When I first reviewed JemStep in 2011, it analyzed your current portfolio and made customized mutual fund rankings. Flash forward to 2013, and they’ve moved into the portfolio management and advice space, similar to previously-reviewed sites like Betterment or Personal Capital. Now it’s called Jemstep Portfolio Manager.

When I first reviewed JemStep in 2011, it analyzed your current portfolio and made customized mutual fund rankings. Flash forward to 2013, and they’ve moved into the portfolio management and advice space, similar to previously-reviewed sites like Betterment or Personal Capital. Now it’s called Jemstep Portfolio Manager.

After signing into my old account and looking around at the new features, I was happy to see they’ve actually gotten pretty close to my wishlist:

- Import my existing portfolio directly from broker. Check.

- Track asset allocation across entire portfolio. Check.

- Customized rebalancing alerts. Not quite. They do give rebalancing alerts, but only customized to their portfolio recommendations, not my personal chosen preferences. See below.

- Detailed performance stats vs. benchmarks. Incomplete? I don’t see this, but I haven’t be able to get past the trade recommendations.

- Reasonable cost. During their initial beta, the service will be free for everyone until March 1st, 2013. After that, the service remains free for those with assets of $25,000 or less. Otherwise see fee schedule discussion below.

Test Drive

The first step is to set a goal. They want things like age, income, target retirement age, risk tolerance, etc. You have provide a preference of mutual funds or ETFs. Given their previous support of actively-managed funds with high recent risk-adjusted returns, I was surprised to see the following:

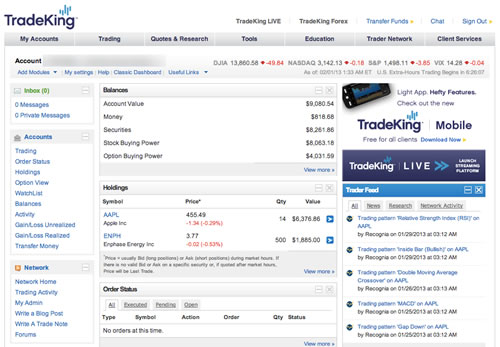

I’ve had an account with Scottrade for several years now, and here is an updated, in-depth review for 2012 (last one I did was in 2006!). I will focus on all the little things that make brokers different from each other, from completing your taxes to buying a stock on a moment’s notice. This review will be from the point of view of a casual private investor who does not trade daily but does mostly buy-and-hold ETF investing and also trades some individual stocks with a small portion of his portfolio (less than 5% of overall portfolio).

I’ve had an account with Scottrade for several years now, and here is an updated, in-depth review for 2012 (last one I did was in 2006!). I will focus on all the little things that make brokers different from each other, from completing your taxes to buying a stock on a moment’s notice. This review will be from the point of view of a casual private investor who does not trade daily but does mostly buy-and-hold ETF investing and also trades some individual stocks with a small portion of his portfolio (less than 5% of overall portfolio).

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)