Here’s my final quarterly portfolio update for Q4 2018. This is how I track my real-world holdings, including 401k/403b/IRAs and taxable brokerage accounts but excluding our house, cash reserves, and a few side investments. The goal of this portfolio is to create enough income to cover our household expenses. As of 2018, we are “semi-retired” and have started spending a portion of our dividends and interest from this portfolio.

Actual Asset Allocation and Holdings

I use both Personal Capital and a custom Google Spreadsheet to track my investment holdings. The Personal Capital financial tracking app (free, my review) automatically logs into my accounts, adds up my balances, tracks my performance, and calculates my asset allocation. I still use my manual Google Spreadsheet (free, instructions) because it helps me calculate how much I need in each asset class to rebalance back towards my target asset allocation.

Here are my YTD performance and current asset allocation visually, per the “Holdings” and “Allocation” tabs of my Personal Capital account, respectively:

Stock Holdings

Vanguard Total Stock Market Fund (VTI, VTSMX, VTSAX)

Vanguard Total International Stock Market Fund (VXUS, VGTSX, VTIAX)

WisdomTree SmallCap Dividend ETF (DES)

Vanguard Small Value ETF (VBR)

Vanguard Emerging Markets ETF (VWO)

Vanguard REIT Index Fund (VNQ, VGSIX, VGSLX)

Bond Holdings

Vanguard Limited-Term Tax-Exempt Fund (VMLTX, VMLUX)

Vanguard Intermediate-Term Tax-Exempt Fund (VWITX, VWIUX)

Vanguard Intermediate-Term Treasury Fund (VFITX, VFIUX)

Vanguard Inflation-Protected Securities Fund (VIPSX, VAIPX)

Fidelity Inflation-Protected Bond Index Fund (FIPDX)

iShares Barclays TIPS Bond ETF (TIP)

Individual TIPS securities

U.S. Savings Bonds (Series I)

Target Asset Allocation. Our overall goal is to include asset classes that will provide long-term returns above inflation, distribute income via dividends and interest, and finally offer some historical tendencies to balance each other out. I make a small bet that US Small Value and Emerging Markets will have higher future long-term returns (along with some higher volatility) than the more large and broad indexes, although I could be wrong. I don’t hold commodities, gold, or bitcoin as they don’t provide any income and I don’t believe they’ll outpace inflation significantly.

I believe that it is important to imagine an asset class doing poorly for a long time, with bad news constantly surrounding it, and only hold the ones where you still think you can maintain faith based on a solid foundation of knowledge and experience.

Stocks Breakdown

- 38% US Total Market

- 7% US Small-Cap Value

- 38% International Total Market

- 7% Emerging Markets

- 10% US Real Estate (REIT)

Bonds Breakdown

- 50% High-quality, Intermediate-Term Bonds

- 50% US Treasury Inflation-Protected Bonds

I have settled into a long-term target ratio of 67% stocks and 33% bonds (2:1 ratio) within our investment strategy of buy, hold, and occasionally rebalance. (Small changes to 65/35 or 70/30 are also fine.) With a self-managed, simple portfolio of low-cost funds, we minimize management fees, commissions, and taxes.

Holdings commentary. On the bond side, I still like high-quality bonds with a short-to-intermediate duration of under 5 years or so. This means US Treasuries, TIPS, or investment-grade municipal bonds. I don’t want to worry about my bonds. Right now, my bond portfolio is about 1/3rd muni bonds, 1/3rd treasury bonds, and 1/3rd inflation-linked treasury bonds (and savings bonds).

On the stocks side, I made a few comments in my 2018 year-end asset class return review. US stocks went down in 2018, but international and emerging markets stocks did even worse. On the flipside, international and emerging markets are a lot cheaper based on various metrics. I remain satisfied with my mix, knowing that I will own whatever successful businesses come out of the US, China, or wherever in the future.

Performance commentary. According to Personal Capital, my portfolio went down 6.9% in 2018. I see that during the same period the S&P 500 has lost 6% (excludes dividends), Foreign Developed stocks lost 14%, and the US Aggregate bond index was basically flat. Of course I didn’t want to see my value fall, but most of the change was due to a lower P/E ratio as opposed to lower earnings from companies.

An alternative benchmark for my portfolio is 50% Vanguard LifeStrategy Growth Fund and 50% Vanguard LifeStrategy Moderate Growth Fund – one is 60/40 and the other is 80/20 so it also works out to 70% stocks and 30% bonds. That benchmark would have a total return of -5.9% for 2018.

I’ll share about more about the income aspect in a separate post.

I found myself thinking a lot today about General Motors

I found myself thinking a lot today about General Motors

Ally Bank has a new promotion called

Ally Bank has a new promotion called

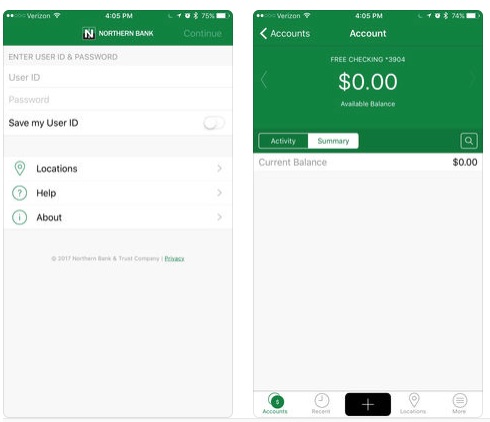

Here comes another new “Direct” bank leapfrogging the current competition for some attention. The Northern Bank Direct Money Market account is offering 2.26% APY on average daily balances up to $250,000, and the rate is guaranteed through June 30, 2019. Of course, another bank could take the throne tomorrow, but at least this one comes with a rate guarantee. Other highlights:

Here comes another new “Direct” bank leapfrogging the current competition for some attention. The Northern Bank Direct Money Market account is offering 2.26% APY on average daily balances up to $250,000, and the rate is guaranteed through June 30, 2019. Of course, another bank could take the throne tomorrow, but at least this one comes with a rate guarantee. Other highlights:

Updated April 2018 with custom ETF allocations. Betterment is an independent hybrid digital/human advisor that will manage a diversified mix of low-cost index funds and help you decide how much you’ll need to save for retirement. (By independent, I mean that they are not tied to a specific brand of funds like Vanguard or Schwab). Betterment is also an RIA, which means they have a legal fiduciary duty to keep client interests first. They frequently announce new features and improvements, so I will work to keep this feature list updated.

Updated April 2018 with custom ETF allocations. Betterment is an independent hybrid digital/human advisor that will manage a diversified mix of low-cost index funds and help you decide how much you’ll need to save for retirement. (By independent, I mean that they are not tied to a specific brand of funds like Vanguard or Schwab). Betterment is also an RIA, which means they have a legal fiduciary duty to keep client interests first. They frequently announce new features and improvements, so I will work to keep this feature list updated.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)