Offer increased to 70k, but must pay $99 annual fee. The Barclays AAdvantage Aviator Red Mastercard is a co-branded American Airlines credit card from Barclays. This offer is notable because the bonus can be triggered by a single purchase of any amount (no spending hurdle). Various perks for AA fliers are also included. Here are the card highlights:

- 70,000 bonus AA miles

- First checked bag free on domestic American Airlines itineraries for the primary cardmember and up to 4 companions traveling with you on the same reservation.

- Preferred boarding (Group 5) for the primary cardmember and up to 4 companions on the same reservation for all American Airlines operated flights. “Eligible cardmembers will board after priority boarding is complete, but before the rest of economy boarding.”

- Up to $25 back in inflight Wi-Fi statement credits every anniversary year on American Airlines operated flights.2

- Anniversary Companion Certificate each anniversary year; earn a Companion Certificate good for 1 guest at $99 (plus taxes and fees) if you spend $20,000 on purchases and your account remains open for 45 days after your anniversary date.

- 2X AAdvantage® miles for every $1 spent on eligible American Airlines purchases.

- 1X AAdvantage® miles for every $1 spent on all other purchases.

- No Foreign Transaction Fees

- $0 intro annual fee for the first year, then $99.

Anniversary Companion Certificate details. From the fine print:

At each card anniversary, you will be eligible to earn 1 domestic economy fare companion certificate redeemable for 1 companion ticket at $99 (plus taxes and fees) if you spend $20,000 or more on eligible Net Purchases with your Card Account that have a transaction date within your cardmembership year (each 12-month period through and including your Card Account anniversary month) and your Card Account remains open for at least 45 days after your anniversary date. After the companion certificate is earned, please allow 1-2 weeks for it to be deposited to the primary cardmember’s AAdvantage® account.

When the companion certificate is used according to its terms, you will pay a $99 companion ticket fee plus government taxes and fees, the amount of which will depend on the itinerary (as of the date of these Card Account Reward Rules government taxes and fees range between $21.60 and $43.20), for a round-trip qualifying domestic economy fare ticket for a companion when an individual round-trip qualifying domestic economy fare ticket is purchased and redeemed through American Airlines Meeting Services. Companion certificate eligible travel must be booked and purchased from select economy inventory. The Companion certificate will be valid one year from the issue date. Companion certificate eligible travel is defined as travel on flights within the 48 contiguous United States, on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airline Inc., SkyWest Airlines, Inc., Air Wisconsin Airlines, PSA Airlines, Inc., or Piedmont Airlines, Inc. This is not available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For residents of Alaska and Hawaii, companion certificate eligible travel is defined as round-trip travel originating in either of those two states and continuing to the 48 contiguous United States. For residents of Puerto Rico only, valid for round trip travel originating in Puerto Rico and continuing to the 48 contiguous United States. For residents of the U.S. Virgin Islands only, valid for round trip travel originating in the U.S. Virgin Islands and continuing to the 48 contiguous United States. Applicable terms and conditions are subject to change without notice. Details, terms and conditions, certain restrictions, and restricted dates apply and will be disclosed on the companion certificate.

Additional bonus details. Note the following language if you have had this card previously. However, I have been able to get a new Barclays card in the past, as long as my old account was closed for at least roughly a year.

From time to time, we may offer bonuses of AAdvantage® miles or other incentives to new American Airlines AAdvantage® Aviator® Red Mastercard cardmembers in connection with an application for a new card account. These bonuses and/or incentives are intended for applicants who are not and have not previously been American Airlines AAdvantage® Aviator® Red Mastercard cardmembers. You understand and agree that you may no longer be eligible for any bonuses and/or incentives in connection with a new American Airlines AAdvantage® Aviator® Red Mastercard account after this Card Account is opened. If you receive a bonus or incentive for which you are not eligible due to your status as a current or former American Airlines AAdvantage® Aviator® Red Mastercard cardmember, we may revoke the bonus or incentive, or reduce your AAdvantage® miles by the amount of the bonus or incentive, or charge your Card Account for the fair value of the bonus or incentive, in our sole discretion.

Bottom line. The Barclays AAdvantage Aviator Red Mastercard is a co-branded American Airlines credit card that offers a relatively simple and straightforward sign-up bonus and free checked bags on domestic AA flights for you and up to 4 travel companions. The $99 companion certificate also has potential value, but you’ll have to spend $20,000 on the card within a year (and then wait for your next card anniversary and thus pay the $99 annual fee) to get it.

I will be adding this offer to Top 10 Best Credit Card Bonus Offers.

Buy a

Buy a

Juno.finance (formerly OnJuno) is a fintech that combines an FDIC-insured bank account and a crypto custodian. Details:

Juno.finance (formerly OnJuno) is a fintech that combines an FDIC-insured bank account and a crypto custodian. Details: The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

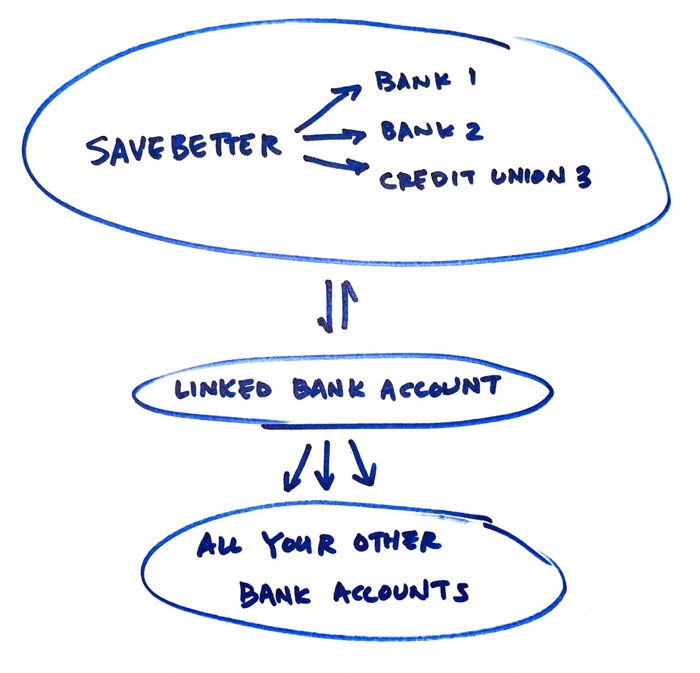

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)