Schwab has rolled out a new digital financial planning tool called Schwab Plan. They claim it to be a simplified version of the same financial planning software used by many human financial advisors. From their press release:

Schwab has rolled out a new digital financial planning tool called Schwab Plan. They claim it to be a simplified version of the same financial planning software used by many human financial advisors. From their press release:

Schwab Plan is a digital self-guided financial plan available through Schwab.com that helps investors build a personalized plan that includes a range of factors such as desired retirement age, retirement goals, social security expectations, portfolio risk profile and asset allocation, and various income sources.

[…] they are able to generate a retirement plan that shows retirement goals and probability of funding those goals, a comparison of an individual’s current asset allocation to a recommended allocation based on plan inputs, and suggested next steps to get and stay on track.

Access to this tool is free to anyone with any type of Schwab account. (Eventually, this should include TD Ameritrade clients as well.) There is no minimum asset requirement and you don’t need to sign up for a new service. For example, I was able to access it with only a Schwab PCRA brokerage window account. Here are a few initial impressions and screenshots after testing it out.

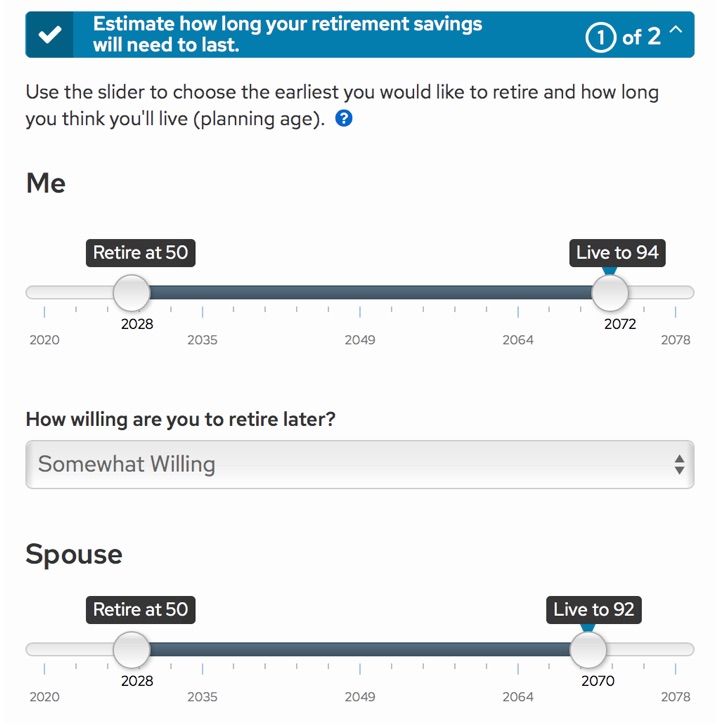

First, you enter some basic personal information like current age, gender, retirement age, and life expectancy:

Next, you estimate your income needs in retirement. They offer additional assistance in estimated your health insurance costs in retirement. You then enter your assets and income sources. Your Schwab accounts are automatically imported, and you can manually add the raw balances of additional external accounts (no account aggregation). They use your information to estimate your Social Security income, and also ask about stock options and restricted stock units.

(They don’t ask about children, college savings, term life insurance, disability insurance, or any of those smaller details that a full-service advisor would ask about. There is also very little customization available in terms of recognizing your external asset allocations.)

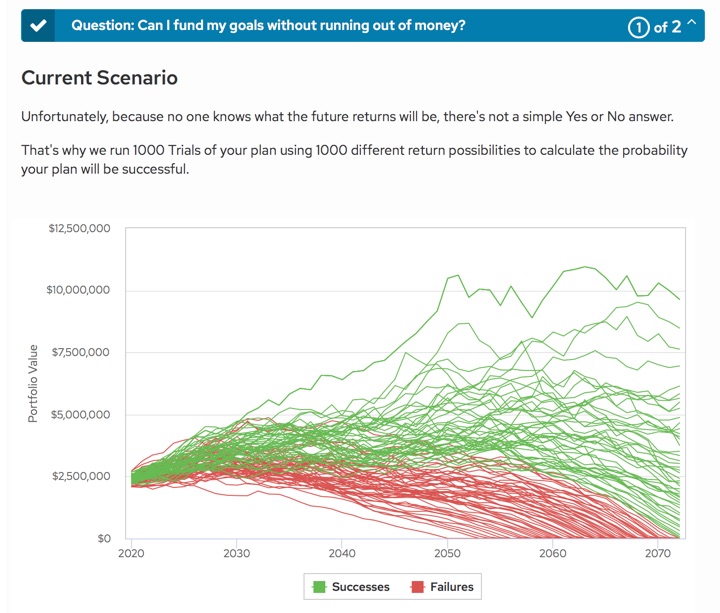

Once everything is entered, they run a Monte Carlo simulation to estimate your probability of success.

You can then adjust the variables, such your retirement age and future spending, in order to see how it affects your success rate. I found the analysis to be reasonably consistent with my other research, and I liked that the results changed significantly for an early retirement (45 year period) as opposed to a traditional retirement (30 year period). They use a “confidence zone” system:

(The Monte Carlo simulations above does not equate to an 86% confidence level. This was after making some tweaks to improve the results.)

Bottom line. Schwab has added a free financial planning tool for all of their customers (no minimum asset requirement). After testing it out, it is not quite “professional-grade”, but I did find it to be slightly more advanced than most other free options. I would recommend trying it out if you have any type of Schwab account. Of course, it also provides a pathway to upgrade to their other portfolio management services, and I still have concerns about their Intelligent Portfolios product.

The third book in the “Investing for Adults” series by William Bernstein is

The third book in the “Investing for Adults” series by William Bernstein is

When to start claiming Social Security to maximize your potential benefit can be a complicated question, especially for couples. There are multiple paid services that will run the numbers for you, including

When to start claiming Social Security to maximize your potential benefit can be a complicated question, especially for couples. There are multiple paid services that will run the numbers for you, including

I started looking into financial independence because I simply couldn’t imagine doing what I was doing every weekday at that time for another 30 or 40 years. Some people know exactly what they want to spend their life doing, and it also pays the bills and then some. I was always envious of those folks. Strangely, I never really felt that making more money was the final answer. I saved diligently in order to quit my job and go back to school and explore alternate paths.

I started looking into financial independence because I simply couldn’t imagine doing what I was doing every weekday at that time for another 30 or 40 years. Some people know exactly what they want to spend their life doing, and it also pays the bills and then some. I was always envious of those folks. Strangely, I never really felt that making more money was the final answer. I saved diligently in order to quit my job and go back to school and explore alternate paths.

The 2020 Berkshire Hathaway Annual Shareholder Meeting was on May 2nd, 2020 and is now available as a recorded video on

The 2020 Berkshire Hathaway Annual Shareholder Meeting was on May 2nd, 2020 and is now available as a recorded video on  The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)