When you charge something on your credit card, the merchant usually pays about 2-3% in transaction fees for the convenience and benefit of accepting these cards. To get your business, issuers often rebate part of these fees in the form of % cashback rewards or frequent flier miles. Credit cards also offer handy conveniences like easily tracking spending, fraud charge-back protection, and extended warranties, but who doesn’t like cash? Extreme users treat them like Swiss army knives to maximize rewards. New customers also get incentives of up to $100.

Here’s an update for the offers during the first quarter of 2012. There is a slight lean towards a New Year’s resolution theme, but I like the inclusion of everyday spending like grocery stores, drugstores, and restaurants. You can often also see the rewards for the rest of the year on the applications.

Chase Freedom Visa – $100 Bonus Cash Back

Reward categories change quarterly. From January 1 to March 31, you can earn 5% cash back on up to $1,500 spent in the following categories:

- Gas Stations

- Amazon.com

From October 1 to December 31, you can earn 5% cash back on up to $1,000 spent in the following categories:

- Dining

- Department Stores

- Movie Theaters

- Charitable Organizations

You must enroll at ChaseBonus.com. All other purchases do earn a standard 1%, with no tiers or expiration of rewards. Currently, the Chase Freedom Visa card has a promotion offering a $100 check if you sign up and make $500 in purchases in your first three months.

Citi® Dividend Platinum Select® Visa® Card

Reward categories change quarterly. From October 1st to December 31st, you can earn 5% cash back on

- Department Stores

- Clothing Stores

- Electronics Stores

- Toy Stores

After you get your card, you must enroll by logging into your account or calling 1-800-231-0891. There is no cap on the 5% back, except for the $300 overall cap on all dividend rewards annually. All other purchases do earn a standard 1% with no tiers, and rewards do not expire as long as you have activity once every 12 months. Also, 0% APR on balance transfers for 12 months with 3% fee and on purchases for 12 months.

Discover More Card

Reward categories change quarterly. From January 1 to March 31, you can earn 5% cash back on up to $800 spent in the following categories:

Reward categories change quarterly. From January 1 to March 31, you can earn 5% cash back on up to $800 spent in the following categories:

- Travel

- Restaurants

You must enroll online to activate the rewards each quarter. Discover card has a tiered cashback rate (1% unlimited Cashback Bonus on purchases after your total annual purchases exceed $3000; purchases that are part of your first $3000 earn .25%.).

PenFed Platinum Cashback Rewards Card

PenFed Platinum Cashback Rewards Card

Bonus categories appear and change regularly for this card, but not on a set schedule. Currently I don’t see anything available. However, the best feature remains – the year-round rewards structure of 5% cash back on gas purchases (must pay at pump), 2% cash back on supermarket purchases, and 1% cash back on everything else. Rewards are credited monthly on your next statement.

Note: To get this card, you must also have membership to the Pentagon Federal Credit Union (you can apply for both at the same time). In general, membership is open to the military, US government employees, or the family or household of existing members. However, anyone can become eligible by joining the National Military Family Association (NMFA) for a $20 one-time fee.

One card they are promoting is the Continental Airlines OnePass Plus Card, which has improved their sign-up incentive to include a $50 statement credit, 30,000 free miles, and a

One card they are promoting is the Continental Airlines OnePass Plus Card, which has improved their sign-up incentive to include a $50 statement credit, 30,000 free miles, and a

Citi® Dividend Platinum Select® Visa® Card

Citi® Dividend Platinum Select® Visa® Card The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

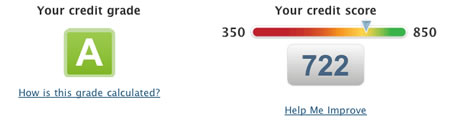

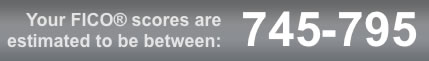

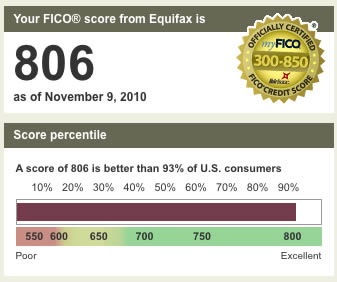

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)