Updated review. New Android and web versions. Added details about “students invest for free” feature (anyone 24 and under). When I wrote about WiseBanyan, I remarked that now people could start investing a portfolio of ETFs with as little as 100 bucks. Well, what about investing just 57 cents at time?

Acorns is a new smartphone app that lets you invest your “spare change” into a diversified ETF portfolio of stocks and bonds. For example, if you bought something for $10.43, the Acorns app will “round up” your purchase to $11 and invest $0.57 into a brokerage account. The idea is that these small investments will make it simple and easy for folks to start saving and investing. Thanks to reader Steven for the tip.

How does it work? You’ll need to provide them:

- Your personal information (name, address, SSN) because this is still a real SIPC-insured brokerage account underneath.

- Your debit or credit card login information (so they can track your transactions and calculate round ups)

- Your bank account and routing number (so they can pull money into your investment account)

The app scans your transactions, calculates the round-ups, pulls that money from your checking account, and automatically invests it for you. You can also make one-time deposits or schedule recurring deposits on a daily, weekly, or monthly basis. The app also tries to identify “found money” like rebates and rewards which it encourages you to also invest with a quick tap. Here’s a YouTube video demo:

Fees. You do not get charged any trading commissions for your investments, which can be a big factor in traditional brokerage accounts.

As of January 1st, 2015, Acorns has changed their fees to be either $1 a month (balances under $5,000) or 0.25% of assets per year (balances above $5,000). So on a $10,000 balance that would be $25 a year. No fee on $0 balances.

As of July 8, 2015, the management fees above will be waived for all students – defined as anyone under the age of 24 or you register under a .edu e-mail address and list your employment as “student”.

Withdrawals are free, but you may incur capital gains at income tax filing time. I don’t know if they will support asset transfers via ACAT.

Portfolio details. You can choose one of five target portfolios, ranging in risk level from conservative to aggressive. Mostly the popular Modern Portfolio Theory stuff that most other automated advisors offer… not surprising as their “Nobel Prize-winning economist advisor” is Harry Markowitz, who is a paid consultant.

All portfolios are constructed using the following six index ETFs:

- Vanguard S&P 500 ETF (VOO)

- Vanguard Small-Cap ETF (VB)

- Vanguard FTSE Emerging Markets ETF (VWO)

- Vanguard REIT ETF (VNQ)

- PIMCO Investment Grade Corporate Bond ETF (CORP)

- iShares 1-3 Year Treasury Bond ETF (SHY)

Fractional shares are used. Dividends are reinvested. Rebalancing happens automatically. Their asset allocation has much in common with most other automated portfolios, although it is probably one of the more different ones that I’ve seen in that you have no exposure to any stocks from Developed European and Asian countries like the UK, Japan, or Australia.

I’m a little concerned about all the tax lots created when buying stocks in such small amounts. Dealing with taxes when you sell might be a headache if they don’t import directly to TurboTax or similar tax software.

Availability. You can now use Acorns in either iOS/iPhone/iPad, Android, or online web-based application. The apps are also compatible with Apple Watch and Android Gear, for those so inclined.

My thoughts. My first reaction was… that it was a great idea that I wished I thought of first. I used to participate in Bank of America’s Keep The Change program, which is similar in that it also rounds up your BofA debit card transactions to the nearest dollar but instead moves the money into a BofA savings account paying essentially zero interest. Acorns takes it further by letting you use any bank and any debit or credit card, and also lets you invest it for potentially higher returns.

In addition, I agree that Acorns will lower the psychological barrier to investing because you don’t even have to commit to $25 a week or $500 a month. You know if you can afford a gizmo or meal at $15.66, you can afford it at $16, so why not invest that spare change? The hurdle can’t get much lower than that.

At the same time, we have to be realistic. With this model how much you save depends entirely on how many purchases you make, with a theoretical average of 50 cents saved per transaction. Even buying five things a day times 50 cents is $2.50 a day or $75 a month. It’s good as a kickstart, but not nearly enough to fund a retirement.

If you want to look at it purely mathematically, a monthly fee of $1 taken out of a $75 investment ends up being like a front-end load of 1.3%. Or given the target demographic of active smartphone users, you could just look at a buck a month as something you’d otherwise blow on some Candy Crush Saga app. I do think it is smart to let anyone 24 and under or a student use it for free.

Also, don’t call it a “piggy bank”. A piggy bank means you put in a quarter, and you can take out a quarter later on. A piggy bank is a bank savings account. Acorns on the other hand is a long-term investment account that you have to be ready not to touch for at least a decade. Sure the “expected” return is 4-9% but you have a good chance of a permanent loss of money if you withdraw within the next few years. If you start using this app, please remember this.

Bottom line: Neat idea, very nicely-designed app. Free for students or anyone age 24 and under. The Acorns app may not fund your entire retirement, but it can help those that need a nudge to invest. Automation helps you keep on track. I think there should an option for an FDIC-insured high-yield savings account.

While reading back through various transcript notes from the 2015 Berkshire Hathaway Annual Meeting, I recalled the following quote from the Q&A session. A shareholder had asked why Berkshire had never borrowed money to buy stocks (i.e. leverage). Charlie Munger replied:

While reading back through various transcript notes from the 2015 Berkshire Hathaway Annual Meeting, I recalled the following quote from the Q&A session. A shareholder had asked why Berkshire had never borrowed money to buy stocks (i.e. leverage). Charlie Munger replied: Our partner Citi has launched yet another new card, AT&T Access More MasterCard® from Citi. This AT&T co-branded card obviously targets a niche, but read on if you will be in the market for a new GSM phone in the next year ($650 is the full price of a new iPhone 6). As such, this card took a little extra research and analysis. Be sure to read all the details before applying, so you understand how to get everything possible out of this offer.

Our partner Citi has launched yet another new card, AT&T Access More MasterCard® from Citi. This AT&T co-branded card obviously targets a niche, but read on if you will be in the market for a new GSM phone in the next year ($650 is the full price of a new iPhone 6). As such, this card took a little extra research and analysis. Be sure to read all the details before applying, so you understand how to get everything possible out of this offer. In November 2012, I invested $10,000 into person-to-person loans split evenly between

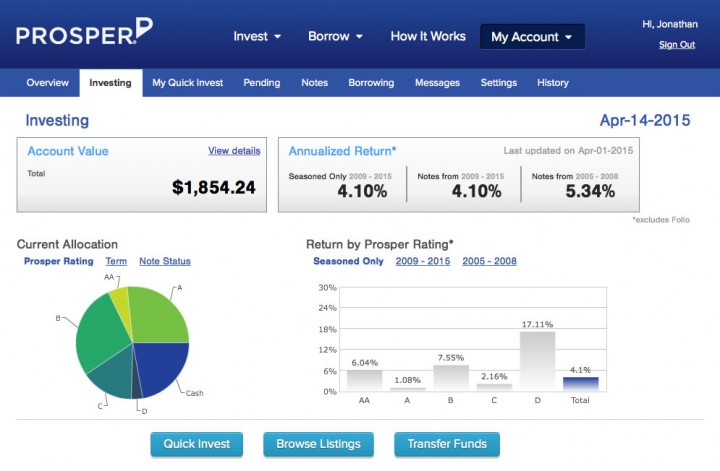

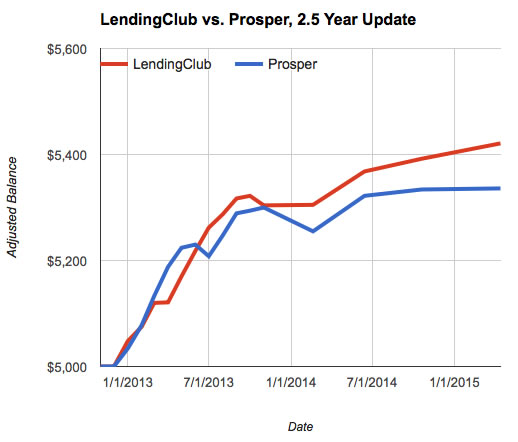

In November 2012, I invested $10,000 into person-to-person loans split evenly between

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)