My first statement for my Citi Professional Card closed recently, and I just checked my rewards balance for the promised free $100 gift card. To my delight, my 10,000 free ThankYou Points have already been deposited! I swiftly went to the ThankYou Rewards site and traded them in for two $50 Target Gift Cards. I shop regularly at Target, so it’s basically the same as cash for me.

My first statement for my Citi Professional Card closed recently, and I just checked my rewards balance for the promised free $100 gift card. To my delight, my 10,000 free ThankYou Points have already been deposited! I swiftly went to the ThankYou Rewards site and traded them in for two $50 Target Gift Cards. I shop regularly at Target, so it’s basically the same as cash for me.

It seems that once you get to the $50 range, 1 point = 1 cent in gift cards. It was hard to find the Target reward option, but the search function saved me. Other good rewards options I found were Shell and Exxon/Mobil Gas Cards or Gap/Banana Republic/Old Navy Gift Cards. For those with student loans, you can even get a $100 loan payment for the 10,000 points. Here’s a screenshot of my points:

[Read more…]

So you’ve gotten yourself a

So you’ve gotten yourself a  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

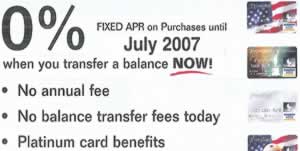

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)