Alliant Credit Union, one of the top 10 largest US credit unions by assets, has teamed up with Suze Orman to promote their new Ultimate Opportunity Savings account. The interest rate of 0.55% APY and structure appears to be the same as their existing High-Rate Savings account, just with an added $100 cash bonus if you deposit at least $100 a month for 12 consecutive months. Unfortunately, it is open to new Alliant CU members only. Thanks to reader Bill for the tip.

Alliant Credit Union, one of the top 10 largest US credit unions by assets, has teamed up with Suze Orman to promote their new Ultimate Opportunity Savings account. The interest rate of 0.55% APY and structure appears to be the same as their existing High-Rate Savings account, just with an added $100 cash bonus if you deposit at least $100 a month for 12 consecutive months. Unfortunately, it is open to new Alliant CU members only. Thanks to reader Bill for the tip.

Note that the fine print also states that you must have at least $1,200 in your account at the end of the period (you can’t have withdrawn it after the deposits).

The $100 bonus is automatically deposited into The Ultimate Opportunity Savings Account after you’ve successfully made a monthly deposit of $100 or more for 12 consecutive months. To qualify for the bonus, you must keep a minimum balance of $100 in your savings account, and have $1,200 (or more) in your account at the end of the 12-month period.1

There is no minimum balance required, but you must accept paperless statements to avoid a monthly fee.

Bonus math. In terms of equivalent interest rate, earning an extra $100 of interest for a $100 monthly deposit is roughly 16% APY, so definitely better than any other non-bonus savings account out there. (Without the bonus, this account would earn less than 4 bucks!) Add in the normal 0.55% APY, and your total APY is ~16.5% APY. It’s much less exciting for bigger deposits, but this can still be a pretty good incentive if you want to start building up an emergency fund.

Alliant CU membership eligibility. Credit unions are supposed to be a cooperative non-profit that serves a specific community, but Alliant is pretty much open to anyone nationwide. If you start the online membership application, it will walk you through their various eligibility options. Here are their membership groups:

Any employee or retiree of a Qualifying Company.

Any member of a Qualifying Organization.

Any immediate family member of an existing Alliant member.

Anyone who lives or works in a Qualifying Chicagoland Community.

Anyone who is a member of the Foster Care to Success charity group.

You’ll find that it only costs $5 to join Foster Care to Success, and Alliant will pay that fee on your behalf!

Other potential member perks. Alliant has a good checking account product and their savings account rates have been historically pretty competitive. Like many other credit unions, they also offer competitive rates on auto loans on both new and used cars.

They also have a 2.5% cashback credit card, but there is a $10,000 monthly cap on purchases plus a $99 annual fee after the first year. After that first year, you’ll need to spend at least $19,800 annually (average $1,650 monthly) and less than $10,000 per month to exceed to do better than a 2% cash back card.

Bottom line. If you’ve been meaning to join a credit union and/or start a new savings/emergency fund for the new year, this $100 bonus might be a nice incentive to reach the modest savings goal of $100 per month.

Here’s my monthly roundup of the best interest rates on cash for January 2021, roughly sorted from shortest to longest maturities. I track these rates because I keep 12 months of expenses as a cash cushion and there are many lesser-known opportunities to improve your yield while still being FDIC-insured or equivalent. Check out my

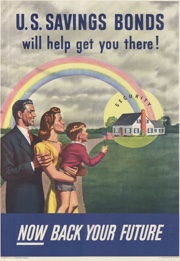

Here’s my monthly roundup of the best interest rates on cash for January 2021, roughly sorted from shortest to longest maturities. I track these rates because I keep 12 months of expenses as a cash cushion and there are many lesser-known opportunities to improve your yield while still being FDIC-insured or equivalent. Check out my  Savings I Bonds are a unique, low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation. With a holding period from 12 months to 30 years, you could own them as an alternative to bank certificates of deposit (they are liquid after 12 months) or bonds in your portfolio.

Savings I Bonds are a unique, low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation. With a holding period from 12 months to 30 years, you could own them as an alternative to bank certificates of deposit (they are liquid after 12 months) or bonds in your portfolio.  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)