In the post How Well Do Americans Balance Income and Spending? by the St. Louis Fed, they examine the breakdown of household spending as compared to income.

In the post How Well Do Americans Balance Income and Spending? by the St. Louis Fed, they examine the breakdown of household spending as compared to income.

In terms of the big picture, 55% of US households were net savers (earned more than they spent), 30% broke even, and 15% ran an income deficit (earned less than they spent). However, that’s everyone across all income levels, and thanksfully they looked deeper in the 2016 Survey of Consumer Finances and broke it down further by income quartile.

It is not surprising that lower income households overall have a harder time spending less than they earn. Instead, I would consider these two observations:

Out of the households in the bottom income quartile earning less than $27,000 per year, roughly 75% of them manage to break even and/or save money each year. This is not to say that households that are earning close to the poverty line ($26k for a family of four) are not struggling. However, I think a family that is “just getting by” on a $100,000 income would appreciate their situation more if they know that so many $26k income families are breaking even at this level, with a third of them even managing a surplus.

Out of the households in the top income quartile earning over $98,000 per year, roughly 25% manage to save nothing or go into debt at the end of each year. Yes, most households with a six-figure income are saving some money. But a quarter of them aren’t saving anything!

I have always been struck by the huge variation in spending by the same number of humans in the same city. The family earning $50,000 finds a way to spend $50,000. The family earning $250,000 finds a way to spend $250,000. If you have a relatively high income, that is a huge opportunity. Don’t waste it. If you create a budget surplus and invest it in productive assets, one day those assets will do the “work” to make money instead of you.

Cashing in your frequent flier miles for a free flight can be hit or miss, especially around a holiday. Which airlines are the most generous with making seats available? Each year, consulting firm IdeaWorks tries to run a fair comparison of all the major airlines to keep them honest. This

Cashing in your frequent flier miles for a free flight can be hit or miss, especially around a holiday. Which airlines are the most generous with making seats available? Each year, consulting firm IdeaWorks tries to run a fair comparison of all the major airlines to keep them honest. This

Updated with alternative method. My relative lack of travel these days means that I am constantly keeping miles and points from expiring. Here’s the

Updated with alternative method. My relative lack of travel these days means that I am constantly keeping miles and points from expiring. Here’s the

Despite the fresh packaging, we should remember that the “FIRE” concept (Financially Independent, Retire Early) is anything but a new concept. Even I can’t help being a little intrigued by the clickbait title “This Secret Trick Let This Couple Retire at 38”. Such an article could have been written about the

Despite the fresh packaging, we should remember that the “FIRE” concept (Financially Independent, Retire Early) is anything but a new concept. Even I can’t help being a little intrigued by the clickbait title “This Secret Trick Let This Couple Retire at 38”. Such an article could have been written about the  After finishing

After finishing

I subscribe to a NY Times e-mail newsletter called

I subscribe to a NY Times e-mail newsletter called

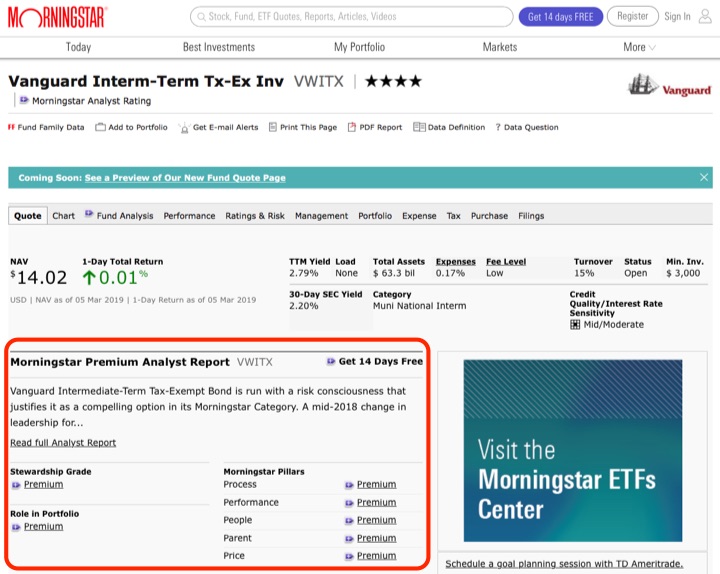

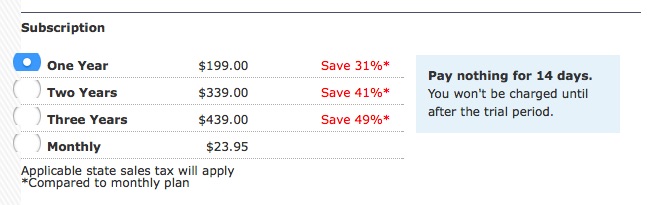

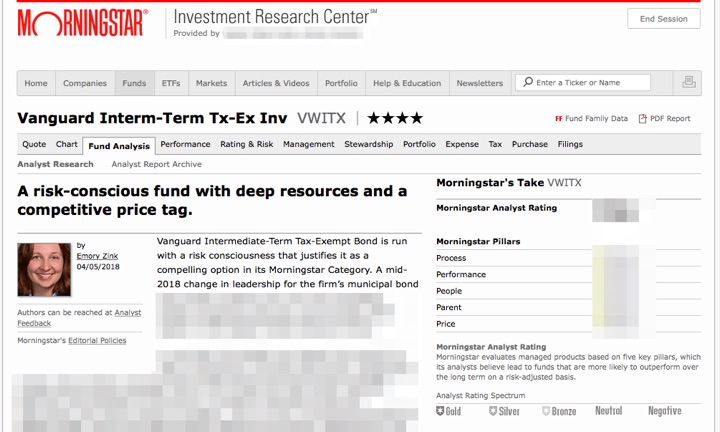

Updated 2019. Let’s say you are a DIY investor and doing some research on some mutual funds. You decide to learn more about the Vanguard Intermediate-Term Tax-Exempt Fund. You pull up the Morningstar quote pages (ticker

Updated 2019. Let’s say you are a DIY investor and doing some research on some mutual funds. You decide to learn more about the Vanguard Intermediate-Term Tax-Exempt Fund. You pull up the Morningstar quote pages (ticker

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)