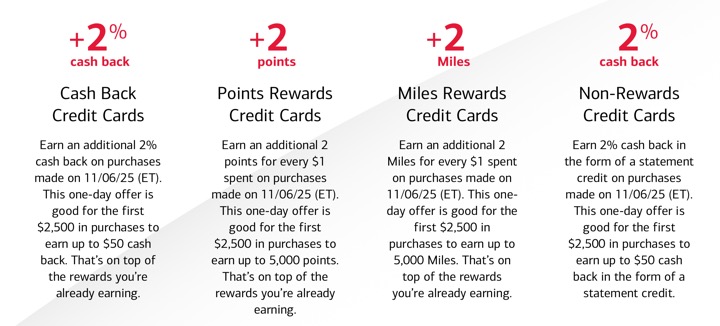

Back for 2025. Bank of America has a one-day credit card promotion called “More Rewards Day” on Thursday, 11/6/25. Depending on your BofA credit card type (both consumer and business cards are all eligible), you can earn an additional 2% cash back or 2 points or miles/$1 spent on up to $2,500 in purchases made on 11/6/25 only (Eastern time zone!), up to a $50/5,000 point cap per unique credit card account. That’s on on top of the rewards you’re already earning. No enrollment required.

Eligible cards include:

Customized Cash Rewards

Unlimited Cash Rewards

Travel Rewards

Premium Rewards®

Premium Rewards® Elite

BankAmericard® Power Rewards®

BankAmericard Rewards®

MERRILL+®

MERRILL+® Elite

Atmos™ Rewards Ascent

Atmos™ Rewards Summit

Royal Caribbean®

Celebrity Cruises®

Norwegian Cruise Line

Beaches

Sandals

Free Spirit®

Allegiant

Air France KLM

BankAmericard®

You can get up to a $50 bonus on each of your unique BofA credit cards. Note that it expires 11:59pm in the Eastern time zone. It appears that somehow they can track the “transaction date” separately from when it posts to your statement. Note that some retail websites don’t actually charge you until a physical item ships.

Only Purchases that post to your account and appear on your statement with a transaction date of 11/06/2025 will qualify. Merchants may impact when a transaction will appear on your statement, particularly if they delay processing of the purchase. Transactions with delayed processing of 90 days or more will not be eligible to be included in the promotional offer.

Some possibilities beyond timing the normal bonus categories on your unique cards:

- Pay estimated income taxes at PayUSATax.com for currently a 1.75% fee.

- Pay your insurance premiums upfront. My State Farm grouped monthly bill can also be timed using manual payment.

- Pay your utilities, property taxes, phone bills, and other monthly bills upfront. Sometimes it just costs a one-time flat fee to pay by credit card, which can be worth if you are charging $1,000+.

- Make your annual charitable contributions for this year on this date.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)

If I purchase or pay on the 6th it should qualify. NM when the merchant posts it. But that’s why I don’t use this card. Matter of fact it’s on my card closing list for the year. They’re only good for the SUB.

I have a BofA Cash Rewards MC with flat 1.5% rewards. I got in the mail an offer of $75 cash back when I spend $2,500 by end of year (2025), that’s another 3% rewards. And, if I can pay my property taxes (which is more than $2,500, on 11/6/2025, then I believe I will get another 2% back on up to $2,500.

That means, the first $2,500 I spend on 11/6 will get me a 6.5% cash reward (if it stacks, that’s $162.50). Looks like paying via credit card costs me 2.35% on the full bill ($3,623.19), thus it costs me $85.14.

I believe my cash back total will be $179.35 ($2,500 * 6.5%, and $1,123.19 * 1.5%), then subtract out the costs of $85.14, and I get NET RESULTS of $94.21.

Do you think this will work?

Note: The offer on the paper, fine print, does say: “Promotional rewards earned as a result of the promotion are incremental of rewards earned on purchases through regular use of your card’s reward program.”

Sounds like it would work to me.

What is the Merrill+ ELITE card?