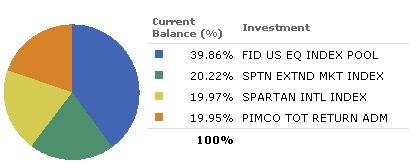

Whew, I am glad this week is over. And I just lost my whole entry just now, so here goes retyping it: As in work, it’s good to have a target to work towards. First, I will assign myself short-term monthly goals, due at the end of each month. Since my initial goal this month was to start this blog (done already on 12/6), my new goal will be to decide on an asset allocation strategy for my non-retirement and retirement dough. Here is my current asset allocation for my 401k:

That is, the breakdown between different asset-types is 40% Large-Cap stocks, 20% Mid-Cap stocks, 20% International Stocks, and 20% Bonds. This breakdown was based loosely on a bunch of different websites such as MSN MoneyCentral, CNN Money, and SmartMoney, but I think I can do more research and get a more solid answer.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)