The card_name is a small business credit card has a limited-offer of a $750 cash bonus (75,000 Ultimate Rewards points) for new cardholders and the simplicity of a flat, unlimited 1.5% cash back on all purchases and all with zero annual fee. Here are the details:

- $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening.

- Unlimited, flat 1.5% cash back (or flat 1.5X Ultimate Rewards points per dollar spent) on all purchases with no limit.

- Free additional cards for employees.

- No annual fee.

Ultimate Rewards points. The cash sign-up bonus actually comes in the form of Ultimate Rewards points at 1 point = 1 cent in cash. 50,000 points = $500 cash. If you have one of the other annual fee cards that offer a boost in value like the Ink Business Preferred, Sapphire Preferred, or Sapphire Reserve, you can transfer your points between Ultimate Rewards accounts and redeem using that other card’s 25% travel bonus. This can increase the value of your points.

You could think of this card as the small business version of the Chase Freedom Unlimited card.

Prefer airline and/or hotel points? You can’t transfer points to miles directly with this card, but if you transfer over your Ultimate Rewards points to the Chase Sapphire Preferred Card (or Ink Business Preferred card), then you can use that card to transfer into hotel and/or airline miles. If you value those miles/points at more than 1 cent per point, then your 1.5X rewards from this card can be significantly higher. Examples:

– You could earn 1.5 United miles per dollar spent.

– You could earn 1.5 Hyatt points per dollar spent.

– You could earn 1.5 British Airways Avios per dollar spent.

– You could earn 1.5 Southwest Rapid Rewards points per dollar spent.

For example, if you placed a perceived value of 1.5 cents on each United mile or Southwest Rapid Rewards point, then you’d receive 2.25 cents of perceived value per dollar spent with this card. Your actual numbers will depend on your own specific redemption choices.

Many people aren’t aware of the fact that they can apply for business credit cards, even if they are not a corporation or LLC. The business type is called a sole proprietorship, and these days many people are full-time or part-time consultants, freelancers, eBay/Amazon/Etsy sellers, or other one-person business owners. This is the simplest business entity, but it is fully legit and recognized by the IRS. On a business credit card application, you should use your own legal name as the business name, and your Social Security Number as the Tax ID.

Note that Chase has an unofficial rule that they will automatically deny approval on new credit cards if you have 5 or more new credit cards from any issuer on your credit report within the past 2 years (aka the 5/24 rule). This rule is designed to discourage folks that apply for high numbers of sign-up bonuses. This rule applies on a per-person basis, so in our household one applies to Chase while the other applies at other card issuers.

Bottom line. The card_name has a large sign-up bonus and flat 1.5% cash back with no annual fee. This card is best for people who want simple and straightforward rewards. If you have certain other Chase credit cards, you can transfer Ultimate Rewards points over to those cards and increase your value. Be sure to compare with other Chase small business cards – Ink Business Preferred and Ink Business Cash.

Also see: Top 10 Best Small Business Card Bonus Offers.

The Best Credit Card Bonus Offers – 2025

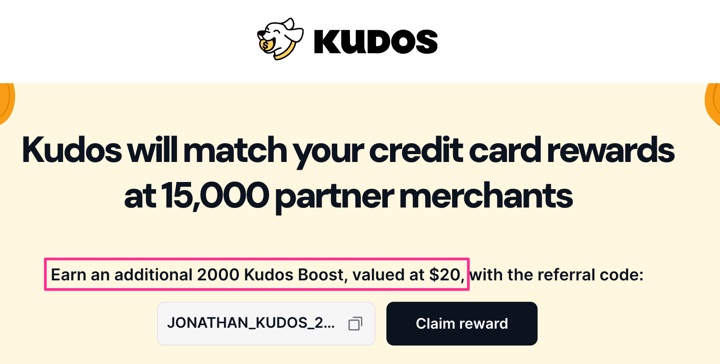

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)