April 2005 Financial Status Update

My Financial Goals: Long-term, Mid-term, and Monthly

I am doing a bit of tinkering with this site, and I wanted to restate clearly my goals. Contrary to the inspirational image to the left, I feel that if you don’t write your goals down clearly, they are much less likely to happen. I am still separating them into Long-term, Mid-term, and Monthly Goals:

I am doing a bit of tinkering with this site, and I wanted to restate clearly my goals. Contrary to the inspirational image to the left, I feel that if you don’t write your goals down clearly, they are much less likely to happen. I am still separating them into Long-term, Mid-term, and Monthly Goals:

[Read more…]

Monthly Goal due 3/31: Taxes & More

Here are my financial goals for March (or what’s left of it):

1) File taxes for myself and the missus. I sent in the many rebates for the TaxCut Deluxe tax prep software that I bought. Will need to do 1 joint Federal and multiple state returns due to us being married mid-year. Not looking forward to it.

2) Looking forward, do the research in order to find the right amount of tax withholding per paycheck in order to pay as little taxes during the year as possible without penalties and avoid giving out an interest-free loan to the IRS. Especially since I wait until March to do my taxes!

[Read more…]

Monthly Goal Update: Setting up “Play Money” Account

I’m a bit late, but here were my goals & sub-goals for last month, and here is my current status:

1) I did some research into ETFs, but not a whole lot. I examined possible areas of interest such as chasing high-dividend earning companies and real estate investment trusts (REITs). Definitely more to be learnt out there.

I did buy 100 shares of DDD @ $4.80 per share. At $480, it is less than 1% of my net worth, and it is a company that I’ve wanted to own a piece of for a while. We’ll see how it goes!

[Read more…]

Monthly Goal due 2/28: Setting up “Play Money” Account

How is it the 11th of February already?!?! Work is keeping me busy, but I still need to set a goal for this short month. I’ll keep it relatively simple. What I am doing is making the ~$5,000 in my FreeTrade account my “Play Money” account. I am also thinking of it as my own experimental personal mutual fund, or a micro-fund, as first brought to my attention by IRA-CAM.com.

While I will probably not have time to even make one trade this month, I am taking steps to set it up so that I can run it with minimal time invested. Steps I want to take this month:

[Read more…]

Monthly Goal Update: Asset Allocation Implementation

My goal for last month was to implement my chosen asset allocation plan. Here is my current status:

1) My E*Trade Traditional IRA is liquidated and transferred to a Vanguard Traditional IRA where it is currently invested in VTTHX. I am going to consider rolling it over to the Roth IRA.

2) My $7,000 Roth Contributions ($3k 2004/$4k 2005) are invested in a Vanguard Roth IRA in VTTHX, along with

3) My Ameritrade Roth IRA (previously cash) which is also transferred to the Vanguard Roth IRA.

[Read more…]

February 2005 Financial Status Update

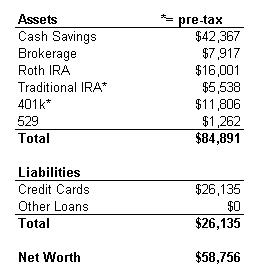

Wow, I can’t believe it is February already! January was a blur, but here my current financial snapshot:

Monthly Goal due 1/31: Asset Allocation Implementation

Now that I have chosen my Asset Allocation, I want to implement it and be fully invested in the stock and bond market by 1/31. This might be tricky, as I am moving some assets away from E*Trade and according to the paperwork it can take up to 4-6 weeks. But I should be able to do the rest by the end of January.

As a side note, I am vacationing to warmer weather for the next week, and may or may not have internet access. I am bringing along Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor by John Bogle, as well as some Vanguard prospectuses for the plane ride. Happy New Year!

Asset Allocation Decided

After some thought and reading, I have decided on the following asset allocation ratio for my current age and position:

70% Stocks / 30% Bonds

Although since I am only 26, some people say I should be more aggressive, I am being realistic in the amount of volatility that I think I can endure and still stick to my plan. Would you really keep your positions if they dropped 35% in one year? That would mean about $20,000 for me, enough to cause some serious heartburn.

However, I am saving for a house as well, and since I’ll need that money in less than 5 years, I think of it as a separate “basket” of money. I am going to handle it much more conservatively. More on that later, but that will allow me to change the rest of my portfolio to:

80% Stock / 20% Bonds, or more specifically:

40% Large Cap / 20% Mid&Small Cap / 20% International / 20% Bonds

This is very similar to my current 401k Asset Allocation. My Monthly Goal due 12/31 is now complete. I thought about putting some in REITs, but I personally think they are a bit inflated right now, and I will get exposure to Real Estate when I buy a house.

January 2005 Financial Status Update

Not quite 2005, but I’m going on vacation on Friday, so here is my monthly snapshot:

My net worth increased by $3006 since last month’s snapshot, which is pretty nice but a little skewed since I get paid bi-weekly and I got 3 paychecks this month. My non-retirement funds now total $25,411, an increase of $2045. Not bad considering since this includes my holiday damage. More analysis on these results later…

Mid-Term Goal: $100,000 Non-Retirement by mid-2007

After setting my Short-Term Goal for this month, I am now setting my Mid-Term Goal. As I have mentioned, I plan to buy a house in an area with insane real estate prices for the long term for family reasons. As we are planning to move in mid-2007, that is the target date. $100,000 in non-retirement accounts will be enough for a good-sized downpayment, as well as other incidental costs.

Let’s check on the current status – If I contribute $14,000 to my wife and I’s Roth IRA in January for 2004/2005, my net worth will look like:

Non-retirement: $23,366

Retirement: $32,384

Thus, I am 23% to my goal, with 2.5 years remaining. That means my required savings and earnings pace will have to amount to $2555/month. That’s going to be tough, the stock and bond markets will hopefully help me out. If I assume a certain earnings rate, then my monthly savings amount may be more reasonable. I will have to consult my economics-trained friends! My other option is to put less into retirement.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)