I try to limit checking my portfolio to once a quarter, and this is my 2025 Q1 update that includes our combined 401k/403b/IRAs and taxable brokerage accounts but excluding our house and side portfolio of self-directed investments. Following the concept of skin in the game, the following is not a recommendation, but a sharing of our actual, imperfect DIY portfolio.

“Never ask anyone for their opinion, forecast, or recommendation. Just ask them what they have in their portfolio.” – Nassim Taleb

How I Track My Portfolio

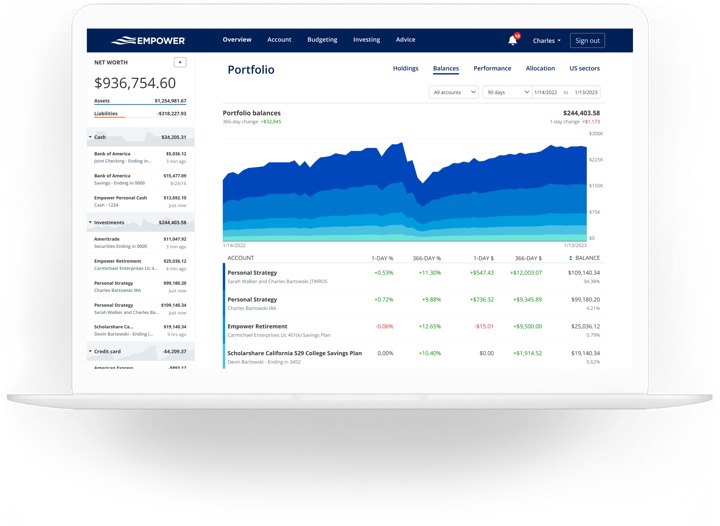

Here’s how I track my portfolio across multiple brokers and account types:

- The Empower Personal Dashboard real-time portfolio tracking tools (free) automatically logs into my different accounts, adds up my various balances, tracks my performance, and calculates my overall asset allocation daily. Formerly known as Personal Capital.

- Once a quarter, I also update my manual Google Spreadsheet (free to copy, instructions) because it helps me calculate how much I need in each asset class to rebalance back towards my target asset allocation. I also create a new tab each quarter, so I have a personal archive of my net worth dating back many years.

2025 Q1 Asset Allocation and YTD Performance

Here are updated performance and asset allocation charts, per the “Holdings” and “Allocation” tabs of my Empower Personal Dashboard.

The major components of my portfolio are broad index ETFs. I do mix it up a bit around the edges, but not very much. Here is a breakdown of my target asset allocation along with my primary ETF holding for each asset class.

- 35% US Total Market (VTI)

- 5% US Small-Cap Value (VBR/AVUV)

- 20% International Total Market (VXUS)

- 5% International Small-Cap Value (AVDV)

- 5% US Real Estate (REIT) (VNQ)

- 20% US “Regular” Treasury Bonds or FDIC-insured deposits

- 10% US Treasury Inflation-Protected Bonds

Big picture, it is 70% businesses and 30% very safe bonds/cash:

By paying minimal costs including management fees, transaction spreads, and tax drag, I am trying to essentially guarantee myself above-average net performance over time.

I do not spend a lot of time backtesting various model portfolios, as I don’t think picking through the details of the recent past will necessarily create superior future returns. You’ll usually find that whatever model portfolio is popular at the moment just happens to hold the asset class that has been the hottest recently as well.

The portfolio that you can hold onto through the tough times is the best one for you. Every asset class will eventually have a low period, and you must have strong faith during these periods to earn those historically high returns. You have to keep owning and buying more stocks through the stock market crashes. You have to maintain and even buy more rental properties during a housing crunch, etc. A good sign is that if prices drop, you’ll want to buy more of that asset instead of less. I don’t have strong faith in the long-term results of commodities, gold, or bitcoin – so I don’t own them.

Performance details. According to Empower, the S&P 500 went down about 5% the first quarter of 2025, while foreign stocks went up around 7%. I don’t remember that happening for a while, and apparently it hasn’t happened since 2009 (see below;source). Overall, my portfolio was flat.

Over the last quarter, here’s a Growth of $10,000 chart courtesy of Testfolio for some of the major ETFs that shows the difference in performance in the broad indexes:

I always like to remember the big picture. Here’s an updated Morningstar Growth of $10,000 Chart for the Vanguard LifeStrategy Growth Fund (VASGX) which holds a static 80% stocks and 20% bonds and most closely mimics my portfolio since 2005, which is when I started investing more seriously and started this blog.

I’ll share about more about the income aspect in a separate post.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)

Planning on moving more into stocks valuations become more attractive?

My spreadsheet says that new cashflows should be put into US stocks, so that’s what I’m doing, but it’s a really small percentage of the overall portfolio. I usually don’t rebalance until things are really off-target by 5%.

Have you ever considered balancing some of your bonds and putting more into international bonds (something like BNDW)?

I should probably look into it more, but my position is mostly that I want my bonds to be boring and safe and international bonds don’t really do that. The US is still the safest option. With international bonds, you either add currency risk, or if you pay to hedge it like with BNDW, you then have more expensive bonds that aren’t safer.

It is plausible a situation where the US defaults and no other countries do, but I have trouble buying bonds from France or Italy (they make up over 15% of BNDX). If you look at the ratings agencies, the overall mix of BNDX is like 20% “junk” or non-investment grade and only 25% AAA.

dump the REIT fund into the S&P

🤔

I think he is trying for a diversified portfolio. Why put more eggs in one basket? If you fall on the way back from the coop, they all break and you miss breakfast.

Is merging data into Empower basically by setting up each brokerage account info into the system with ID and PW? I use Full View, Fidelity’s aggregation services at fidelity.com. Just curious if one system is more superior to another.

Yes, you just use your login and password, unless you want to manually type in your holdings instead. I haven’t used Full View in a while, but I don’t think Full View tracks the performance and breaks down the asset allocation of your entire portfolio together.

Watching one person have the power to impact the value of companies in the stock market with daily social media posts and chaotic shifts in U.S. policy has me reconsidering asset allocation. It has been a different feeling than the ‘normal’ ups and downs of the business cycle that I have experienced previously. It is really too much power for one person to have – especially if they don’t have the interests of the wider citizenry at heart (my opinion). I’ve been thinking more about “when you win the game, stop playing” advice given by some. I am taking a sabbatical of sorts this year to test ‘retirement’ and returning to part time work next year – but considering not working after that. I’m mid-40s and trying to figure out some ways to think about the long-term growth vs short and mid-term needs. Taking 4% of investments + inflation would work fine according to calculators with minimal investment growth… but that gets more scary if we head into recession and broad market decline. I did read your article about looking at the last ~5 years of investment value rather than a current snapshot. Is it ‘enough’ to put ~5 years (or whatever number) in some kind of cash ladder and then the rest into my normal allocation of 70/30 or 60/40? Maybe that is too conservative. Have you written or read about asset allocation in early retirement? Those I know who have retired early had some kind of pension option they could rely on as a safety net, which would make this much easier. : )