Capital One settled a class action settlement involving alleged deceptive marketing because it kept the interest rate on customers with deposits in their older “360 Savings Account” lower without closing them, while simultaneously marketing a new “360 Performance Savings Account” at a higher interest. Many people in the older accounts either thought they were the same or thought they were getting the higher, marketed interest rate. Anyone who had an original “360 Savings” account between 9/18/19 and 6/16/25 is included in the settlement.

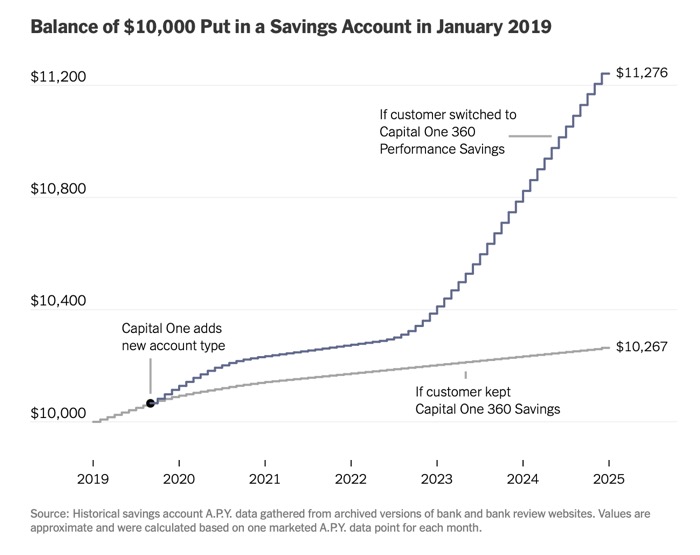

The Consumer Financial Protection Bureau estimated that Capital One avoided paying $2 billion in interest by not automatically converting each 360 Savings account to a 360 Performance Savings account. Meanwhile, the settlement amount is really $300 million, with another $125 million earmarked for higher interest rates in the future for the older accounts.

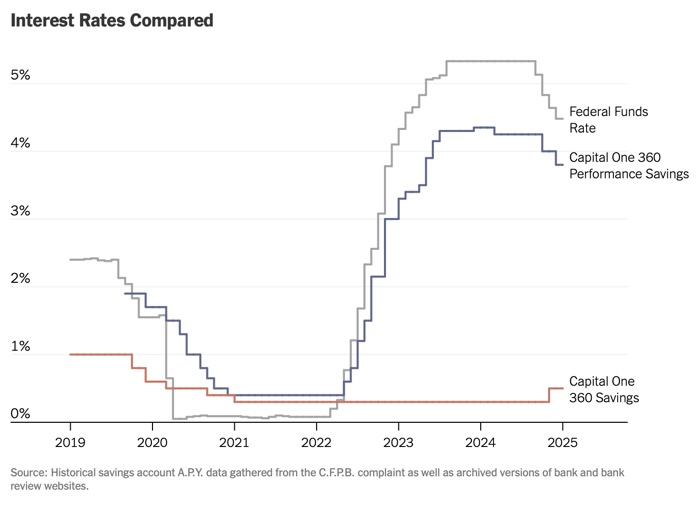

Via this NYT article, you can see charts of both the different interest rates (above) and what would have happened to a single account with $10,000 balance (below).

I just received my postcard regarding the settlement, and the main takeaways are:

- The cash payments will be related to the historical account balances in the older, low-interest accounts. There is no evidence to submit. For me, that is probably very little if any. However, they do have a provision to perhaps distribute any leftover funds pro-rata, so who knows.

- I should still choose an electronic payment, because if the amount is less than $5, they will not be sending paper checks and will only send the funds to you via electronic payment. I usually prefer Venmo.

Random side-story! During a jury duty stint years ago, a personal injury lawyer once spent time to explain to us the details of the infamous “I spilled McDonald’s hot coffee on myself” lawsuit. To make it very brief, it was a specific McDonald’s location that decided to speed up its morning rush by making extra, extra hot coffee (180-190°F) and portioning it into cups ahead of time so that in theory it would stay hot for longer. Coffee made under normal, industry-standard operating procedures would not be that hot (135-140°F). 190°F is hot enough for instant 3rd-degree burns requiring skin grafts. To summarize, the details matter.

In this case, one of the problems was that “360 Savings” and “360 Performance Savings” were basically identical. There was no other “plausible deniability” reason for them to have the new account, other than to disadvantage their existing customers. With other banks, they will often tweak something so that the two accounts are a little bit different. Maybe the minimum balance changes, so they are targeted “higher balance” accounts which are thus cheaper to manage (and justify a higher interest rate). Maybe one will require a direct deposit or recurring transfers, again justifying a different interest rate.

Nearly every consumer financial company takes advantage of behavioral tendencies like forgetfulness or inertia. Checking account overdraft fees. Credit card late payment fees. Auto-renewing subscriptions for Netflix on down. Charles Schwab made over $9 billion in “net interest income” in 2024, which was basically half of their total revenue. Guess what uninvested cash in your Schwab brokerage account earns? 0.05% APY.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)

My wife had a lot of money in the older 360 account. When I reviewed her annual tax statement the weak interest was shocking (e.g., $10 monthly vs. $50 elsewhere) — I prompted her to move the money to another bank. This revealed the predatory mindset of Capital One’s management. They exploited their LOYAL customers, not new ones. Stay away.

It doesn’t help that Capital One closed one of my inactive accounts years before this. I called to ask why, as I wanted to keep it open. The representative literally laughed at me and said they didn’t want my business/I wasn’t their kind of customer. Per the follow-up survey, I asked a manager to review the call recording and was told “You did not receive the kind of service we seek to provide.” Well, why did you did you do this to loyal 360 customers for several years? Predators. Stay away.

Now that Capital One has merged with Discover, I fear for the future of Discover. Discover’s prior customer service and interest rates ranged from average to excellent.

I disagree that this falls into the same category as “normal” corporations sucking and trying to use psychology to get customers paying for things they don’t need etc.

I’m pretty fastidious around my finances – quicken syncs all my accounts (20+ CC for points games, a dozen or more checking/savings/investment accounts). I catch stuff all the time that’s odd and have to fix it. But this I missed – partly because ta the time (~2021) I didn’t have enough cash to be rate chasing so I wasn’t looking. But as it happened the company I worked for got acquired – I had a tiny percentage of it as a stock grant from many years ago and suddenly I had some real money. Yet it didn’t occur to me to check because I had my beloved Orange savings account (opened in ~2000!).

I did catch it when rates shot up – I moved the money out of it in October 2022 to a new performance savings account when rates really started shooting up.

I’m looking forward to what i hope is a couple of thousand in back interest…

Side note I didn’t close my original account – never going to do that – I like having a bank account with only a 5 digit account number. Kind of wild to think only a few 10’s of thousands of people opened their account before me I bet there are only a few hundred people left with these old accounts. Years ago (the last time I had to call in for something) the account rep was mildly shocked by the account number:) I just checked quicken and I opened it 9/21/2000 with a $50 deposit!:)

UFB bank is notorious for doing this exact same thing of changing account names with little difference except a different rate.

JP hit it right, this falls into “inertia” and objects at rest tends to stay at rest.

Chris is one in a thousand, I used to be too until Quicken sucked so badly, I’ve given up. MS-Money was the best.

I was an auditor of Dreyfus (huge mutual fund managers) in the 1990’s. They introduced a new fund, Dreyfus World Wide Dollar Money Market Fund that yielded over 10% at almost zero risk. It got huge almost overnight. Rates started to drop yet the parent sponsor (Dreyfus) cut their management fee and made up the difference to keep the yield at the magical 10% level. Our partner used the exact word of “inertia” for the reasoning,

And regarding the settlement, lawyers are the real winners, they’ll take 33-40% of the settlement, plus expenses for their hard work, nobody is going to see a full payout of what they would have been owed.

That’s the way of the world, folks!

Quicken definitely took a dip – surprisingly in the last year they have released several changes that actually make it better – finally you can just check a box and have it memorize a transaction you are typing in – and *easily* manage those stored rules – used to be a pain. I can’t quite think of other examples – but after the PE company bought them it was very stagnant for a long time and plenty of bugs and errors – seems like they finally caught up and are improving it for real (at least a little bit) now.

Performance is still terrible (though this might just be my 300MB file stretching back to 1993:).

But as a nod to your comment about inertia, I just don’t think I’ll ever stop using it – the data stored in there is never getting migrated. I loved mint – but when they changed (and most notably stopped having the bill payment reminders) I tried switching to monarch – but setting everything up again from scratch…meh.

Quicken is very much my comfort object at this point..

didn’t they do the same with the 360 checking accounts?

according to the article, the corporation is paying about 20% of what it saved in that time frame back to the customers. This is what a settlement is, and the corporation wins and lands to keep doing this. i also was an orange customer and didn’t start looking at the performance rates until 2023, where i closed out most of my original accounts and moved to performance grudgingly because of the rate changes. i want chafing a 0.1 or 0.25% change before.

According to https://capitalone360savingsaccountlitigation.com , you only get the “approximate amount of additional interest that would have been earned on the account during the Class Period had the account received the interest rate of the 360 Performance Savings product” if your savings account is *closed* or *converted*. You need to do this by October 2. Their estimate is this option is 15% more than users who just keep their legacy savings accounts at the bad rate open.

I just called capital one and asked for my savings accounts to be converted, and it took about 20 minutes for 10 accounts (the poor guy had to read out the legalese for each account). This IMO, is the silver lining here, that I can convert my legacy accounts to the better interest rate w/out having to change accounting / routing numbers and mess up any linked activity.