Updated with increased 100k offer. The card_name is a premium card for small businesses with excellent features like purchase price protection, travel accident insurance, car rental coverage, and the famous AMEX extended warranty that actually pays out. The card features have been changed as of October 2023 to include new rewards categories and perks. Here are the highlights:

- Welcome Offer: 100,000 Membership Rewards(R) points after you spend $15,000 on eligible purchases within the first 3 months.

- 4X Membership Rewards(R) points on the top 2 eligible categories where your business spends the most each month from 6 eligible categories. Your top 2 categories are allowed to change each billing cycle, and you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap.*

- 3X Membership Rewards(R) points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.*

- $240 Flexible Business Credit. Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment is required.

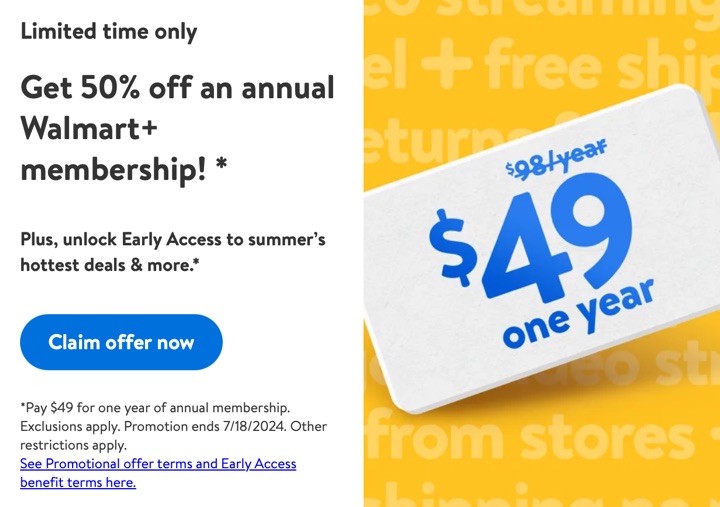

- Up to $155 Walmart+ Credit annually. Get up to $12.95 back in statement credits each month when you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. $12.95 plus applicable taxes on one membership fee. Enrollment is required.

- The Business Gold Card now comes in three metal designs: Gold, Rose Gold and Limited Edition White Gold. The new White Gold design is only available while supplies last.

- Annual fee is $375.

- See Rates and Fees

The six eligible categories for the 4X Membership Rewards(R) points are:

- Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways

- Purchases at US media providers for advertising in select media (online, TV, radio)

- U.S. purchases made from electronic goods retailers and software & cloud system providers

- U.S. purchases at gas stations

- U.S. purchases at restaurants, including takeout and delivery

- Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

Membership Rewards points can be converted to the following airline and hotel programs (there are more, this is just a selection):

- Delta SkyMiles

- Hawaiian Airlines

- JetBlue

- ANA Mileage Club (partner of United Airlines)

- Air Canada (partner of United Airlines)

- British Airways (partner of American Airlines)

- FlyingBlue (Air France/KLM)

- Singapore Airlines

- Virgin Atlantic

- Choice Privileges

- Hilton Honors

- Marriott Bonvoy

Business card eligibility. Many people aren’t aware that they can apply for business cards, even if they are not a corporation or LLC. Sole proprietors are a small business. If you received a 1099-MISC tax form and filled out a Schedule C, that means you have business income, you pay self-employment taxes, and you’re a sole proprietorship. This is the simplest business entity, but it is fully legit and recognized by the IRS. On a business card application, you should use your own legal name as the business name, and your Social Security Number as the Tax ID.

This card will require you to personally guarantee that you’ll pay them back what you purchase with the card, which means they’ll check your personal credit score like any other consumer card. However, as the card is a business card, American Express won’t have it show up on your personal credit report, so it won’t change things like your credit limits, average account age, or credit utilization ratio.

Bottom line. The card_name is a premium business card that includes the classic American Express features like excellent customer service and customer-friendly protections. The card now offers the ability to earn 4X Membership Rewards® points on the 2 categories where your business spent the most each month, on up to $150,000 in combined purchases from these categories each calendar year. There is also a welcome offer for new applicants.

I will add this card to my list of Top 10 Best Business Card Offers.

Over the years, I’ve collected every single Harry Potter audiobook in the series via such offers. Great for kiddo bedtime reading. I’ve also redeemed previous credits for

Over the years, I’ve collected every single Harry Potter audiobook in the series via such offers. Great for kiddo bedtime reading. I’ve also redeemed previous credits for  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

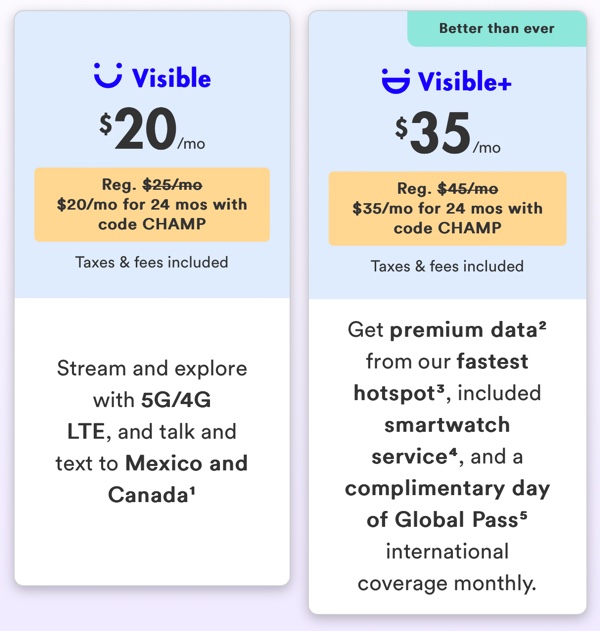

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)