Coinstar kiosks count your physical coins for you and take a pretty big 11.9% cut, unless you redeem for a gift card (where they still get a cut from the retailer). Walmart and Amazon are my favorite options, although I usually save up my coins for their occasional bonus promos. I just received this peculiar $15 BTC promo from them:

Curious about crypto? Try purchasing at a Coinstar Bitcoin ATM powered by Coinme. Through June 30, 2022, when you create a new Coinme account and purchase $100 or more of crypto at a Coinstar Bitcoin ATM you’ll get $15 in bitcoin!* Use the promo code CoinstarBTC and be sure to use the same email address when you create your new Coinme account.

Purchasing crypto at a Coinstar Bitcoin ATM is simple:

– Create a Coinme account

– Find a Coinstar Bitcoin ATM

– Purchase a crypto voucher with cash (coins are not accepted for crypto transactions)

– Redeem your voucher to instantly claim crypto with Coinme

Did you catch that? You can’t buy Bitcoin with physical metal coins. Even at a Coinstar kiosk, of all places! Why not? How are paper bills somehow different??

*Terms apply. Valid for new Coinme accounts only. The $100 crypto purchase must be made in a single transaction at a participating Coinstar location using your Coinme account. This offer begins May 16th and ends June 30th, 2022. If a qualifying purchase is made during the offer period, $15 in BTC will be deposited to your Coinme wallet within seven (7) business days of purchase. See Official Rules for more details.

In addition, there are some serious fees:

Each crypto purchase carries a transaction fee of 4% and a cash exchange fee of 7%.

So you put in $100 in paper bills (don’t even get to return coins back into circulation), only get $89 of Bitcoin plus $15 of bonus Bitcoin, but then when you sell you have to pay another fee. All this along with BTC high price volatility. And you have to sign up for another crypto broker. Pass.

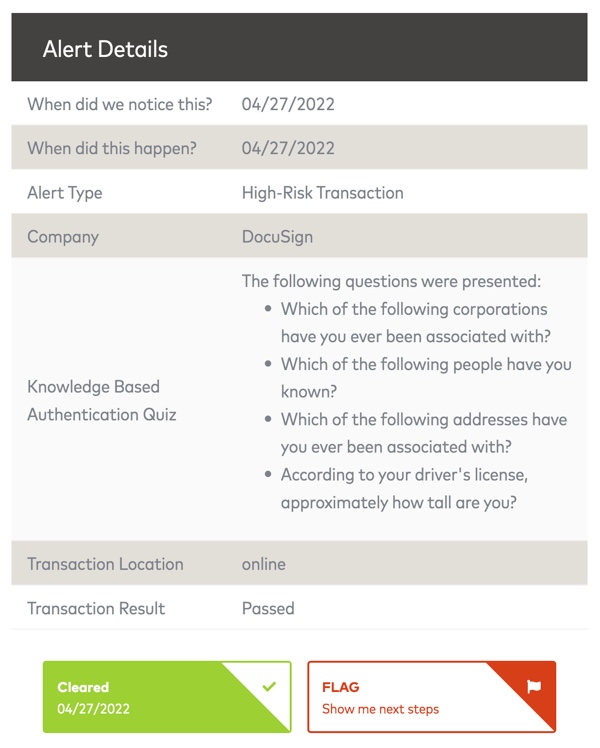

Data breaches are scary fact of life these days. If you have a Mastercard, did you know that they offer a

Data breaches are scary fact of life these days. If you have a Mastercard, did you know that they offer a

2021 end-of-year update. I have an informal goal each year of earning the equivalent of the maximum annual IRA contribution limit of $6,000 using the profits from various promotions alone. If you had put $6,000 into your IRA every year for the last 10 years (2011-2020) and invested in a simple Target Date retirement fund, you would have turned

2021 end-of-year update. I have an informal goal each year of earning the equivalent of the maximum annual IRA contribution limit of $6,000 using the profits from various promotions alone. If you had put $6,000 into your IRA every year for the last 10 years (2011-2020) and invested in a simple Target Date retirement fund, you would have turned  Check again to see if targeted for latest promo. If you have a Citi credit card that earns ThankYou points, you can redeem them to buy eligible items at Amazon.com. The redemption rate is 1 ThankYou points = 0.8 cents to spend at Amazon, which may not be the best value available. However, here are targeted promotions where you can save money after redeeming just 1 single MR point (a penny’s worth). (To see the link, you may need to visit this page on the internet if viewing this via e-mail or RSS.)

Check again to see if targeted for latest promo. If you have a Citi credit card that earns ThankYou points, you can redeem them to buy eligible items at Amazon.com. The redemption rate is 1 ThankYou points = 0.8 cents to spend at Amazon, which may not be the best value available. However, here are targeted promotions where you can save money after redeeming just 1 single MR point (a penny’s worth). (To see the link, you may need to visit this page on the internet if viewing this via e-mail or RSS.)

Check again to see if targeted for newest discount. If you have Ultimate Rewards points from Chase credit cards, you can use them to buy eligible items at Amazon.com. The redemption rate is 1 Ultimate Rewards points = 1 cent at Amazon, which is the same rate as their statement credit redemptions. However, here are targeted promotions where you can save money after redeeming just 1 single MR point (a penny’s worth). (To see the link, you may need to visit this page on the internet if viewing this via e-mail or RSS.)

Check again to see if targeted for newest discount. If you have Ultimate Rewards points from Chase credit cards, you can use them to buy eligible items at Amazon.com. The redemption rate is 1 Ultimate Rewards points = 1 cent at Amazon, which is the same rate as their statement credit redemptions. However, here are targeted promotions where you can save money after redeeming just 1 single MR point (a penny’s worth). (To see the link, you may need to visit this page on the internet if viewing this via e-mail or RSS.)

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)