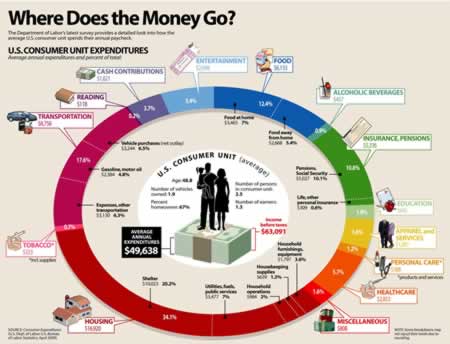

I’ve been catching up on my stack of old magazines, and in the process discovering a bunch of new websites. One appropriate site to mention is Bundle.com, which describes itself as the “first money comparison site that lets you see how people just like you spend and save money.” Here’s a promotional video from them which walks you through it:

For example, this is what the households in San Francisco, CA were spending their money on in December 2009:

“House & Home” does not include mortgage or rent, but are things like utilities, home repair and improvements, and phone service. “Health & Home” includes insurance, child care, pet care, and charitable giving. Where does the data come from? Via their FAQ:

With a team of experienced statisticians and data junkies, we’ve compiled, tagged and sorted data from a (still-expanding) collection of sources. Our data comes from the U.S. government, from anonymous and aggregated spending transactions from Citi, and from third party data providers.

Aha, my sneaky Citibank card! This is exactly the kind of data I would think would be recorded and sold from aggregation sites like Mint.com. Now, is it just me, or is there no data available under the “Saving” tab?

A reader recently asked me about what I thought about the fact that financial aggregation site

A reader recently asked me about what I thought about the fact that financial aggregation site  It’s Friday, so here’s an easy slam dunk resolution involving emergency funds. If you’ve done any sort of financial reading lately, you know that many folks recommend having at least 3-6 months of living expenses put aside. Given the current high unemployment rates, I personally wasn’t comfortable until I had 12 months of expenses. Not only could you lose your job, but there could be unexpected health expenses, car repairs, or whatever. But that’s not the main point here.

It’s Friday, so here’s an easy slam dunk resolution involving emergency funds. If you’ve done any sort of financial reading lately, you know that many folks recommend having at least 3-6 months of living expenses put aside. Given the current high unemployment rates, I personally wasn’t comfortable until I had 12 months of expenses. Not only could you lose your job, but there could be unexpected health expenses, car repairs, or whatever. But that’s not the main point here. I was catching up on some blog reading and caught an old post from Plonkee about the different ways that couples can manage their finances. The three different methods were categorized as communist, socialist, or capitalist. Rather controversial, eh? Don’t get too excited folks, just read on:

I was catching up on some blog reading and caught an old post from Plonkee about the different ways that couples can manage their finances. The three different methods were categorized as communist, socialist, or capitalist. Rather controversial, eh? Don’t get too excited folks, just read on:

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)