Apple has settled a class-action lawsuit that their voice-activated Siri assistant violated users’ privacy by recording conversations and sending them to third-party contractors. Eligibility includes those that “owned or purchased a Siri-enabled device and experienced an unintended Siri activation during a confidential or private communication between September 17, 2014 and December 31, 2024.”

If this applies to you, first check your inbox (including Spam folder!) for an email from “Lopez Voice Assistant Settlement Administrator” [info@lopezvoiceassistantsettlement.com] with the subject line “Lopez Voice Assistant Class Action Settlement”. At the top of the e-mail, you should find a Claimant Identification Code and Confirmation Code that will make it easier to file a claim. My e-mail arrived on 5/11/25. Here are a few useful details:

- You can get up to $20 per device, for up to 5 devices (up to $100 total) where you attest under penalty of perjury that you “experienced an unintended Siri activation during a conversation intended to be confidential or private”.

- Eligible devices include iPhone, iPad, Apple Watch, MacBook, iMac, HomePod, iPod touch, or Apple TV.

Submit your claim online at www.lopezvoiceassistantsettlement.com. Claim form must be submitted no later than July 2, 2025. You don’t need to have received the e-mail to file a claim, but the codes may help confirm your eligibility.

Based on my past experience, I would simply submit a claim right away… and then forget about it. Choose a payment method that you are confident will still work years from now. I could only pick from direct deposit or eCheck, so here pick a bank account you know you won’t close. Let yourself to be surprised on the upside later down the road. Then either buy some Starbucks or some fractional AAPL shares with the money. 😜

The Best Credit Card Bonus Offers – 2025

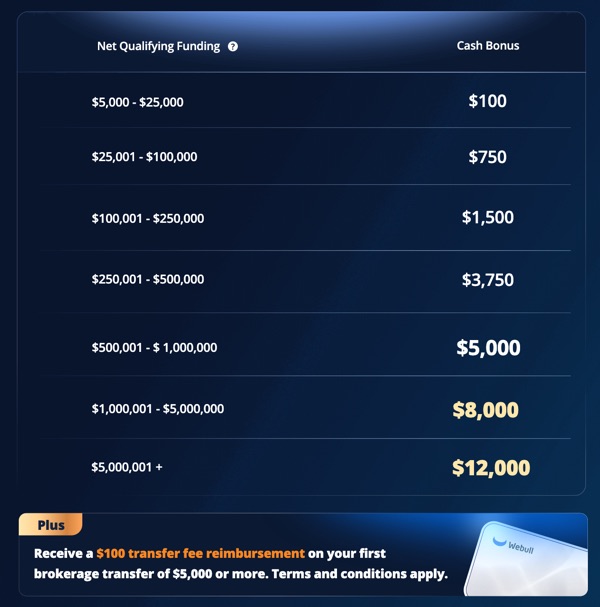

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

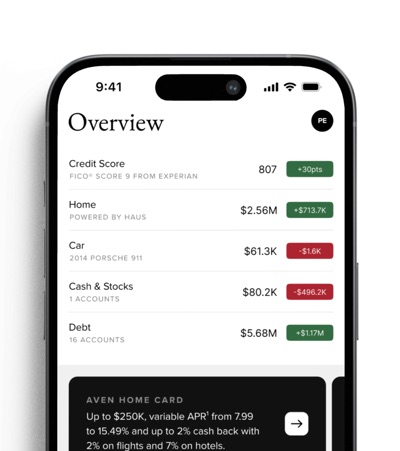

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)