New offers September 2025. Brokerage app Moomoo is offering a couple of new promotions, one for new customers (or existing customers that haven’t ever funded their accounts), and another one for existing customers.

New customers can get $1,000 of NVDA stock + 8.1% APY for 3 months via my referral link if they make a net deposit of $50,000+ by 9/25/25. The minimum hold period is only 60 days. The extra 4% APY is only valid for 3 months on the first $20,000 of cash sweep deposits. Full terms here.

Complete a net deposit of $50,000 during the Promotion Period, and you will receive $1,000 in NVDA stock in total³, as fractional shares of NVDA³. After receiving your free stocks, you need to maintain average assets of $50,000 or more for 60 days to unlock these stocks.

To be clear, this is for cash deposits, not ACAT transfers But earning $1000 on $50,000 held for 60 days works out to 12% annualized, plus you can earn the 8.1% APY on up to $20,000 in cash deposits for 90 days.

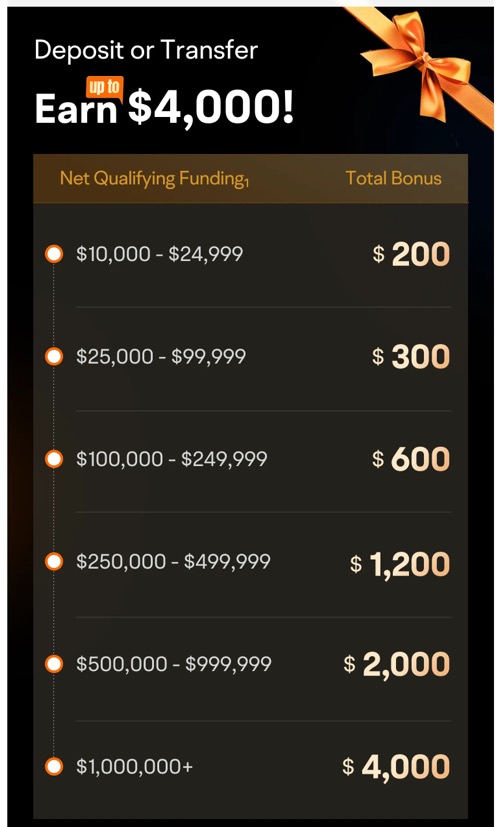

Existing customers are being offered an ACAT transfer bonus of up to $4,000 in “cash rewards”. Full terms here. Here are the tiers:

$200 on $10,000 is a 2% bonus, which is very good for a 90 day minimum hold. $300 on $25,000 is 1.2%, still good. $600 on $100,000 is 0.6%, which is where I become less interested.

What Moomoo calls a “Cash Reward” is not a direct cash credit to your account; it works like a coupon that rebates a future stock trade. You may have to activate it and then make a trade to claim it. In the past, I have chosen to just buy (and then sell) enough SGOV (a conservative T-Bill ETF) to trigger it in a simple manner if you don’t have other stock trades you plan to make. For example, you might need to buy a single $101 share of SGOV to trigger a $100 cash reward into your account. It was a bit of a hassle, but still worth it when the reward was big enough.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)

First, I wish you had posted earlier so I could have used your referral link!

Second, these rewards come as discounts on trades and it’s not super clear how this all works. I have it figured out at this point, but you might want to include details on how to actually redeem your coupons, where to find them, how long they take to settle, etc. This app is not intuitive (and it’s also riddled with typos).

Thanks for sharing, you are right there are several wrinkles to this deal. I have just started this promo myself and will update the post with details and terms excerpts as I find them. Looks like the credits are usually shown in the Rewards section of the app, and appear to be triggered with a specific buy order of stocks. I plan to just buy SGOV or similar ETF with stable NAV/price to trigger the cash credits with minimal cost.

That’s exactly what I’ve been doing (SGOV). In my experience so far, the reward only posts to my account after the three day settlement period. But the coupon gets removed from the Rewards list sooner.

Can you please share an updated referral link that has not expired?

I have updated the link to one that shouldn’t expire, thanks.

https://j.moomoo.com/00znt4

Can these (the invite promo) be used on a PC computer?

Yes, it should work on a PC, Moomoo has a Windows desktop app.

Jonathan, I was skimming the terms and could not find any language requiring trading, could you please suggest?

These terms are confusing. I had a few questions – can you help?

On this: does this imply that all rewards must be applied to the first trade order, or they can’t be used? “Cash rewards will be credited to the first eligible trade order (buy-to-open orders only) during the Promotion Period.”

On this: I don’t understand what “can be used as a deduction” means. Does this mean that if I make a stock purchase of $1001, only $901 of my own money (plus the $100 reward) will be deducted from the account? So that I can then later sell that stock and keep/withdraw the reward that went into it?

“Complete a net deposit of $100 during the Promotion Period, and you will receive a $100 Cash Reward. The Cash Reward can be used as a deduction when the stock purchase order exceeds $1000”.

That’s how mine have worked.

Be aware that you won’t see the coupon usage until the trade settles after three days.

Tried to click through but it says your promo code is no longer valid. It says you need to generate a new one.

Jonathan, your referral link has expired. Can you generate a new one?

Code no longer valid; Is it per sign-up?

Can someone please share the referral link ?

I have updated the link to one that shouldn’t expire, thanks.

https://j.moomoo.com/00znt4

FYI – when you do the app, it asks for linking of account funding right away during signup; I had 5k available to transfer, but if you aren’t setup & ready to fund before applying, I’m not sure you can do this after & still get the bonus. They use Plaid for accoutn validation, make sure your preferred funding account works with Plaid authorization.

See the last question from the FAQ that I quoted:

Does anyone know whether you can transfer in stock to satisfy the $5000 minimum or if it has to be a cash deposit?

My reading of the terms is that it has to be cash deposit.

Hello,

Where to look for an additional $50 referral cash or coupon deposited into account?

Thanks!

As long as you open via referral link and deposit $100, you should get the $100 cash coupon + $50 cash coupon + 5 free stocks in your Rewards section.

Keep us informed I opened and funded with $5000 on May 10th. Funds still aren’t available but moomoo did give me $1000 to use and I picked up some SGOV with it.

Yeah the ACH deposits take a while to clear. I guess they want to make sure it doesn’t get reversed. You mean July 10th?

Mine cleared an hour after this

I’m still in pending approval land, maybe my credit alerts on file confused them. Been this way for 7 days. Sent email, was told: “I’ve passed along your request to our relevant team for further investigation. We’ll get back to you as soon as possible. For urgent trade issue, please call customer service line directly.”

We’ll see I guess, maybe this doesn’t work out.

They seem incompetent; reached out a few times, asked I upload proof of employment, did that days ago, today they said they’re closing my ticket due to inactivity. Fun times. Most inept broker I’ve dealt with so far behind all the glitz, only Firstrade has proven worse.

Do you have link to the ACAT Transfer Promo?

ACAT transfer promo details:

https://www.moomoo.com/us/support/topic4_406

Jonathan, is this the additional promotion, on top of the one you already posted, monetarily?

This is extra $100 for transferring any shares from another broker. I transferred 30 DVN and moomoo shows $100 bonus on this as of 9/14.

Are ACAT transfers generally free from the standpoint of the sending brokerage?

Might be worth making this work for the $100.

Where do you see the cash rewards? I bought over a week ago after I saw the $100 and $50 coupons show up but don’t see the credits. “Buy to open” is an option type. Maybe they mean option trades only?

Each coupon is applied to an additional $1000 stock purchase, a few days after the purchase.

In order to “cash in” your $100 and $50 coupons, you will need to make a trade worth at least $1,000 each (or $500, or a different amount, depending on the coupon). A simple trade would be to buy 10 shares of SGOV (1-3 month T-Bill ETF) which would cost about $1000.50. You’d trigger the cash coupon. In three business days, the trade will clear and you will own $1000.50 of SGOV and $100 (whatever the coupon value) will be deposited as cash into your account. You can then sell the SGOV if you want, and clear roughly $1,000.50 again (maybe $1,000.48 or $1,000.52, but very close). In the end, you’ll have roughly $1,100. Hope that helps.

Given that the required deposit for the big bonus is $5,000, we should be able to trigger this pretty easily as long as you break up the trades.

The article has a small error.. the total potential is $250 to $395 and not $295.

Fixed, thanks!

I’m still waiting for the $100 and $50 bonuses to post but I did receive the TSLA stock instead of Google so that was legit.

Sharing my experience, I was able to use the promo to get $TSLA, $TRIP and remaining $GRAB in addition to the $100+$50. I see multiple posts across forums to invest in SGOV to trigger awards and then sell after 60 days of holding- unable to understand the value in it vs. investing in some ETFs, am I missing anything?

SGOV is as safe as it gets; This is useful if you just want to earn interest while keeping the account funded:

“The iShares 0-3 Month Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities less than or equal to three months.”

But if you actually intend to trade with this account, that works as well. I’m just interested in the bonus.

Finally got it all rolling; It’s worth noting that, at least for my account, it’s margin based. I never use margin. So be aware your account might include margin. The desktop app is also extremely complicated, I can’t find a “My Rewards” in it, I do have it in the mobile app. Using mobile might be the best bet. You can also trade on foreign exchanges. So be careful!

Thank you, Jonathan for the update on new terms, What has actually changed?

Hi, if I’d sign up and was enrolled into the National Day promotion – and have since utilised the cash plus reward portion – would you happen to know if I can still opt for the Tesla/ Google share promotion?

This is a very janky app and a very complicated offer. I’m almost done with it and ready to collect and they’ve offered me an Expedia stock instead of Google or Tesla because I didn’t do the draw for the stock during the promo period (I realize none of this probably makes sense if you’re reading it for the first time–it doesn’t really make sense, anyway). If you’re going to do this, do the draws for the stocks immediately after qualifying. Also note that they hold the reward stocks for an additional 10 business days (2 weeks) after the 60-day qualification period, and the “cash reward” actually only applies to stock trades, so it isn’t a cash reward at all.

Am I reading it right that this promotion requires that you use a (typically expensive) ACAT to move assets to moomoo? Ally Invest charges $50 for ACAT transfers (whether cash or securities.) Robinhood just raised theirs to $100…

Either way, the original new user promo looks really tempting.

It’s true, some brokers do charge an outgoing ACAT fee, so you should look into that before participating. But several major brokers offer $0 ACAT fees, or at least $0 partial ACAT fees: Vanguard, Fidelity, Schwab, TD Ameritrade, Merrill Edge, and Interactive Brokers.

The good thing about the $2,000 tier is that you can just bring over $2,000 of ETFs/stocks with a partial ACAT by specifying X shares of Y stock. So you just need to have $2,000 of stock at one of those brokers above, either in a separate new account or existing. You could even just move over $2,000 in cash and buy $2,000 of SGOV or BIL.

Fair enough. A good case for multiple brokerage accounts. And it looks like 5 of the 6 no-ACAT-fee brokerages you mention are included in the offer’s terms & conditions.

From the offer’s Terms & Conditions:

Robinhood, Webull, TD Ameritrade (including ThinkorSwim),Interactive Broker, Fidelity, E Trade, Cash App, Charles Schwab, Ally Invest, Firstrade, or Merrill Lynch. Transfers from other broker-dealers are not eligible for this Promotion.

I already did ACAT transfer of about $1000+ to get $100 (comes next week) back in last week of July.

I don’t think if existing customers who already did one ACAT are eligible for this new promo? I could be wrong…

Regardless, love moomoo! My free stocks are coming in today just got notices that they are moving from pending to my account.

I already did ACAT transfer of about $1000+ to get $100 (comes next week) back in last week of July.

I just confirmed with moomoo that existing customers who already did one ACAT are eligible for this new promo!

I love moomoo! My free stocks are coming in today just got notices that they are moving from pending to my account.

Thanks for the tip. I just got and sold my 15 free shares as well today. Net average sale price was $4.22 per share. Still waiting on my GOOG to land.

Nice!

219.54 Is my total free stocks releasing now.

Plus 150 signup/referral bonuses (you should have gotten 50 too)

Plus 100 ACAT #1

ACAT #2 pulling today — see if/when the new $100 bonus shows up.

I went aggressive with trades like TSLA and others but sold them all to make a few extra hundred cap gains. Offset the ACAT stock that was down 200 when transferred haha

Gonna stick it all in SGOV for now after selling all the freebies.

Hi Jonathan,

Thank you for posting! I’ve been lagging on Moomoo deals but finally jumped in. Opened an account today, waiting for it to be fully funded/settled with the first deposit and then I want to jump onto the ACAT deal.

My question is why you consider the $2K tier the sweet spot for the deal? I get it that gets best ROI but if you have some stocks sitting at one broker, why not transfer them to another broker and get the full bonus? I’m thinking I could transfer $50K worth of existing investments – could even be as easy as SGOV. I’d rather transfer stock vs cash so that it keeps growing while the transfer is taking place.

Any flaw in this thought?

Also, couple of smaller things I couldn’t find. Is there a time limit I have to keep transferred money with Moomoo? And do they publish a list of eligible brokers? Mine would be Fidelity.

Thank you!

Certainly, if you have existing assets then transferring 50k for the $400 bonus would be fine. I was just pointing out that the $100 tier is both the best ROI percentage and is the most accessible overall, as that is not always the case.

Hi Jonathan,

I think I’m a bit confused about the $50 part of the account opening promo.

I used your link to open the account and deposited $5K via ACH. I received a notification to claim free stock and got a mix of SIRI, LCID and GRAB. I also got a share of GOOG. They’re all frozen now and I understand I need to keep the funds and wait 60 days and then they’ll unfreeze in another 10 business days.

What about the $50 coupon though? I already made a trade (purchased SGOV) with the funds I brought in but I see no sign of $50. When should I expect it and where to look for it?

You should have gotten a separate notification of a $50 cash coupon, and it should also show up under “Me” and then “My Rewards”. It may also be under “Coupons”.

I chatted with CS and apparently the $50 referral offer is for referrer only. Referee gets nothing besides the lucky draws. I checked the T&C of the referral campaign and it appears to me CS is correct. Please let me know if you think otherwise! Thanks!

It looks like they changed the offer (again). You can see in my original screenshot that there definitely was a $50 cash reward for the referree (link below), but now I don’t see it. I’ll update the screenshot, sorry about that.

https://motion-structure.live/wordpress/wp-content/uploads/2023/07/moomoo_230817.jpeg%3C/a%3E%3C/p%3E

The stock bonus is the most annoying bonus I’ve had to deal with in my life so far; Now I found where in the silly app to “draw” for them, but there’s a hold on them for another 60 days. At least I’m getting interest at SGOV in the meantime. Maybe I did it wrong? Wouldn’t surprise me given how obtuse the app is. My total hold time is going to be 120 days, 60 to get the stocks, another 60 to get them out plus initial balance. Ugh. This was the bonus back in August; maybe the new one is less obtuse.

Yes, lucky draws have a 60 day hold. Per T&C you’re supposed to keep the money in the account to get lucky draws, so the hold ensures just that. How do you deduct 120 days hold? Where do the extra 60 days come from?

Don’t know — maybe lucky draw was available immediately? I thought it was 60 days to unlock that. Or I wasted 60 days for no reason. Oh well. The mobile UI is so bad I had no idea.

Anyone receiving the Dec 2023-Jan 24 transfer promotion bonus? It has been more than 10days after Jan 15, 2024 but I have not got it

Anyone get a 1099 from moomoo?

Not yet but now at least see 2023. Just no documents yet.

Fidelity is still processing too

What if you have previously held an account with them that is now closed?

I’m not sure how strict they are with that.

I have a question about this latest promotion. If I were to deposit $50,000, do I need to purchase stocks or could I just leave the cash in the account for 60 days and receive the bonus?

No, you don’t need to invest the cash to receive this deposit bonus.

Whoa, tell me more about this 8.1% on uninvested cash. That could be a huge bonus, even for just three months. It all seems too good to be true.

On $50k cash held for 60 days, you’d earn $675 interest plus the $1000 in NVIDIA stock. That’s a 3.35% return in two months (annualized 20%).

Realistically I would leave it in for 90 days to keep earning 8.1% interest. So you’d earn $1012 interest plus $1000 NVDA = a 4% return in three months (annualized 16%).

Am I missing something about how this works?

It says “No minimum balance required to start or fees charged to you. FDIC-insured up to $1M at partner banks4”.

“4. FDIC coverage information: When the uninvested cash in your brokerage account is swept to deposit accounts at program banks, it becomes eligible for FDIC insurance up to $1 million or $250,000 per program bank, inclusive of any other deposits you may already hold at the bank in the same ownership capacity, which may impact how much is covered. You are responsible for monitoring the total amount of deposits that you have with each Program Bank, in order to determine the extent of FDIC deposit insurance coverage available to you. MFI is not responsible for any insured or uninsured portion of the Deposit Accounts or any other deposits at the program banks.?Please note that until funds are swept to a program bank, they are held in your brokerage account which is protected by SIPC. Once funds are swept, they are no longer held in your brokerage account and are not protected by SIPC. However, these funds are eligible for FDIC insurance through the Program Banks subject to FDIC insurance coverage limits.”

Yep, it could add up to 20% annualized. 12% from the the Nvidia bonus and 8% from the boosted cash APY (4.1% normal + 4% bonus on up to $20k).

I just want to warn people that moomoo is a very odd business. I learned through customer service that unless your bank is part of the Plaid system, there is no way to deposit or withdraw funds except by wire! Fidelity does not work with Plaid, so I am unable to do business with moomoo and had to close the account within minutes after opening it. Sad.

I agree, Moomoo is a bit of a Frankenstein brokerage of different components.

8.1% is only for the first 20k?

Ashwin, where are you seeing that?

That’s a good catch, it is buried deep in the #5 footnote of what is already the fine print! They really should disclose that one better, I’ve never seen it done so poorly. I will edit the post.

Nevermind, now I see it in the fine print here: https://www.moomoo.com/us/support/topic4_410?_ftsdk=1756825986904641

“APY Booster Rates can only be applied towards the initial 20,000 USD in the Cash Sweep program.”

Good catch! That certainly changes things. By my math, that means $50,000 held for three months earns approx:

$1000 bonus

$405 interest on $20k at 8.1% for three months

$308 interest on $30k at 4.1% for three months

total $1712 which is 3.43% return (13.7% annualized)

You could optimize it a little it dropping your holdings from $50k to $20k in the third month, assuming you could earn > 4.1% elsewhere.

$50,000 held for just two months earns approx:

$1000 bonus

$270 interest on $20k at 8.1% for two months

$205 interest on $30k at 4.1% for two months

total $1475 which is 2.95% return (17.7% annualized)

Still a great bonus, but nowhere near the initial claim, in terms of total profits on a big chunk of idle cash. Many thanks for pointing this out, Ashwin.

FYI if you are doing this promotion: to get the 4% booster you need to activate a cash sweep account.