Here’s my quarterly portfolio update for Q3 2018. These are my real-world holdings and includes 401k/403b/IRAs and taxable brokerage accounts but excludes our house, cash reserves, and a few side investments. The goal of this portfolio is to create enough income to cover our household expenses. As of 2018, we are “semi-retired” and have started spending some dividends and interest from this portfolio.

Actual Asset Allocation and Holdings

I use both Personal Capital and a custom Google Spreadsheet to track my investment holdings. The Personal Capital financial tracking app (free, my review) automatically logs into my accounts, tracks my balances, calculates my performance, and gives me a rough asset allocation. I still use my custom Rebalancing Spreadsheet (free, instructions) because it tells me exactly how much I need in each asset class to rebalance back towards my target asset allocation.

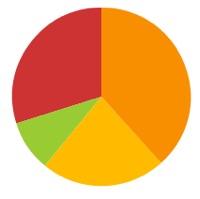

Here is my portfolio performance for the year and rough asset allocation (real estate is under alternatives), according to Personal Capital:

Here is my more specific asset allocation broken down into a stocks-only pie chart and a bonds-only pie chart, according to my custom spreadsheet:

Stock Holdings

Vanguard Total Stock Market Fund (VTI, VTSMX, VTSAX)

Vanguard Total International Stock Market Fund (VXUS, VGTSX, VTIAX)

WisdomTree SmallCap Dividend ETF (DES)

Vanguard Small Value ETF (VBR)

Vanguard Emerging Markets ETF (VWO)

Vanguard REIT Index Fund (VNQ, VGSIX, VGSLX)

Bond Holdings

Vanguard Limited-Term Tax-Exempt Fund (VMLTX, VMLUX)

Vanguard Intermediate-Term Tax-Exempt Fund (VWITX, VWIUX)

Vanguard Intermediate-Term Treasury Fund (VFITX, VFIUX)

Vanguard Inflation-Protected Securities Fund (VIPSX, VAIPX)

iShares Barclays TIPS Bond ETF (TIP)

Individual TIPS securities

U.S. Savings Bonds (Series I)

Target Asset Allocation. Our overall goal is to include asset classes that will provide long-term returns above inflation, distribute income via dividends and interest, and finally offer some historical tendencies to balance each other out. I personally believe that US Small Value and Emerging Markets will have higher future long-term returns (along with some higher volatility) than US Large/Total and International Large/Total, although I could be wrong. I don’t hold commodities, gold, or bitcoin as they don’t provide any income and I don’t believe they’ll outpace inflation significantly.

I believe that it is important to imagine an asset class doing poorly for a long time, with bad news constantly surrounding it, and only hold the ones where you still think you can maintain faith.

Stocks Breakdown

- 38% US Total Market

- 7% US Small-Cap Value

- 38% International Total Market

- 7% Emerging Markets

- 10% US Real Estate (REIT)

Bonds Breakdown

- 50% High-quality, Intermediate-Term Bonds

- 50% US Treasury Inflation-Protected Bonds

I have settled into a long-term target ratio of 67% stocks and 33% bonds (2:1 ratio) within our investment strategy of buy, hold, and occasionally rebalance. With a self-managed, simple portfolio of low-cost funds, we minimize management fees, commissions, and taxes.

Holdings commentary. On the bond side, as Treasury rates have risen, last quarter I sold my shares of Vanguard High-Yield Tax Exempt and replaced it with Vanguard Intermediate-Term Treasury. I liked the slightly higher yield of that (still pretty high quality) muni fund, but as I settle into semi-retirement mode, I don’t want to worry about the potential of state pension obligations making the muni market volatile. In addition, my tax bracket is lower now and the Federal tax-exempt benefits of muni bonds relatively to the state tax-exempt benefit of Treasury bonds is much smaller now. On a very high level, my bond portfolio is about 1/3rd muni bonds, 1/3rd treasury bonds, and 1/3rd inflation-linked treasury bonds (and savings bonds). These are all investment-grade and either short or intermediate term (average duration of 6 years or less).

No real changes on the stocks side. I know that US stocks have higher valuations, but that’s something that is already taken into account with my investment plan as I own businesses from around the world and US stocks are only about 30% of my total portfolio. I have been buying more shares of the Emerging Markets index fund as part of my rebalancing with new dividends and interest. I am considering tax-loss harvesting some older shares with unrealized losses against another Emerging Markets ETF.

The stock/bond split is currently at 68% stocks/32% bonds. Once a quarter, I reinvest any accumulated dividends and interest that were not spent. I don’t use automatic dividend reinvestment.

Performance commentary. According to Personal Capital, my portfolio now slightly down in 2018 (-2.7% YTD). I see that during the same period the S&P 500 has gained 5% (excludes dividends), Foreign (EAFA?) stocks are down 8.2%, and the US Aggregate bond index is down 2.4%. My portfolio is relatively heavy in international stocks which have done worse than US stocks so far this year.

An alternative benchmark for my portfolio is 50% Vanguard LifeStrategy Growth Fund (VASGX) and 50% Vanguard LifeStrategy Moderate Growth Fund (VSMGX), one is 60/40 and one is 80/20 so it also works out to 70% stocks and 30% bonds. That benchmark would have a total return of +0.07% YTD (as of 10/16/18).

I’ll share about more about the income aspect in a separate post.

One of the major building blocks of your portfolio is probably a bond mutual fund or ETF. The most popular bond benchmark is the Bloomberg Barclays Aggregate Bond Index (AGG), which basically tracks all U.S. taxable investment-grade bonds. These popular index funds all track some variation of this index:

One of the major building blocks of your portfolio is probably a bond mutual fund or ETF. The most popular bond benchmark is the Bloomberg Barclays Aggregate Bond Index (AGG), which basically tracks all U.S. taxable investment-grade bonds. These popular index funds all track some variation of this index:

Fintech (financial technology) is supposed to make our lives better. You’ll hear how they want to nudge us to save more, invest better, spread risk, and lower costs. But if you look a little deeper, another thing many want to make easier is debt.

Fintech (financial technology) is supposed to make our lives better. You’ll hear how they want to nudge us to save more, invest better, spread risk, and lower costs. But if you look a little deeper, another thing many want to make easier is debt.

Warren Buffett had his annual charity lunch today and was on CNBC for a short interview. As usual, he was asked about the current stock market situations and, as usual, he managed to sum everything up in a few folksy sentences. Here’s a direct quote from the

Warren Buffett had his annual charity lunch today and was on CNBC for a short interview. As usual, he was asked about the current stock market situations and, as usual, he managed to sum everything up in a few folksy sentences. Here’s a direct quote from the  When it comes to constructing a portfolio, I used to think it was all about numbers and optimization. When you pick an asset class based on historical data, that assumes you hold through both the good times and the really bad times. It has helped me to keep gathering nuggets of knowledge over time to maintain my faith during those really bad times.

When it comes to constructing a portfolio, I used to think it was all about numbers and optimization. When you pick an asset class based on historical data, that assumes you hold through both the good times and the really bad times. It has helped me to keep gathering nuggets of knowledge over time to maintain my faith during those really bad times.

Like many others, I had a vague goal of $1 million net worth in my 20s. It’s easy to find a theoretical path a million. For example, $750 per month earning 8% returns for 30 years with get you there. Doing the actual earning, saving and investing is the hard part. It gets even harder during a bear market when your money feels like it is burning up in flames.

Like many others, I had a vague goal of $1 million net worth in my 20s. It’s easy to find a theoretical path a million. For example, $750 per month earning 8% returns for 30 years with get you there. Doing the actual earning, saving and investing is the hard part. It gets even harder during a bear market when your money feels like it is burning up in flames.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)