10 a month.)

- There is a new inactivity fee of $25 per account for every 6 months of login inactivity.

- The outgoing ACAT transfer fee was increased to $100. Previously $75.

Original post:

SoFi (“Social Finance”) is an all-in-one finance app that expanded from students loans into banking, stocks, crypto, credit cards, and more. Here are their current promotional offers; New users can receive a separate opening bonus for each separate part of SoFi (Money, Invest, Loans, etc).

- SoFi Checking Referral Offer: Up to $325 new user bonus. Open a new SoFi Money account and add at least $10 to your account within 5 days, and get $25. Then get up to $300 additional bonus with qualifying direct deposit. Plus up to 4.30% APY.

- SoFi Credit Score Tracking Offer: $10 in rewards bonus points. You’ll earn $10 in rewards points when you activate free credit score monitoring

- SoFi Invest Referral Offer: $25 new user bonus. Taxable brokerage account. Open an Active Investing account with $10 or more, and you’ll get $25 in stock.

- SoFi 401(k) Rollover Offer: Up to $10,000 Bonus. Get a 1% match when you roll over your 401(k) into a SoFi IRA. Partnered with Capitalize to make the transition easier.

- SoFi Student Loan Refi: $300 bonus. Warning: Do your research before refinancing your Federal student loans to a private lender.

- SoFi Doctors and Dentists Student Loan Refi: $1,000 bonus. Special low rates just for doctors and dentists.

- SoFi Private Student Loan: $300 bonus.

- SoFi Personal Loans Referral Offer: Fixed $300 bonus. Fixed $300 bonus, 90 days after successful funding. The loan has no fees and you can pay it back in full after 90 days (you can pay it down to $50 before then to accrue minimal interest, thus making a new profit after the bonus).

Ally Bank Checking (Spending Account): $300 Bonus w/ Direct Deposit

Bonus is back, now $300. Ally Bank has a new checking account promotion for their “Spending Account”. You must open your first Spending Account by 11/18/2025 and use the promo code GET300, fund it within 30 days of opening, and set up qualifying direct deposits of at least $1,000 a month for two consecutive months. Your first monthly qualifying direct deposit(s) totaling at least $1,000 must post to your Spending Account within 60 days of when you open the account. You’ll then get a $300 bonus within 30 days of the qualifying direct deposits.

If you don’t have an Ally Spending account already but are using their Savings account, this is a good bonus to grab. If you don’t have an Ally Savings account yet, I would open a Savings first grabbing this $100 bonus (which works for both Savings and Checking and only works if you have no Ally accounts at all), satisfy all the requirements, and then after do this bonus on your first Checking (allows you to have other Ally accounts).

Spending Account mini-review. Their Spending Account is solid but nothing extraordinary – a checking account with no monthly fees, no minimums, online bill payments, ATM rebates up to $10 per statement cycle, but it only pays a sad 0.10% APY interest on balances up to $15k and 0.25% APY on balances above $15k. However, it does pair well if you already use the Ally Savings Account. You can set an Ally Savings account to be the automatic (and free) backup funding source if you overdraft the Spending account. You can also have multiple Savings Accounts (useful when they enforced the six withdrawals per month limit). So when Ally was my primary account, I would keep a very minimal amount in my Spending Account, a bigger amount in Savings Account #1 as overdraft backup, and another bigger amount in Savings #2 or Savings #3 or No Penalty CD or whatever.

All deposits would go straight into Savings #1, earning higher interest right away. You can even do mobile check deposit directly into Savings. Bill Pay must come out of Spending/Checking, but all of my 5-10 payments would be scheduled on say the 2nd of the month. (You can request to shift each of your credit card due dates to match up.) I would then schedule a big transfer from Savings #1 to Spending/Checking on the 1st of the month. If a random withdrawal hits my Spending/Checking, it would just trigger an auto-withdrawal from Savings #1. The result: maximum interest earned from Savings and minimal idle cash in Spending/Checking.

While I have used my Ally Bank accounts regularly for years due to their well-designed bank-to-bank transfer service and overall solid customer service, the Ally Savings APY has been lagging during this period of interest rate hikes, usually 1% APY behind the rate leaders. Most of my idle cash has moved into money market mutual funds (like VUSXX or FDLXX) and Treasury bonds, both earning me at least 1% APY more on an after-tax basis due to my local state income tax deduction.

Closing US Bank Accounts to Avoid Annual Fee After Smartly Credit Card Negative Changes

As of 9/15/25, my US Bank Smartly credit card was downgraded from 4% cash back for my situation to the more restrictive version of the negative changes to the US Bank Smartly credit card, which matches what is available to new applicants. In other words, a 2% cash back card. Going for any higher cash back rewards tier would actually lose you money due to the interest you must give up on your bank balances.

US Bank changed the terms of their product less than 6 months after many people applied and opened multiple new accounts, including myself. Rather disappointing, although I would have accepted the less restrictive version. But now, since I can get better cash back elsewhere, it was time to tear down the US Bank relationship that I had previously been incentivized to build.

Before 9/15/25, I had:

- Smartly Checking account with active deposits and withdrawals.

- Smartly Savings account.

- Smartly Credit Card with thousands of dollars in monthly transactions.

- US Bancorp Investments Self-Direct Brokerage account with $100,000+ in assets.

After the negative changes, I will have:

- Smartly Checking with $5 balance.

Smartly Savings(closed).- Smartly Credit Card with no regular activity.

US Bancorp Investments Self-Direct Brokerage account(closed).

This minimal setup keeps a few accounts open for possible future use, but in the meantime there will be no regular activity and no fees. The US Bank Smartly Checking has a $12 monthly fee that can be waived with a U.S. Bank Smartly credit card. The US Bank Smartly credit card itself has no annual fee. I’ll make a transaction on the checking and the credit card once a year to maintain activity and prevent closure. Hibernation mode.

Capital One 360 Checking $250 Bonus w/ Direct Deposit

Capital One has a $250 bonus for “new” 360 Checking accountholders. What is “new”? If you have or had an open 360 Checking, Simply Checking, or Total Control Checking account as a primary or secondary account holder with Capital One on or after January 1, 2022, you will be ineligible for the bonus. Here are the details:

- Open a 360 Checking account on or after August 22, 2024, using promotional code CHECKING250.

- Complete at least 2 Qualifying Direct Deposits each of $500 or more to your 360 Checking account within 75 days of account opening.

- You have 75 days to complete the requirements above. After the first 75 days from account opening, your status to receive the bonus will be assessed and processed, which can take up to 60 days. This means, if all requirements are met, you can expect your bonus to be deposited into your account within 135 days from account opening. To receive your bonus, your account must also be open and in good standing at the time the bonus will be deposited.

(This can be a good idea to close any idle Capital One 360 accounts.)

The 360 Checking account is similar to many other online checking options. There is a rather disappointing 0.10% APY interest rate, and nothing special other than the ability to link easily with 360 Savings. Highlights:

- No monthly fees, no minimum balance required.

- 0.10% APY on all balance tiers.

- Remote check deposit via app.

- Paper checks will cost you $20 for 50 checks, or $25 for 100 checks.

- In addition to their own ATMs, Capital One uses the Allpoint ATM network for fee-free ATM access.

- You can use your 360 Savings as the overdraft backup source of funds.

A pretty generous checking bonus if you are eligible, but not that attractive long-term unless you already prefer using CapOne 360 Savings.

US Bank Smartly Credit Card Review: More Negative Changes September 2025

Update August 2025: Previously-grandfathered “V1” cardholders should have received both paper and e-mail notifications of new changes that are to be effective 9/15/25. The e-mail subject will be “Important information about your U.S. Bank Smartly Visa Signature Card”. There appears to be two possible sets of new requirements.

The more restrictive version basically changes you to the current version available to new applicants, which requires all qualifying balances to be held in a checking account earning essentially zero interest. There are also new excluded categories like tuition and estimated tax payments.

Updated rewards earning

You will continue to earn unlimited 2% cash back on every purchase with no caps.¹The way in which you earn a Smartly Earning Bonus will be updated as follows:

Earn up to an additional 2% cash back on your first $10,000 in eligible Net Purchases each billing cycle when paired with a U.S. Bank Smartly® Savings account plus qualifying balances in U.S. Bank Smartly® Checking and/or Safe Debit account(s).¹

– Earn a total of 2.5% cash back with a qualifying balance between $10,000 and $49,999.

– Earn a total of 3% cash back with a qualifying balance between $50,000 and $99,999.

– Earn a total of 4% cash back with a qualifying balance of $100,000 or more.Not all purchases are eligible to earn the Smartly Earning Bonus. Purchases classified in the categories listed below may be excluded from earning the Smartly Earning bonus:

– Education/school, gift cards, insurance, or tax

– Business-to-business transactions (i.e. advertising services, construction material suppliers, etc.)

– Transactions using third-party bill payment servicesThese purchases will earn the base 2% cash back and are not calculated as part of the $10,000 billing cycle cap.

The less restrictive version is mostly the same, with the very important difference being that your qualifying balances can still be held in an investment account. Thanks to reader Playc.

Updated rewards earning

You will continue to earn unlimited 2% cash back on every purchase with no caps.¹The way in which you earn a Smartly Earning Bonus will be updated as follows:

Earn up to an additional 2% cash back on your first $10,000 in eligible Net Purchases each billing cycle when paired with a U.S. Bank Smartly® Savings account and average daily combined qualifying balances in U.S. Bank deposit, trust or investment accounts.¹

– Earn a total of 2.5% cash back with a qualifying balance between $5,000 and $49,999.

– Earn a total of 3% cash back with a qualifying balance between $50,000 and $99,999.

– Earn a total of 4% cash back with a qualifying balance of $100,000 or more.Not all purchases are eligible to earn the Smartly Earning Bonus. Purchases classified in the categories listed below may be excluded from earning the Smartly Earning bonus:

– Education/school, gift cards, insurance, or tax

– Business-to-business transactions (i.e. advertising services, construction material suppliers, etc.)

– Transactions using third-party bill payment servicesThese purchases will earn the base 2% cash back and are not calculated as part of the $10,000 billing cycle cap.

Unfortunately, I got the more restrictive version. That means they will have completely changed their advertised and promised features less than 6 months from getting this card. As a result, I will be closing my Smartly Checking, Smartly Savings, Smartly credit card, and US Bank brokerage account. Not a good look for a place that wants to be taken seriously as one of the major nationwide banks. Unreliability is not something most banks want to be known for.

Update 4/15/25: The rumors were true and have taken effect as of 4/15/25. If you have not applied yet, I wouldn’t bother. Given the spending cap and bonus category exclusions, in nearly all cases, the potential lost interest on the required cash deposits (earning no interest) will be higher than any additional potential cash back rewards earned. I consider this now basically a 2% cash back card.

Update 4/8/25: The same Reddit user has posted follow-up details, and they appear to confirm the details of the initial rumor. Please refer to the newest Reddit post, screenshot #1, screenshot #2, and screenshot #3. They appear legitimate in my opinion.

For existing cardholders, no changes have been announced. Everything is the same, for now. No $10k/month spending cap. Balance tiers are the same. Investment account balances still count. No new bonus category exclusions. Hope the grandfathering of loyal customers lasts, as we went through a good amount of trouble moving over significant assets.

For new cardholders that apply after April 14th, this card is no longer attractive above the base 2% cash back. They will require the qualifying deposits to be held in the Smartly Checking or Safe Debit accounts, which earn zero or essentially zero interest. Balances held in a brokerage account no longer qualify. Even balances held in their own Smartly Savings account (currently up to 3.50% APY) no longer qualify. Given the spending cap and bonus category exclusions, in nearly all cases, the potential lost interest on this cash will be higher than the additional potential cash back rewards earned. Goodbye, Smartly, we hardly knew ye.

Update 4/7/25: The rumors have gotten more supporting evidence. Reddit user Zanutrees posted this screenshot from an internal US Bank e-mail that appears to be legitimate. The two most critical quotes:

- “A revised U.S. Bank Smartly Visa Signature® Card is launching soon and will be available for application in branches starting April 14! Resources to help you prepare for the launch of the revised card will become available on Card Central tomorrow, April 8.“

- “It is important to note that existing Bank Smartly cardmembers as well as any clients who applied prior to April 14 will receive the original Bank Smartly Card features and benefits; the revised card features and benefits will only affect clients who apply for the card on or after April 14.“

Overall, the two actionable responses are the same as below (apply ASAP or never). We just got more support behind the 4/14 deadline and the fact that they will be offering grandfathering (for an unspecified amount of time).

Update 4/2/25: Doctor of Credit reports a Reddit rumor that the US Bank Smartly credit card will be undergoing some major negative changes as of 4/14/25. This includes:

- Base is still 2% cash back on unlimited amounts. Bonus cash back (up to another 2% for a total of 4%) is capped to $10,000 in purchases per statement cycle.

- Bonus cash back now excludes: Educational/school, gift cards, insurance, taxes, business to business transactions, and 3rd party bill payments.

- For new cardmembers after April 14th, only checking account balances count now towards the $10k/$50k/$100k deposit requirements. Critically, savings account balances and investment balances do not count after 4/14 for new cardmembers. Existing customers will be grandfathered in for now.

Again, the above is a rumor. However, I do believe the following are true:

- There is basically no way that this card can continue to exist without some sort of added restrictions. 4% with no cap simply does not math out, as I guarantee that some people are paying $100,000 in college or private school tuitions, $300,000+ in tax bills on this card, and who knows how many business transactions between “friendly” parties…

- US Bank has a history of first rolling out a consumer-friendly product, and then later pulling it from the market or changing the features.

- US Bank also has a history of grandfathering in existing customers of those products and continuing to offer them some/all of the old features.

Therefore, I see two possible actionable responses:

- Giving up on this Smartly card and not applying at all, and possibly avoiding the US Bank ecosystem altogether. It’s hard to work with unreliable people. If these changes take place, after 4/14 the lost interest on $100,000 in cash will outweigh the extra 2% by a good margin.

- Working extra fast right now in order to open up your US Bank Smartly savings account (this seems to be the easiest to open), then Smartly checking w/ bonus, then the US Bank self-directed brokerage account, fund it with $100,000, and apply for the Smartly credit card all as soon as possible, definitely before the rumored 4/14 deadline. Take advantage of the fact that they probably have to grandfather in these current terms at least for a year or so, otherwise in theory they would be bait-and-switching and might get in trouble.

Since my last update, I opened a new US Bank brokerage account, moved over $101,000 in cash, and then invested it all into the SGOV ETF that holds Treasury Bills. (I could have moved over stock ETFs instead, but I had the cash available.) I then applied for the Smartly credit card and was approved with a $25,000 limit despite my previous lack of “pre-approval”. I was hoping that reaching their top rewards tier first would encourage them to approve my new card, and maybe it helped. I’m okay with accepting the rumored changes as long as they grandfather me in on the brokerage balances; it could have been worse. What do you think?

I just took a quick look at the application page. Everything still looks the same as before as of today. I did take some screenshots in case there are subtle changes later.

Update 11/11/24: Applications for this card are now open. No sign-up bonus. It let me check if I was “pre-approved” with a soft pull (had to unfreeze TransUnion for it to work), but I was not pre-approved. That might be because I recently applied for the Altitude Reserve (now-discontinued) after setting up a Smartly Checking and Savings account to get “in” with them but was getting impatient (was denied for US Bank credit cards in the past without a banking relationship due to my geographic area). Will have to sit this one out for now, but plan to try again later if they don’t pull it quickly.

Original pre-review post:

US Bank recently announced the US Bank Smartly Visa Signature Card, a new rewards credit card that offers up to 4% cash back on all purchases, if you have enough qualifying balances with them. This is the newest entrant to relationship banking, where banks offers you extra perks for combining multiple account types with them like savings accounts and investment/retirement accounts.

The card is not open to applications yet, but you can get on an e-mail waitlist. Here are the details of how that “up to 4% cash back” breaks down according to this US Bank press release and CNBC article.

Base rewards of 2% cash back on all purchases, with no limit. Technically, this card earns 2 points per $1 spent in eligible net purchases. In order get 2% cash back, you must redeem those points into an eligible U.S. Bank checking or savings account.

Bonus rewards of 0.5%, 1% or 2% cash back based on your qualifying combined balances at US Bank. You must also have an open Bank Smartly Savings account. Your qualifying combined balances with U.S. Bank include “open consumer checking account(s), money market savings account(s), savings account(s), CDs and/or IRAs, U.S. Bancorp Investments and personal trust account(s).” Business accounts, commercial accounts, and the Trustee only (IFI) client relationship do not qualify.

- $5,000 – $49,999.99 earns 2.5% total cash back. Total of 2.5 Points per $1 (a base of 2 Points plus the Smartly Earning Bonus of 0.5 Points),

- $50,000 – $99,999.99 earns 3% total cash back. Total of 3 Points per $1 (a base of 2 Points plus the Smartly Earning Bonus of 1 Point).

- $100,000+ earns 4% total cash back. Total of 4 Points per $1 (a base of 2 Points plus the Smartly Earning Bonus of 2 Points).

Other bits: CNBC article reports no annual fee. Points will expire if there is no reward, purchase, or balance activity on your account for 12 consecutive statement cycles. Bank Smartly Credit Card and Bank Smartly Savings available in all 50 states.

Bank Smartly savings account. Let’s take a closer look at the Bank Smartly Savings account, which also earns difference rates based on both your balance inside the Smartly savings account itself AND your qualifying combined balances at US Bank. Here’s their current interest rate grid, updated as of 9/3/2024.

Importantly, these rates can change at any time. But right now, if you have at least $25k in Smartly and $25k in combined qualifying combined balances across US Bank, you can get the current top rate of 4.10% APY.

There is also a $5 monthly maintenance fee, which is waived if you have a Bank Smartly® Checking account (or Safe Debit account which also costs $4.95 a month). The Bank Smartly® Checking account itself has a $6.95 monthly fee, waived with $1,500+ average account balance, qualifying U.S. Bank consumer credit card, or combined monthly direct deposits totaling $1,000+.

Therefore, technically if you get this credit card, that would make the Bank Smartly Checking account free, which in turn would make the Bank Smartly Savings account free. Right now there is also a $450 bonus for new Bank Smartly Checking customers with a direct deposit requirement.

Rough opportunity costs with depositing cash at Bank Smartly Savings. Let’s try some rough theoretical numbers. Let’s say you actually have $100,000 in cash lying around, but you could get ~5.10% APY elsewhere and so you would be giving up ~1% APY to park your money at US Bank instead. If you held all of it at Bank Smartly Savings to qualify for the 4% cash back on the credit card, you’d be giving up $1,000 in taxable interest each year ($100,000 x 1%).

In exchange, you are getting 2% extra cash back over your existing, flat 2% cash back card. Cash back rewards are generally considered non-taxable as they are a rebate on your purchase. If you assume a marginal tax rate of 0% (this is just a guess), then you’d need $50,000 in annual purchases ($4,166 a month) at 2% extra cash back to break even with the hit from the lower interest. If you assume a marginal tax rate of 22%, then you’d need a little less: $39,000 in annual purchases ($3,350 a month) at 2% extra cash back to break even with the hit from the lower interest.

US Bank self-directed investments accounts! As with the Bank of America Preferred Rewards program, an alternative way to satisfy the balance requirements with minimal opportunity costs is to transfer over existing assets into a self-directed US Bank brokerage account. For example, you could transfer over $100,000 in index ETFs inside an IRA or taxable brokerage account. This would appear to fully satisfy the requirements as a “U.S. Bancorp Investments” account. This way, US Bank also gets a stronger foothold in the world of wealth management, as all the banks seem to want these days.

Be careful though, as US Bank’s self-directed brokerage account has a slightly higher fee schedule than much of the competition. Stock trades are $4.95 each, although you get 100 free trades per calendar year if you have both a Bank Smartly Checking account and paperless statements. There is a $50 annual account fee and a separate $50 annual IRA fee; these are waived if you have $250,000 in combined statement household balances.

My quick take. If all of these details actually hold through launch, they would be a potential improvement over the best current situation of 2.62% cash back on all purchases via the Bank of America Preferred Rewards program (also requires $100k in assets held at BofA) and a BofA cash back credit card. (The Robinhood 3% credit card is still “coming soon”.) But will it last? Even the BofA 2.62% has remained something of an outlier, but my hunch is that it has encouraged enough of people to keep a ton of cash at BofA earning zero interest so that BofA is still happy overall. Given that this new US Bank program actually offers a decent interest rate and an even higher cash back rate, I am concerned about its longevity. On the other hand, maybe this is US Bank’s big push to become a major player on the national level of Bank of America or Chase.

I’d have to open a lot of new accounts to go for this one. Savings account, brokerage account, credit card, move over assets, all for a bonus that is based on my credit card spend so will trickle in slowly. (None of these have a big upfront bonus.) Given the amount of shady stuff US Bank will probably have to deal with when paying 4% cash back, I’d also have to trust that it will last long enough to be worth the effort.

US Bank has a history of making cards and then pulling them from the market, but sometimes they also let the grandfathered users keep the old perk system. Hmm…

OnPath FCU: 6.00% APY Rewards Checking ($150 Bonus) + 4.40% APY Elite Money Market

APY now 6.00% APY. Bonus now increased to $150 (was $100). OnPath Federal Credit Union now has two accounts that are competitive in the high-interest cash landscape:

- Rewards High-Yield Checking at 6.00% APY on up $10,000 if you make qualifying transactions each month. $150 new checking bonus via referral.

- Elite Money Market at 4.40% APY ($25,000 minimum balance). Three withdrawal allowed per month without penalty. Funds must be new money to OnPath. NCUA-insured up to $1,000,000.

Credit union membership requirements (easy). OnPath FCU is based in Louisiana, a their field of membership starts with people that live and work in that area. However, anyone nationwide can join OnPath FCU with a $5 donation to OnPath Foundation. I did not experience a hard credit check, which was nice.

Elite Money Market details. This is a new account type, and it looks like they are looking to pull in some big deposits. (OnPath has been growing, recently merging with Louisiana Federal Credit Union.) You have to open with at least $25,000 and maintain at least a $25,000 balance to earn the highest APY. Funds must be new to OnPath. This account offers NCUA excess-share insurance up to $1,000,000.

It’s a little hidden on their website, but you it’s in the Savings section and look for “Elite Money Market” on the left menu.

Note: The Elite Money Market (EMM) has some ACH restrictions. My understanding is that they do have some limitations when you initiate ACH transactions internally (at OnPath) between an internal (OnPath) and external (outside) account. They also appear to not allow externally-initiated ACH transfers directly to/from the EMM account. To work around this, you can perform an instant transfer of your money into an OnPath checking account (no limits), and then withdrawal the money via that OnPath checking account using an externally-initiated pull.

6.00% APY High-Yield Rewards Checking details. Their High-Yield Rewards Checking earns 7% APY on balances up to $10,000 and .50% APY on balances over $10,000, if you meet these three qualifications per monthly cycle.

- Have 15 or more debit card purchases post and settle.

- The primary owner must log into online or mobile banking at least once.

- Be enrolled in and receive electronic statements.

Qualification cycles start on the last day of each month and end on the second to last day of the following month. Here are the exact dates for each cycle [pdf]. They will e-mail you at the end of each month to confirm if you’ve met the qualifications. All balances for non-qualified accounts earn .01% APY.

Out-of-network, domestic ATM fee rebates ($10 max per month) are also included if you meet the qualifications. No monthly service fee, no minimum balance requirement, and $25 minimum deposit to open.

OnPath has been pretty reliable and hasn’t given me any problems. There are no minimum debit purchase amounts, although I still try to vary the amounts. I also avoid waiting until the end of the month, because it says you have to post and settle, which might take a couple business days.

$150 Refer-a-Friend Bonus. This bonus is independent of the checking account qualifications above, but you need to pick a checking account and I picked the one above since it stacks well. Note that this refer-a-friend bonus has a $10 minimum per transaction, but the ongoing requirements for the 7% APY do not include the minimum.

- First, register your information at member’s $100 bonus referral link (that’s mine). I have already registered on my end, and successfully referred members in the past.

- Become an OnPath FCU member and open a new OnPath FCU personal or business checking account.

- Within 60 days of account opening, make at least 15 debit card transactions of $10 or more (excluding ATM transactions), AND have one (1) or more direct deposits totaling at least $250.

- Both referring and referred parties will receive a $100 Visa Reward card mailed to them upon completion. I got my prepaid Visa in the mail with no issues. You can cash out the Visa Reward card by purchasing an Amazon gift card, or buy using it as a funding source for the Cash App (via PayPal) or Apple Cash.

Here’s a quick screenshot of the OnPath FCU user interface. They use the same backend provider as many other credit unions.

TIAA Traditional and Lifetime Income Annuities Now Available to Public via IRA

TIAA-CREF recently announced that they are allowing the public to invest in their fixed and income annuities inside a Traditional or Roth IRA (via Bogleheads). This includes their most well-known TIAA Traditional Annuity, which has traditionally been only available to those working in nonprofit colleges, universities, hospitals (TIAA stands for Teachers Insurance and Annuity Association of America).

This was a Father’s Day coincidence, as what they suggest is very similar to what I helped set up for my father. As a long-time educator, the bulk of his retirement savings was accumulated using the TIAA Traditional annuity through both employer and employee contributions. After considering many factors, I advised him to annuitize a portion of it upon retirement for guaranteed lifetime income. The rest of the portfolio was stock and bond mutual funds.

In the example that TIAA provides, they annuitize 1/3rd of the total available portfolio, and the rest is spent down using the popular “4% withdrawal rule”. Their claim is that “annuitizing a portion of your savings with TIAA Traditional offers between 33% and 43% more income than a 4% withdrawal strategy.”

Looking at the fine print, they state:

Calculation uses the TIAA Traditional “new money” income rate for a single life annuity with a 10-year guarantee period at age 67 using TIAA’s standard payment method beginning income on March 1, 2025 (7.9462%).

So a 67yo person taking a single-life income annuity with a 10-year guarantee, which pays out 8% of principal every year. So if you annuitized $1,000,000, you would get roughly $80,000 a year in annual income, guaranteed, every year until death (with minimum 10 years of payments, or $800,000). 8% is double (100% more) what you’d get out from the “4% rule”, so if you annuitize 1/3rd if your portfolio, it would boost the first-year income by 33%. Math works out.

Here are some additional details I would emphasize:

- With the income annuity used, the 8% withdrawal rate won’t ever go up or adjust with inflation. It’s a fixed payout every year, so the real inflation-adjusted value will decrease over time. After 15 years or 30 years, the payout from $1M would still be $80,000.

- The “4% rule” taken from perhaps a 60% stock/40% bond portfolio is designed to be raised with inflation each year. After 15 years, the $40,000 a year from $1M would be $62,000 with 3% average inflation and $72,000 a year with 4% average inflation. After 30 years, the $40,000 a year from $1M would be $97,000 with 3% average inflation and $130,000 a year with 4% average inflation.

- At death, the TIAA annuity would have zero value (assuming past the 10-year guarantee). Your 60/40 portfolio may have a lot (or a little, or nothing) left over.

- The TIAA annuity is a guaranteed only by the claims-paying ability of TIAA. TIAA is usually one of the absolute top-rated insurance companies in terms of safety, but it doesn’t print its own money.

Overall, I felt that the trade-offs were worth it for my parents. They are financially conservative folks. Their annuitized income was lower because they took a joint-life annuity with my mother, but when added on top of their combined Social Security, their guaranteed monthly paycheck in retirement was large enough to cover all of their basic monthly expenses. Unless there was a big one-time expense, they would not have to take a single penny out of the rest of their investment portfolio.

I knew the value of the TIAA income would decrease over time due to inflation, but some studies have shown that retiree expenses also tend to trend downward over time. Social Security will still go up with inflation, and so should their investment portfolio over the long run.

TIAA Traditional as an accumulation vehicle. My dad was already with TIAA Traditional for decades before I started helping him with his finances, and while I am thankful for the financial stability of TIAA-CREF, I don’t know that I would pick the TIAA Traditional Annuity if I was starting out today. As a fixed annuity, there is a guaranteed minimum interest rate and then they credit extra if their underlying investments do well. The value thus is always increasing steadily and never goes down, which some people may like. Even a “safe” bond fund can have a negative year, as we saw recently.

Based on the numbers that I have seen, the long-term average return of TIAA Traditional will probably be very close to that of a low-cost Total US Bond Fund like BND. So it’s like a bond fund with smoothed returns. But this also means the long-term average return of TIAA Traditional will likely not be as high as if you held a Target Retirement Fund with stocks/bonds. Thus, I could see TIAA Traditional as a partial substitution for the bond portion of your portfolio, especially if you plan on annuitizing it upon retirement and can thus earn some of that vague “loyalty bonus”. THAT is the main advantage of TIAA – the ability to earn an excellent annuitization income rate from a very solid company.

(You can view the current TIAA Traditional interest rates here. Note that there are multiple different rate classes, and since the IRA class is fully liquid, it tends to offer one of the lower rates.)

For my parents, I am quite happy with the results of annuitizing a portion of your retirement portfolio. It depends on your own goals, but a fixed base monthly paycheck in retirement offers great peace of mind. I personally enjoy the fact that they stress much less about market swings. If TIAA continues to offer competitive income payout rates along with their top-tier safety rating, I will definitely keep this option in mind for myself.

Merrill Edge + BofA Preferred Rewards = Up to $1,000 ACAT Transfer Bonus, Improved Credit Card Rewards

Updated May 2025. Merrill Edge is the self-directed brokerage arm formed after Bank of America and Merrill Lynch merged together. They are currently offering an increased cash bonus of up to $1,000 for moving “new money” or assets over to them from another brokerage firm. The offer code is 1000PR. Offer valid for both new and existing IRAs and taxable brokerage accounts (they call them Cash Management Accounts).

Here’s an overview along with my personal experience as I’ve had an account with them for a few years now.

Cash bonus. If you are holding shares of stock, ETFs, or mutual funds elsewhere, you can simply perform an “in-kind” ACAT transfer over to Merrill Edge. Your 100 shares of AAPL will remain 100 shares of AAPL, so you don’t have to worry about price changes, lost dividends, or tax consequences. Any cost basis should transfer over as well. Make a qualifying transfer and/or deposit to your new account within 45 days and maintain your balance for at least 90 days. The fine print version:

- You must enroll by entering the offer code in the online application during account opening or by providing it when speaking with a Merrill Financial Solutions Advisor at 877.657.3847.

- Fund your account with at least $20,000 in qualifying net new assets within 45 days of account opening. Assets transferred from other accounts at MLPF&S, Bank of America Private Bank, or 401(k) accounts administered by MLPF&S do not count towards qualifying net new assets.

- You must be enrolled in Preferred Rewards as of 90 days from meeting the funding criteria described in Step 2.

- After 90 days from meeting the funding criteria described in Step 2, your cash reward will be determined by the qualifying net new assets in your account (irrespective of any losses or gains due to trading or market volatility) as follows:

- $100 bonus with $20,000+ in new assets

- $200 bonus with $50,000+ in new assets

- $400 bonus with $100,000+ in new assets

- $1,000 bonus with $250,000 or more in new assets

Customers not enrolled in Preferred Rewards as of 90 days after funding will receive the following cash reward: qualifying net new assets of $20,000 to $49,999 receive $100; for $50,000-$99,999, receive $150; for $100,000-$249,999, receive $250; for $250,000 or more, receive $600.

Note that Preferred Rewards tiers usually requires a while to reach, unless you satisfy their “fast track” requirements:

You can enroll, and maintain your membership, in the Bank of America Preferred Rewards® program if you have an active, eligible personal checking account with Bank of America® and maintain the balance required for one of the balance tiers. The balance tiers are $20,000 for the Gold tier, $50,000 for the Platinum tier, $100,000 for the Platinum Honors tier, and $1,000,000 for the Diamond Honors tier. Balances include your combined, qualifying Bank of America deposit accounts (such as checking, savings, certificate of deposit) and/or your Merrill investment accounts (such as Cash Management Accounts, 529 Plans). You can satisfy the combined balance requirement for enrollment with either:

– a three-month combined average daily balance in your qualifying deposit and investment accounts, or

– a current combined balance, provided that you enroll at the time you open your first eligible personal checking account and satisfy the balance requirement at the end of at least one day within 30 days of opening that account.

After I did a similar bonus a couple years ago with a partial transfer (just enough to satisfy one of the tiers), a Merrill Edge rep contacted me and offered me a custom bonus to move even more assets over. (The bonus ratios were about the same, but higher limits.) Therefore, if you are considering this and happen to have more than $250,000 to transfer over, you may want to give them a call and see if they can offer even more money.

(Additional Outgoing ACAT Fee Reimbursement: Merrill Edge will also reimburse you any outgoing ACAT transfer fee or final closure fees that your old broker may charge you. You will need to contact Merrill directly and then send them a copy of your final statement with the fee shown.)

You can even transfer in Admiral Shares of Vanguard mutual funds – they won’t let you buy any additional shares, but you can only hold or sell them. You can, however, buy more shares of the corresponding Vanguard ETF if you wish. (Alternatively, you should consider having Vanguard convert your Admiral share into ETFs on a one-time basis that will preserve your original cost basis. After you have ETFs, you can move those over to Merrill Edge and trade them as you wish.)

The features for the account itself seem like most other online brokerages. Unlimited commission-free online stock, ETF and options trades (+ $0.65 per-contract fee). You can trade ETFs, fixed income, mutual funds, and options.

Preferred Rewards bonus. The Preferred Rewards program is designed to rewards clients with multiple account and higher assets located at Bank of America banking, Merrill Edge online brokerage, and Merrill Lynch investment accounts. Here is a partial table taken from their comparison chart (click to enlarge):

BofA checking accounts. With Gold status ($20k in assets) and above, you’ll get the monthly maintenance fee on up to 4 checking or savings accounts waived. That means you no longer have to worry about a minimum balance or maintaining direct deposit, depending on your account type. You’ll also get waived ATM fees at non-BofA ATMs at Platinum and above (12/year at $50k assets, unlimited at $100k). Free cashier’s checks.

Credit card rewards. With the Preferred Rewards boost, you can get up to 2.6% cash back on all your purchases with the Bank of America Unlimited Cash Rewards card, or 2.6% towards travel and no foreign transaction fees with the Bank of America Travel Rewards Card. You can also get 5.2% cash back on the first $2,500 in combined grocery/wholesale club/gas purchases each quarter with the Bank of America Customized Cash Rewards Card.

My personal experience. In terms of Merrill Edge, I’ve had an account with them for several years now and my lightning review is that they have a “okay/good” user interface and solidly “good” customer service (i.e. real, informed humans available 24/7 on the phone, not email-only customer service that takes hours to days like Robinhood). I am not an active trader and only make about 10-15 trades a year, but have been quite satisfied with the account. I can also move money instantly between my Merrill Edge and Bank of America checking accounts, making it relatively easy to sweep out idle cash into an external savings account, as their default cash sweep pays nearly zero interest. Don’t leave too much cash there!

The biggest financial benefit to this BofA/Merrill Edge combo with Preferred Rewards has probably been the 75% boost to their credit card rewards, allowing me to get a flat 2.625% cash back on virtually all my daily purchases. The second biggest benefit has probably been this cash bonus, and the third is the waived checking and ATM fees.

The ongoing credit card rewards would be the main reason to do this deposit offer, as the bonus percentages alone aren’t that high. For example, a $400 bonus on a $100,000 transfer amount is only 0.4%. Other brokerage transfer bonuses can be 1%, even 2%, and up.

Bottom line. Merrill Edge is currently offering up to $1,000 if you move over new assets to their self-directed brokerage. This can simply be mutual fund or ETFs shares currently being held elsewhere. When you keep enough assets across Bank of America and Merrill Edge, their Preferred Rewards program can offer ongoing perks like waived bank account fees and boosted credit card rewards.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)