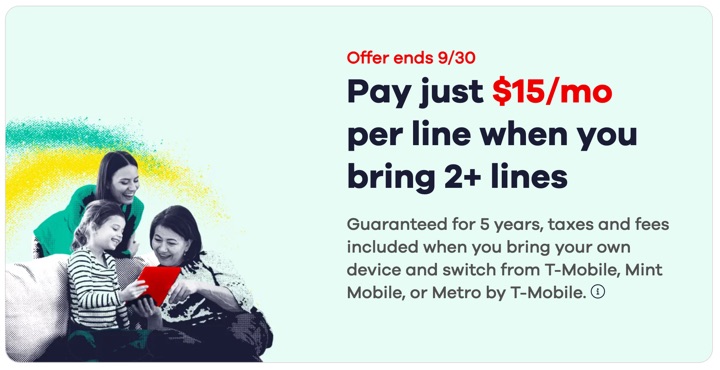

If you currently have cell service from T-Mobile, Metro, Ultra Mobile, or Mint Mobile (all owned by T-Mobile), consider this aggressive deal from Total Wireless (owned by Verizon). You must switch over at least 2 lines and bring your own device. Importantly, this offer also ends soon 9/30/24. Here is the press release, and the offer page is Totalwireless.com/byebye.

- $15/month per line (includes all taxes and fees) for their Total 5G Unlimited plan. This usually cost $50/month with AutoPay. Discounted price is guaranteed for 5 years.

- Unlimited 5G data on Verizon 5G network, never throttled. Total promises “Unlimited data that never slows you down because of how much you use” and that “Speeds do not slow down through network management”. This is better terms than most MVNOs offer, which usually have lower priority during congested spots and throttling after a certain amount data usage. Supposedly, these are better data terms than the basic Visible plan.

- 15 GB hotspot.

- Free international calling from the US to 85+ destinations, texting to 200+ destinations.

- Free international roaming in Canada & Mexico, 15+ countries total.

- No contract.

It seems that T-Mobile and Verizon are in a bit of a beef right now regarding poaching each other’s customers. Might a good time to take advantage? I’m definitely considering it as a Mint customer, although I do hate the porting process as I’ve run into problems before. The switching is always the most stressful part.

To activate this offer, Metro, Mint Mobile, Ultra Mobile and T-Mobile customers can bring their phones to exclusive Total Wireless stores or visit Totalwireless.com/byebye, use code “BYEBYEMETRO,” “BYEBYEMINT,” or “BYEBYETMOBILE” and port in their phone numbers.

New limited-time 25k offer w/ no annual fee. The

New limited-time 25k offer w/ no annual fee. The

Tuesday, November 29th is Giving Tuesday 2022, an international day about giving support through charities and nonprofits by donating money or volunteering your time. In case you aren’t inundated with mailings already, this time of year is a big deal for charities, with 40% of donations occurring in the last six weeks of the year. Here are some ways you can “double your impact” with a matching donation.

Tuesday, November 29th is Giving Tuesday 2022, an international day about giving support through charities and nonprofits by donating money or volunteering your time. In case you aren’t inundated with mailings already, this time of year is a big deal for charities, with 40% of donations occurring in the last six weeks of the year. Here are some ways you can “double your impact” with a matching donation.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)