Inspired by reader experiences, I set aside an hour today to obtain auto insurance quotes from the major providers in my area. Insurance companies provide different quotes for “new customers” and “renewals”. Guess which one is usually lower? Also, many insurers choose to focus on specific types of customers such young, high-risk, or low-risk. Finally, I’ve also moved around a lot so I’ve noticed that my quotes change significantly based on where I live. The bottom line is that insurance prices vary for a lot of different reasons, and the only way to know which one is cheapest for you is to compare quotes directly.

It will help to gather the following information first:

- Personal information. Full name, birthdate, occupation, education level, accident history. None required Social Security Number, but others might.

- Car information. Many pull this from DMV records automatically. Year, model, date of purchase, own/lease/finance, and security system details.

- Driving patterns. Is the car primarily used for work/commute/pleasure? How many miles driver per year?

- Insurance details. Have your current bill handy to know your specific coverages, limits, and deductibles.

The Results!

The totals shown are 6-month premiums for two cars and include liability, personal injury, collision, and comprehensive coverage. Exact same limits and deductibles for all insurers.

- State Farm (existing) – $665 per 6-month period. This includes various discounts like accident-free, multiple-cars, etc.

- GEICO – $479. The cheapest quote by far, beating State Farm by $186 per 6 months, or $372 a year. This follows anecdotal evidence that GEICO is pricing their insurance very aggressively for new customers.

- Allstate – $693. Slightly more expensive than State Farm. I noticed that they have a lot of optional “bells and whistles” features like accident forgiveness. They also offer a discount for electronic bills and auto-pay from bank account. The price shown includes these discounts.

- Progressive – $849. Way higher than State Farm. Their claim to also provide quotes from other car insurance companies was also very disappointing. They couldn’t provide any other quotes at all. After changing my existing insurer, they said State Farm’s rate would be between $696 – $5,922. Not helpful.

- Liberty Mutual – $568. Cheaper than State Farm by $194 a year. Not bad but higher than GEICO for me.

- USAA – ???. I tried as I’ve heard good things about USAA, but I do not have the proper military affiliation to be eligible for their car insurance.

$372 a year is pretty significant. I’m definitely intrigued by this cheap GEICO quote, but I have to do some more research as I also have homeowner’s and umbrella insurance from State Farm and I’m not sure how the total package price would differ.

Ever since we started cutting back our work hours in order to share childcare duties, Mrs. MMB and I have kept a closer eye on our monthly spending patterns. One of the headaches for budgeters is dealing with large lump-sum payments like those for home/car repairs, healthcare bills (human repairs), and home/car/life insurance. Our homeowner’s insurance is due annually (we don’t use mortgage escrow anymore), life insurance is due annually, and auto insurance is due semi-annually.

Ever since we started cutting back our work hours in order to share childcare duties, Mrs. MMB and I have kept a closer eye on our monthly spending patterns. One of the headaches for budgeters is dealing with large lump-sum payments like those for home/car repairs, healthcare bills (human repairs), and home/car/life insurance. Our homeowner’s insurance is due annually (we don’t use mortgage escrow anymore), life insurance is due annually, and auto insurance is due semi-annually.  Much of the discussion around The Patient Protection and Affordable Care Act (PPACA) aka Affordable Care Act aka Obamacare has been about politics. But it’s the law, it’s constitutional, and a lot of things are happening soon. For most full-time workers that wish to keep their employer-provided health insurance, little will change. However, things will be very different for the self-employed, unemployed, uninsured, and those seeking semi-retirement or retirement before age 65 and Medicare. You can use it even if you already have employer-provided insurance, although you may become ineligible for certain tax credits. There’s way too much information to cover everything, but here’s my summary of the developments.

Much of the discussion around The Patient Protection and Affordable Care Act (PPACA) aka Affordable Care Act aka Obamacare has been about politics. But it’s the law, it’s constitutional, and a lot of things are happening soon. For most full-time workers that wish to keep their employer-provided health insurance, little will change. However, things will be very different for the self-employed, unemployed, uninsured, and those seeking semi-retirement or retirement before age 65 and Medicare. You can use it even if you already have employer-provided insurance, although you may become ineligible for certain tax credits. There’s way too much information to cover everything, but here’s my summary of the developments.

In a NY Times Op-Ed piece entitled Money Won’t Buy You Health Insurance, Donna Dubinsky shares her troubles with getting

In a NY Times Op-Ed piece entitled Money Won’t Buy You Health Insurance, Donna Dubinsky shares her troubles with getting

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

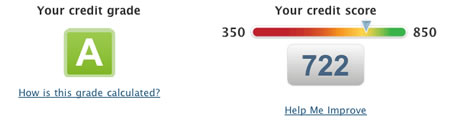

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)