Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a better return on investment than what you see on your bank statement.

Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a better return on investment than what you see on your bank statement.

Interest rates are still depressingly low, and I haven’t made any changes to how I hold my cash reserves since my last update in June. However, there are still better options out there for cash stuck in a too-big-to-fail megabank savings account paying 0.000001%.

Best Currently Available Interest Rates

If I wasn’t already invested as outlined at the bottom of this post, here are the FDIC-insured or government-backed opportunities that I would be looking into based on my needs.

- Everbank Yield Pledge Money Market and Interest Checking account both offer 1.40% APY guaranteed (up to $50k each) for the first 6 months for new accounts. Since it is fixed, this is essentially a 6-month CD with a higher rate than any other 6-month CD rate out there and with no early withdrawal penalty to worry about.

- “Series I” US Savings Bonds offer rates that are linked to inflation. “I Bonds” bought right now will earn 1.48% total for the first six months, and then a variable rate based on ongoing inflation after that. You must hold them for a year, and if you redeem them within 5 years you lose the last 3 months of interest. While future rates are unknown, the net rate after a year is still likely to be competitive with top 1-year CD rates. More info here.

- Rewards checking accounts pay above-average interest rates, but only if you to jump through many hoops. Make a mistake and you’ll forfeit your interest for that month. Rates can also drop quickly, leaving a “bait-and-switch” feeling. If you’re up for it, a recent example is Consumers Credit Union where you can earn up to 5.09% APY on up to a $20k balance, although 3.09% APY is easier to achieve unless you satisfy a long list of requirements. Good news is the rate is guaranteed until August 2015.

- Certificates of deposit. If you have a large cushion, it’s quite likely to just sit there for years. Why not put some money in longer-term investments where you can still take it out in a true emergency and pay an early withdrawal penalty. Synchrony Bank (formerly GE Capital Retail Bank) is offering a 5-year CD paying 2.30% APY for $25k+ balances (2.25% APY for $2k+) with an early withdrawal penalty of 180 days interest. For example, if you withdraw from this CD after 2 years and pay the penalty, your effective rate earned will still be 1.72%.

- Willing to lock up your money for 7 years? Tobyhanna Federal Credit Union has a 7-year CD paying 3.04% APY, however the early withdrawal penalty is a full 2 years of interest. More info at DepositAccounts.com.

- How about two decades!? “Series EE” US Savings Bonds are not indexed to inflation, but they have a guarantee that the value will double in value in 20 years, which equals a guaranteed return of 3.5% a year. However, if you don’t hold for that long, you’ll be stuck with the normal rate which is quite low (currently a sad 0.50% APY). You really want to be sure you’ll keep it for 20 years.

Where’s My Money At?

Here’a quick recap of how I have our cash reserves split up. Keep in mind that most of the rates that I locked in are no longer available, but I did blog about them at the time.

- Ally Bank Online Savings paying 0.90% APY (as of 11/3/14) which also serves as a no-fee overdraft option to my Ally Interest Checking, that way I can keep a minimal balance in checking. Ally checking also has unlimited ATM fee rebates and no fees. I know there are some savings accounts paying a tiny bit more, but not worth the trouble for less than 0.1% difference on $10,000.

- Ally Bank CDs earning between 1.84% and 3.09% APY. These are old 5-year CDs with a short 60-day interest penalty. Current Ally CD rate of 11/3/14 is 2.00% APY for 5-Year CD with 150-day early withdrawal penalty.

- PenFed CDs earning 5% APY. Long gone, although earlier this year PenFed did offer 5-year CDs at 3% APY (no longer available). Current rates are only so-so.

- I also bought several US savings bonds that I now consider part of my retirement portfolio as opposed to cash reserves, as I don’t think I’ll ever want to cash them in before full maturity. More info below.

All rates are believed current as of writing, 11/3/14.

Update: The

Update: The  Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a

Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a

One more quick savings bond update… the official rate for new I Savings Bond was

One more quick savings bond update… the official rate for new I Savings Bond was  Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a

Our family keeps a full year of expenses put aside in cash reserves; it provides us with financial stability with the additional side benefits of lower stress and less concern about stock market gyrations. Emergency funds can actually have a  Let’s focus on the Ally Bank certificates of deposit, where you can still access your money as long as you pay a early withdrawal penalty of 60 days interest – significantly less than at other banks. Why is this good?

Let’s focus on the Ally Bank certificates of deposit, where you can still access your money as long as you pay a early withdrawal penalty of 60 days interest – significantly less than at other banks. Why is this good? Capital One bought ING Direct USA back in early 2012, and has finally completed their transition and re-branding. Their new savings account product is called Capital One Consumer Bank Savings. Since I’ve had an account with them for over a decade (September 2001, as they remind me every time I log in), here’s an updated review of my 2nd oldest bank account meant for both new and existing customers.

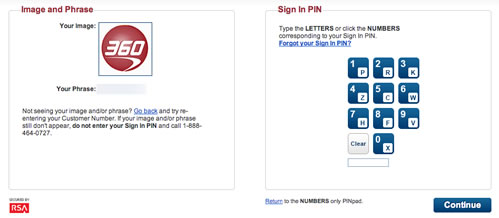

Capital One bought ING Direct USA back in early 2012, and has finally completed their transition and re-branding. Their new savings account product is called Capital One Consumer Bank Savings. Since I’ve had an account with them for over a decade (September 2001, as they remind me every time I log in), here’s an updated review of my 2nd oldest bank account meant for both new and existing customers.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)