A few days ago, the US Department of Commerce released1 that the nation’s savings rate for 2006 was negative 1%. This means as a whole we spent more than we earned after-taxes, again. (It was also negative for 2005). Much is being made about how this is the lowest savings rate since the Great Depression, when there was a negative 1.5 percent rate in 1933. Should we be worried? Is the sky falling?

What’s the recent trend?

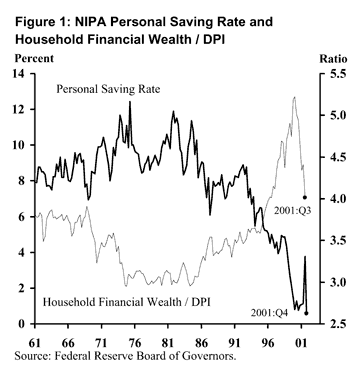

I wonder what the margin of error is on this data. Looking at this graph, it seems like perhaps something happened about a year and a half ago? But then I found it goes back a lot further than that. This chart starts from the 1960s2:

To help better understand the numbers, you have to go into the definitions a little bit. The personal savings rate ignores the capital gains in our investments like stocks and bonds, and also tangible assets like cars and real estate. In fact, our overall net worth is not doing that bad and actually increased over last year. The graph above tracks this by dividing household total wealth by disposable personal income (DPI). There are a few ways the experts try to explain this:

[Read more…]

My wife and I are both job-hunting, and I’ve been thinking a lot about careers in general. I also recently watched the movie

My wife and I are both job-hunting, and I’ve been thinking a lot about careers in general. I also recently watched the movie

Out of the 637 posts that I scribbled this year, here are the ones that represent the good, the bad, and the fun of our 2006 financial adventure:

Out of the 637 posts that I scribbled this year, here are the ones that represent the good, the bad, and the fun of our 2006 financial adventure:

I’d like to know what topics that you’d like to learn more about, whether it is something personal related to me, or a financial topic in general. Please go ahead and leave an anonymous comment in this post (type in anything for name and e-mail). I won’t publish them, it’ll just be between you and me. I can’t make any promises, but I will take each suggestion into consideration. Thanks!

I’d like to know what topics that you’d like to learn more about, whether it is something personal related to me, or a financial topic in general. Please go ahead and leave an anonymous comment in this post (type in anything for name and e-mail). I won’t publish them, it’ll just be between you and me. I can’t make any promises, but I will take each suggestion into consideration. Thanks! Ever wondered where your taxes went? Who has the time to actually read our $2.8 trillion budget? Well, now there’s an easier way: the incredibly high-res Visual Guide to the Federal Budget. From the site:

Ever wondered where your taxes went? Who has the time to actually read our $2.8 trillion budget? Well, now there’s an easier way: the incredibly high-res Visual Guide to the Federal Budget. From the site: The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)