Mint.com, the financial dashboard and budget tracking website bought by Intuit in 2009, is “shutting down” on January 1st, 2024 (update: now extended to March 2024). Shutting down doesn’t feel like quite the right word, as though the Mint brand is going away, Intuit is transitioning nearly all the core Mint features into Credit Karma, also owned by Intuit.

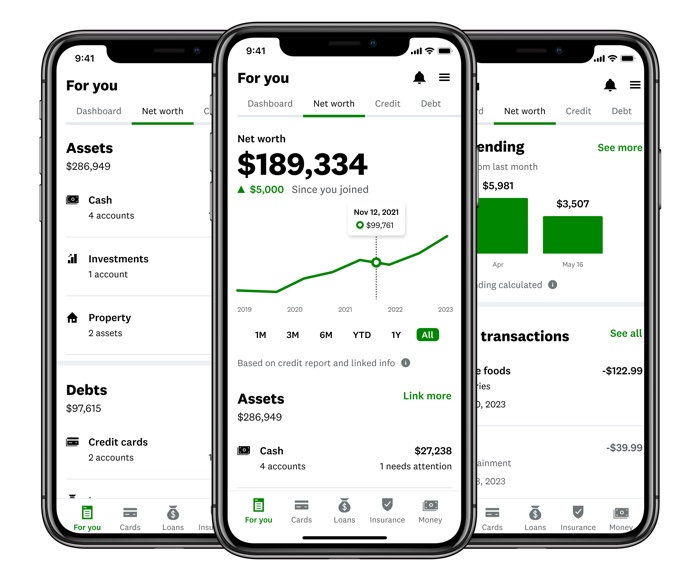

💰 Credit Karma. Basic balance tracking for free with ads. Direct import from Mint. Known best for their free credit scores and free credit monitoring services, Intuit bought Credit Karma in 2020 (sense a trend?). If you want to continue with tracking account balances, monitor overall spending broken down by category, and be shown ads for credit cards, then you can just migrate all your info to Credit Karma without having to type in all your logins again. Honestly, this seems like a reasonable merger as both used an ad-supported free service model, although the Credit Karma ads are definitely more prominent.

I am already a Credit Karma user for the free credit monitoring, but have not been invited to the formal migration yet. I plan on migrating and giving them a chance first, although I think the current CK website is quite… ugly. The app screenshots look a lot better, so we’ll see. Feature-wise, their FAQ makes it sound pretty similar to what Mint used to offer:

You will be able to bring the majority of your Mint financial account balances, your entire net worth history, plus all of your supported account connections and transactions.

Here are a few more non-Intuit alternatives to Mint to consider:

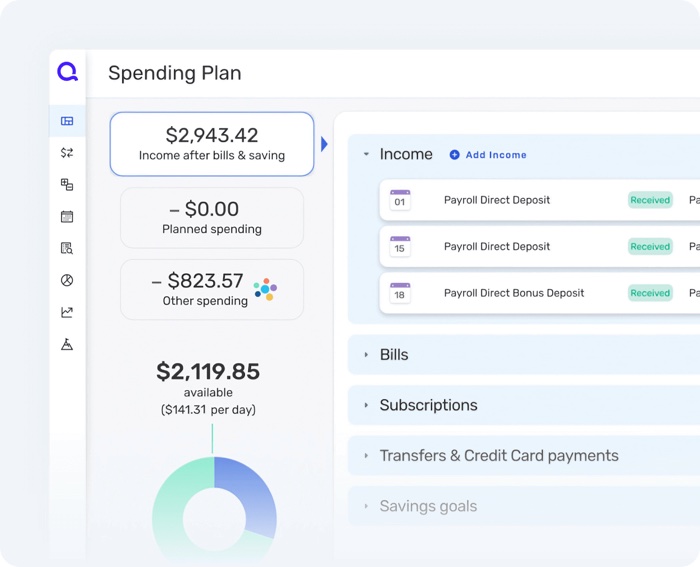

💰 Quicken Simplifi. Fully featured with automation and forecasting features. No ads for a monthly fee. Quicken has made a more “Mint-like” version called Quicken Simplifi, and the regular price is $3.99/month (discounted 50% to $2/month for first year currently). Deemed “Best Budgeting App” by Wirecutter.

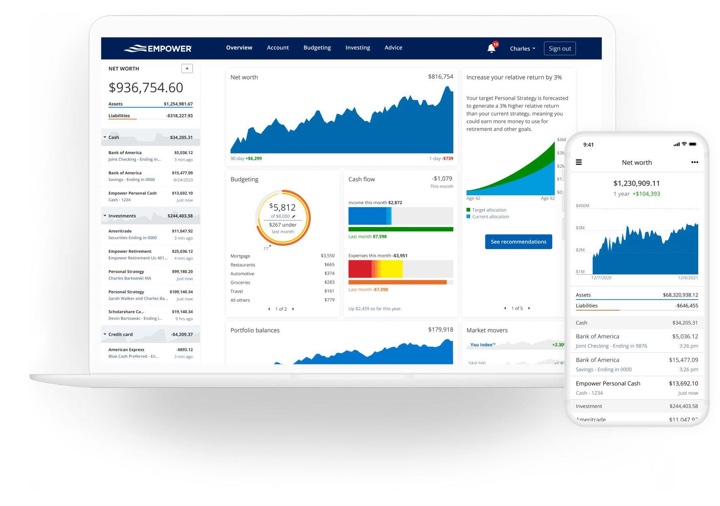

💰 Empower Dashboard. Free financial account tracking more focused on investments and asset allocation. Well, free with one sales phone call. I personally use Empower (formerly Personal Capital) to track all of my investments across different brokerage accounts and 401k providers. Empower also tracks bank accounts, but due to habit I initially preferred to use Mint to track all of my cash across different banks and credit unions. Empower is probably my fallback if Credit Karma gets too annoying, as I’m already familiar with it (and it’s also free with no ads).

I like to tell people upfront that even though it is “free”, after you sign up for Personal Capital, they will call you on the phone to see if you might like their financial planning service. This is how Empower makes money, and I’m fine with that. If you ignore their calls, they will keep calling. If you answer it once and politely decline, they will never call you again (it’s been years and years now) and let you use the dashboard completely free and in peace (and without huge banner ads). I highly suggest the latter option.

💰 Money by Envestnet Yodlee. Free, basic account tracking. No ads. Yodlee was one of the earliest aggregators that allowed you to view all of your balances in one place. Envestnet is a provider of technology for wealth management and financial advisors, and bought Yodlee in 2015. They appear to make most of their money selling this aggregation service to large financial institutions and now financial advisors for wealthy clients, and I can only guess that they offer this “Money” dashboard without ads (or support) as a sort of free beta testing preview for individuals. If you just want to see your various balances in a nice barebones list and don’t need any additional cool features, this may fill all your needs. Note that in my limited experience, Yodlee has more connection issues with certain banks and credit unions than Mint or Plaid, so test it out first.

💰 Monarch Money. Fully-featured budget tracking. No ads. $99 per year regular price. If you wished Mint would have stayed an independent company and continued adding new features and stayed alive by charging money for those features, Monarch Money has the closest feel to that. I haven’t used it myself, but that is certainly my impression after reading through its website, looking at the UI screenshots, and skimming reviews. It uses rollover budgeting like YNAB (You Need A Budget), which is has a very similar feature set and pricing to Monarch Money. It does come in at the highest price here at $15.99/month or $99 a year (discounted to $50 for first year with code MINT50).

This is by no means an exhaustive list. Where will you be going when the Mint.com site shuts down in 2024?

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)