Final update July 2023, with full cashout. It has now been nearly 6 years for my experiment comparing a Fundrise Real Estate portfolio and the Vanguard Real Estate ETF. In Fundrise, we have a start-up with “crowdfunding” beginnings that offers users a share of a concentrated basket of properties actively chosen from the private market. In Vanguard, we have a one of the largest real estate ETFs in the world – users own a tiny passive slice of ~165 public-traded REITs. I invested $1,000 into both in October 2017 and cashed out in July 2023, for a holding period of 5 years and 9 months.

Fundrise Starter Portfolio background. When I bought in, the Fundrise Starter Portfolio was a simple 50/50 mix of two eREITs: the Fundrise Income eREIT and the Fundrise Growth eREIT*. Since these are finite baskets of entire properties, over time they will close one fund and start another similar basket. What new investors are buying today will be different apartment complexes and office buildings than what I bought in 2017. Here were my holding as of the end of June 2023:

Each private eREIT works within recent crowdfunding legislation that allows all investors to own a basket of individual real estate properties (not just accredited investors with high net worth). The minimum deposit is now just $10. You must buy shares directly from Fundrise, and there are only limited quarterly liquidity windows as this is meant to be a long-term investment. There are also additional options available with higher investments:

Vanguard REIT ETF background. The Vanguard REIT ETF (VNQ) is the ETF share class of a $60+ billion index fund that invests in publicly-traded real estate investment trusts (REITs). You can purchase it via any brokerage account. You have the liquidity of being to sell on any day the stock market is open. A single share currently costs about $100, but many brokers offer fractional dollar-based trades if you want. All shareholders are holding the same ratio of (tens of?) thousands of office buildings, hotels, storage centers, nursing homes, shopping centers, apartment complexes, timber REITs, mortgage REITs, and so on. Here is a recent breakdown:

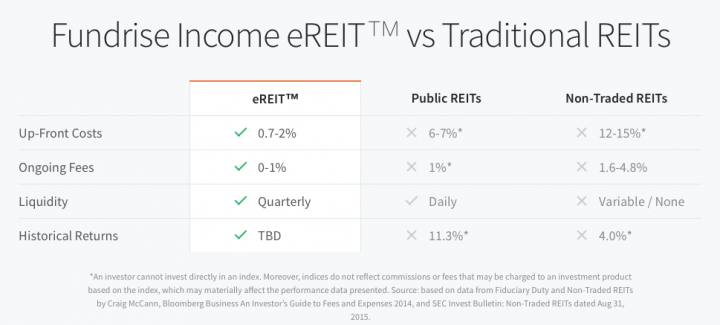

Expenses. The Fundrise Starter Portfolio has an 0.85% annual asset management fee and a 0.15% annual investment advisory fee (1% “all-in” total). The Vanguard REIT ETF has an expense ratio of 0.12% on top, but each public REIT also has their own internal costs like employee salaries to manage their properties. In each case, investors are paying for real estate management, office space and salaries for those employees, etc. REITs may also use debt to increase their real estate exposure (leverage). Is the technology offered by Fundrise a more efficient way to invest in real estate?

Final performance numbers. Based on an initial $1,000 investment in October 2017 and immediately reinvestment of all dividends, here are the monthly balances of my Fundrise portfolio vs. the Vanguard REIT ETF.

Again, there are quarterly redemption windows, and I initiated my request for a full withdrawal May 26, 2023 in preparation for the end of the second quarter on June 30th. On July 4th, I was notified that my request was approved, and I received the funds into my bank account on July 7th.

While the balances have much closer at times, the final balance was $1,931 (12.2% annualized return) for Fundrise, compared to only $1,272 (4.3% annualized return) for the Vanguard REIT ETF. The final endpoint is probably the widest margin during the entire experiment.

Commentary. One issue with this comparison is that this chart uses two different types of NAVs (net asset values). Vanguard updates the NAV daily based on the combined agreement of millions of investors. Every trading day, there is a price where you can liquidate your VNQ shares. Meanwhile, Fundrise NAVs are only estimates as there is no daily market value available since they hold entire apartment complexes, office buildings, and so on (similar to your house, but with even fewer comps). Your liquidity from Fundrise is limited to quarterly windows that are not guaranteed. That is why I wanted to finish this experiment will a full cash-out, so we can at least somewhat test if the NAVs are realistic. I was honestly a bit skeptical that the Fundrise NAVs could keep going up while the VNQ NAVs were struggling, but they did cash me out at the NAVs they posted. I have to give them credit for that. In the end, perhaps Fundrise is closer to owning a basket of pieces of real apartment complexes and buildings, in that the rising interest rates really didn’t hurt residential housing prices so far either.

The potential drawbacks still remain. In a more stressful bear market, the liquidity is not guaranteed and neither is the NAV if you were forced to liquidate the entire thing as opposed to trading existing shares to new investors. I made my withdrawal request before the sudden PeerStreet bankruptcy filing, but Fundrise is also a young company without a long history of profitability. (Fundrise does benefit from earning ongoing management fees on the assets under management, while PeerStreet earned a cut of the loan proceeds. Without a steady stream of new loans, PeerStreet quickly stopped making as much money.)

Bottom line. I have finally concluded a nearly 6-year experiment (5 years was the initial goal) where I compared investing $1,000 each into real estate via Fundrise direct active investment and the passive REIT index ETF from Vanguard. Based on actual cash-out numbers, Fundrise final balance was $1,931 (12.2% annualized return), while the Vanguard REIT ETF final balance was $1,272 (4.3% annualized return).

You can learn more about all Fundrise Real Estate options here. Anyone can invest with Fundrise; you don’t need to be an accredited investor.

Morningstar has another educational article about

Morningstar has another educational article about

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)