If you earned interest from a money market fund or bond mutual fund/ETF last year, a significant portion of this interest may have come from US Treasury bills and bonds, which are generally exempt from state and local income taxes. (California, Connecticut, and New York have special rules.) However, in order to claim this exemption, you’ll probably have to manually enter it on your tax return after digging up a few extra details.

Here’s how to do it in at HRBlock.com, the online version of H&R Block tax software. I found the two following quotes from the H&R Block FAQ:

How do I enter interest from U.S. Treasury obligations?

This information doesn’t appear on the form, but we’ll need it to calculate the tax-exempt interest on your state return. This information won’t affect your federal return.

Where do I report U.S. Treasury obligations from Form 1099-DIV?

Report them in the Income section on the Interest topic. Enter them as U.S. Savings Bond and Treasury obligation income.

These two answers somewhat conflict with each other, so I just started a new dummy return as a California resident to look around. If you don’t find a box to enter the interest during the 1099-DIV entry process in your Federal return interview (I did not see this), you should be able to enter the information in the State return portion of the interview.

Under the “Income” section of the State Return, there will a screen called “Your Income Adjustments and Deductions”. Here there should be a place to report US Treasury dividends.

Click on “Add” and you will be asked to enter the “US Treasury dividends excludable in [Your State]”. For example, if you received $100,000 in total dividends from the Vanguard Treasury Money Market Fund (VUSXX) in 2023, you will find it does meet the threshold requirements for California, Connecticut, and New York and it had a US government obligation percentage of 80.06% in 2023. In this example, $80,060 of the $100,000 in dividends would be excludable.

Here are some links to find the percentage of ordinary dividends that come from obligations of the U.S. government. You should be able to find this data for any mutual fund or ETF by searching for something like “[fund company] us government obligations 2023”]. If you do not see the fund listed within the fund company, it may be assumed to be 0%.

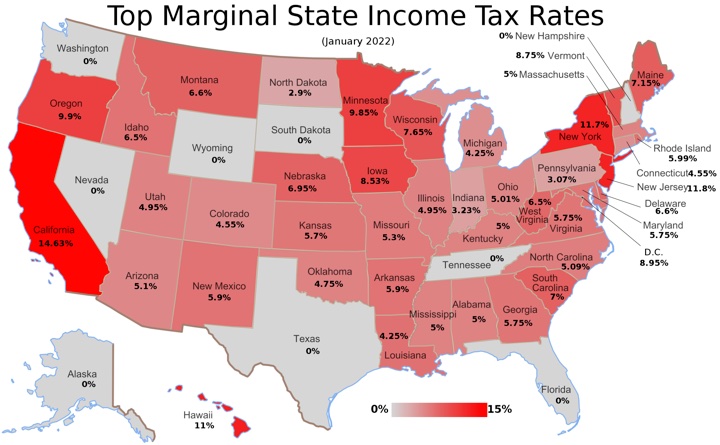

[Image credit – Tax Foundation]

In 2022, 21 states issued special relief payments to eligible residents in 2022. The Tax Foundation has a partial list of

In 2022, 21 states issued special relief payments to eligible residents in 2022. The Tax Foundation has a partial list of

As we head into the last few months of 2021, this is a reminder to check on your Healthcare and Dependent Care Flexible Spending Accounts (FSA). This

As we head into the last few months of 2021, this is a reminder to check on your Healthcare and Dependent Care Flexible Spending Accounts (FSA). This  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)